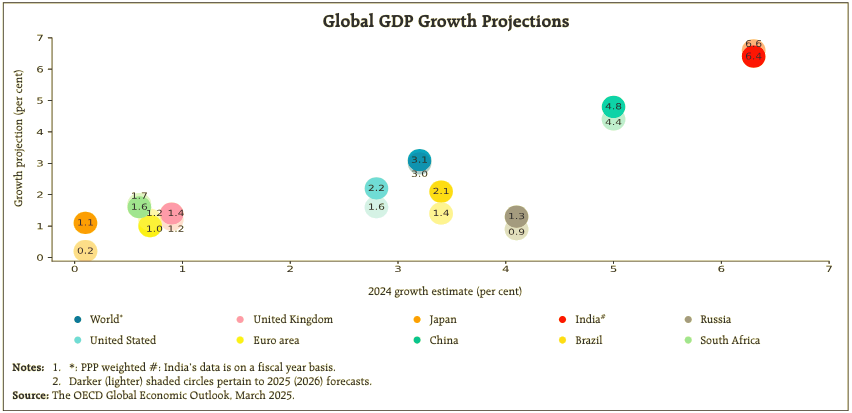

The projections by the Conference Board, which has over 1,000 public and private corporations and other organizations from 60 countries as members, indicate that the world economy is likely to witness a significant deceleration over the next decade. Estimates suggest that a full-blown tariff war could raise the price level by 1.0-1.2 per cent in the US, reduce real GDP growth by 0.6 percentage points in 2025, and leave the U.S. economy persistently 0.3-0.4 per cent smaller in the long run. These assessments have been vindicated by the incoming data pointing to a weakening US growth momentum.

Financial markets are increasingly pricing in the anticipated slowdown in global growth, with benchmark indices in the US and most non-European geographies witnessing a decline. As of March 17, 2025, the US dollar has given up all of its gains since mid-November 2024, weighed by US trade policy and growth uncertainties.

Geopolitical tensions and changing global power relations are adding another layer of complexity. In Europe, shifting security priorities are triggering a surge in military spending, particularly in Germany and its neighbouring nations, driving bond yields to rise the most in a week in nearly three decades. Expectations that the fiscal stimulus would lead to a turnaround in growth in the Euro area led to gains in European equities, making them significantly outperform their US counterparts in 2025. With financial markets on the edge and global tensions rising, the months ahead are shrouded in uncertainty.

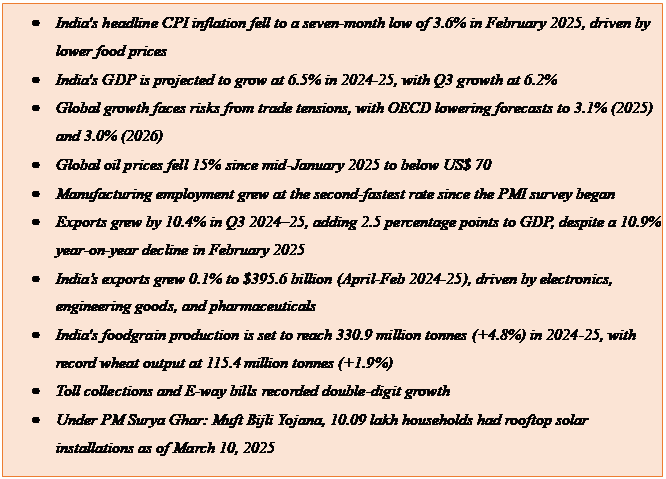

Amidst these challenges, the outlook for global commodities remains a silver lining. Supply prospects for food and energy have been improving. Global cereals production during 2025 is projected to surpass that of 2024. 4 Oil prices (UK Brent) declined

by about 15 per cent since mid-January 2025 (up to March 11) to below US$ 70 over concerns that a trade war could dampen economic growth and weaken energy demand. Prices are expected to moderate through 2025-26 as inventories increase due to

production expansion in an environment of modest demand growth. Metal prices, however, witnessed increases in February, tracking news of the US imposition of import tariffs on steel and aluminium. Tariff concerns and safe-haven demand drove gold prices to a historical high of US$ 3000 per ounce on March 14, 2025.

Policymakers are now walking a tightrope, having to balance the upward strain of rising prices on account of tariffs and currency depreciation, as well as the downward pressure on inflation from an economic slowdown.

Despite global economic headwinds, the Indian economy continues to demonstrate resilience as the growth momentum is supported by robust sectoral performance and improving consumption trends. The Indian economy recorded a sequential

pick-up in growth during Q3: 2024-25 driven by private consumption and government spending. Supply chain pressures remained below historical average levels, despite a marginal uptick in February.

The latest quarterly data underscores this strength, with real GDP expanding by 6.2 per cent in Q3: 2024-25, shaking off the sluggishness of the previous quarter. Private consumption expenditure is on an upward trajectory, signalling strong consumer confidence and sustained demand. Government spending has picked up significantly in recent months, providing a further fillip to growth. Key sectors, including construction, financial services, and trade, continue to thrive as pillars of economic resilience. Various high-frequency indicators of economic activity point towards a sustained momentum in growth during Q4 as well. The first revised estimates (FRE) of GDP for 2023-24 placed the real GDP growth at 9.2 per cent — the highest in over a decade if we exclude the post-COVID rebound — demonstrating that in an uncertain world, India’s growth story remains a beacon of stability and progress.

Recent developments across different sectors reaffirm the assessment of a sequential pick-up in growth momentum. The Kharif season 2024-25 has seen an upward revision in production estimates for foodgrains and oilseeds and rabi foodgrains registered

a growth of 2.8 per cent mainly on account of above-normal rainfall supported by comfortable reservoir levels. Despite a mild loss in momentum, the Indian manufacturing sector saw a rise in purchasing activity and employment in February 2025. The

services sector recorded a strong expansion in new businesses and employment.

Notwithstanding the innate strength built on strong macroeconomic fundamentals and prudent policy, the reverberations of a tumultuous external environment are also reflected in various segments of the economy. Sustained foreign portfolio outflows exerted significant pressures on domestic equity markets in February and engendered currency depreciation. The Reserve Bank has deployed a strategic mix of interventions, including open market operations (OMO), daily variable rate repo (VRR) auctions, and dollar/rupee buy-sell swap auctions.

These proactive measures have helped stabilise market liquidity conditions, ensuring financial resilience in an unpredictable global environment. The decline in overall inflation is expected to further support recovery in consumption and bolster macroeconomic strength, which would act as a bulwark to ward off the myriad of external challenges.

*Excerpted from the chapter on State of India Economy published in the March 2025 edition of the Reserve Bank of India Bulletin.

– global bihari bureau