Stock Watch: The George Soros impact continues

By Amit Sinha*

By Amit Sinha*

Weekly Insights – Technical

Week: February 20-24, 2023

Indian Stock Market Indices status as of day closing February 24, 2023:

Sensex: 59,463 (-141.87)

Nifty 50: 17,465 (-45.45)

Nifty Bank: 39,909 (-92.15)

Call it the George Soros impact as the underperformance of the share market continued this week. The benchmark indices continued their downtrend for the last 6 consecutive trading sessions and closed below 200 DMA (Daily Moving Average) in the last 3 sessions. No short-term respite is seen for hapless investors and traders who are seeing their wealth eroding sharply since the budget day. We saw this breaching of 200 DMA (a level of around 17,500) in May 2022. Nifty50 had then plunged to a level of around 15,500 and further to a 15,200 level. It’s imperative that the market sustains above the 200 DMA to signify any downtrend reversal.

Also read: Stock Watch: The George Soros impact

Without any positive cues and expectations from around the world, the weakness it seems is going to persist in the weekly time frame. Wall Street also downslides as the biggest weekly fall in 2023. Dow Jones, S&P 500 and Nasdaq – All are in a falling trend owing to the fear of further consistent and subsequent increasing rates hikes by the US FED due to unabated inflation rate. European and the rest of Asia Markets also declined considerably with SGX Nifty showing signs of an extreme bearish trend. The USD (US Dollar Index) is rising, and it closed yesterday at 105.25 (+ 62%).

Nifty50 chart on weekly time frame as on February 24, 2023 (closing):

Banks still continue to underperform with a major bank, the State Bank of India, falling 20%, and ICICI 14%. The Adani Group’s leveraging from BOB (Bank of Baroda ) and others continue to impact the market. Perhaps the market is getting day by day more worried about Adani Group’s over-leveraged business debts from banks, Life Insurance Corporation (LIC) and other Domestic Institutional Investors (DII). The share prices of Adani Stocks have now gone below the LIC’s buying prices of the stocks which is of paramount fear. As per estimated data, it would take 16 years + to repay the debts by Adani. However, in the case of TATAs for example, it will be around 1.5 years.

There is a certain amount of growing concern, in consensus among Indian academicians, politicians and economists about big monopolies (monopolistic business models) which are built on extremely high public money leverages, that they do not tend to sustain in the short to long term. Whenever allowing or allocating to create a monopolistic set-up in the country’s major businesses like airports, ports, power and other major country’s infrastructure businesses, there has to be some vital responsibility in allowing the leveraging mechanism. The incumbent government should be emphasising more on their business growth more without much public leverage. In Adani’s case, it has been too much too soon and the jitteriness is affecting the Indian stock market which has more or less been de-coupled from the United States and other stock markets for a few weeks in following trends due to this reason.

Next Week Trading Session Outlook

The upcoming session also looks bleak as long as there is no positive news in foresight. Banks, IT, and Steel have sideways to a negative view. IT will majorly depend on cues from NASDAQ as large and mid-cap Indian companies are majorly service driven rather than product-making, and rely heavily on US conditions and its outsourcing of service businesses.

As mentioned earlier, the technical analysis on 200 DMA suggests that to make an upswing we will have to wait for cross-overs of 20, 50 and 100 DMA over 200 DMA in the near short term and sustain.

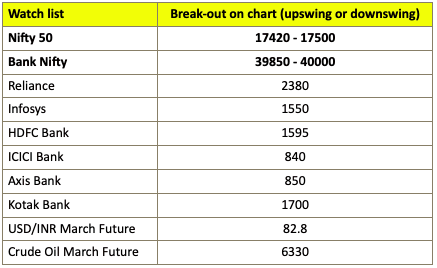

Indices/Top Stocks/Currency/Commodity – Technical Levels to watch for next week

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.