New Delhi: The Union Cabinet today approved an ‘Incentive Scheme for the Promotion of Low-Value BHIM-UPI Transactions from Person to Merchant (P2M)’ for the financial year 2024-25.

This initiative will be rolled out with a projected budget of 1,500 crore, effective from April 1, 2024, to March 31, 2025. The scheme specifically targets UPI (P2M) transactions that do not exceed 2,000/- and are intended for small merchants.

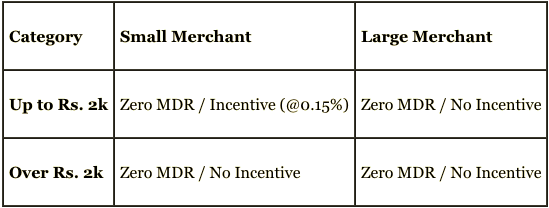

Incentives will be offered at a rate of 0.15% on the transaction value for small merchants on transactions up to Rs.2,000.

Throughout the duration of the scheme, acquiring banks will receive 80% of the approved claim amount without any stipulations.

However, the disbursement of the remaining 20% of the approved claim for each quarter will depend on meeting specific criteria: 10% will be granted only if the acquiring bank’s technical decline is below 0.75%, and the other 10% will be released if the bank’s system uptime exceeds 99.5%.

The benefits of this initiative include a more convenient, secure, and faster cash flow, along with improved access to credit through digital transactions. Every day citizens will enjoy seamless payment options without incurring extra charges.

Additionally, small merchants will be able to utilize UPI services at no extra cost, which is crucial since they are often sensitive to pricing; these incentives will motivate them to accept UPI payments.

This initiative aligns with the Government’s goal of promoting a less cash economy by formalizing and digitizing transactions.

Furthermore, the 20% incentive is tied to banks maintaining high system uptime and low technical decline, ensuring that payment services are consistently available to the public. Ultimately, this approach strikes a careful balance between fostering the growth of UPI transactions and minimizing the financial impact on the Government’s budget.

The Incentive Scheme aims to achieve several key objectives. Firstly, it seeks to promote the indigenous BHIM-UPI platform, targeting a total transaction volume of 20,000 crore for the fiscal year 2024-25. Additionally, the scheme is designed to assist payment system participants in establishing a strong and secure digital payments infrastructure. A significant focus is placed on expanding UPI usage in tier 3 to 6 cities, particularly in rural and remote areas, by encouraging innovative solutions like feature phone-based (UPI 123PAY) and offline (UPI Lite/UPI LiteX) payment methods. Furthermore, the initiative emphasizes maintaining high system uptime and reducing technical declines.

It is important to note that advancing digital payments is a crucial component of the Government’s financial inclusion strategy, offering diverse payment options to the general public. The costs incurred by the digital payment sector in delivering services to customers and merchants are recouped through the Merchant Discount Rate (MDR). According to the Reserve Bank of India, an MDR of up to 0.90% of the transaction value applies to all card networks for debit cards, while the National Payments Corporation of India (NPCI) sets the MDR for UPI P2M transactions at up to 0.30%. To further encourage digital transactions, the MDR for RuPay Debit Cards and BHIM-UPI transactions was set to zero starting January 2020, following amendments to the Payments and Settlement Systems Act, 2007, and the Income-tax Act, 1961.

To bolster the effectiveness of service delivery within the payment ecosystem, the “Incentive Scheme for Promotion of RuPay Debit Cards and Low-Value BHIM-UPI Transactions (P2M)” has been launched with the necessary Cabinet approval.

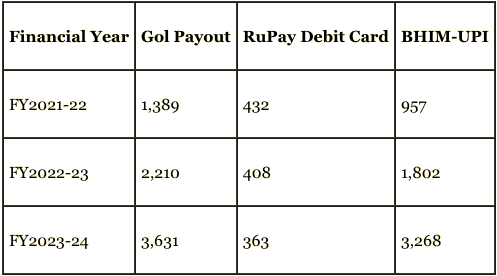

Year-wise incentive payout by the Government (in Rs. crore) during the last three financial years:

The Government provides the incentive to the Acquiring bank, which is the Merchant’s bank, and this amount is subsequently distributed among various stakeholders. These include the Issuer Bank, which is the Customer’s Bank, the Payment Service Provider Bank that assists in onboarding customers through UPI app or API integrations, and the App Providers, also known as Third Party Application Providers (TPAPs).

– global bihari bureau