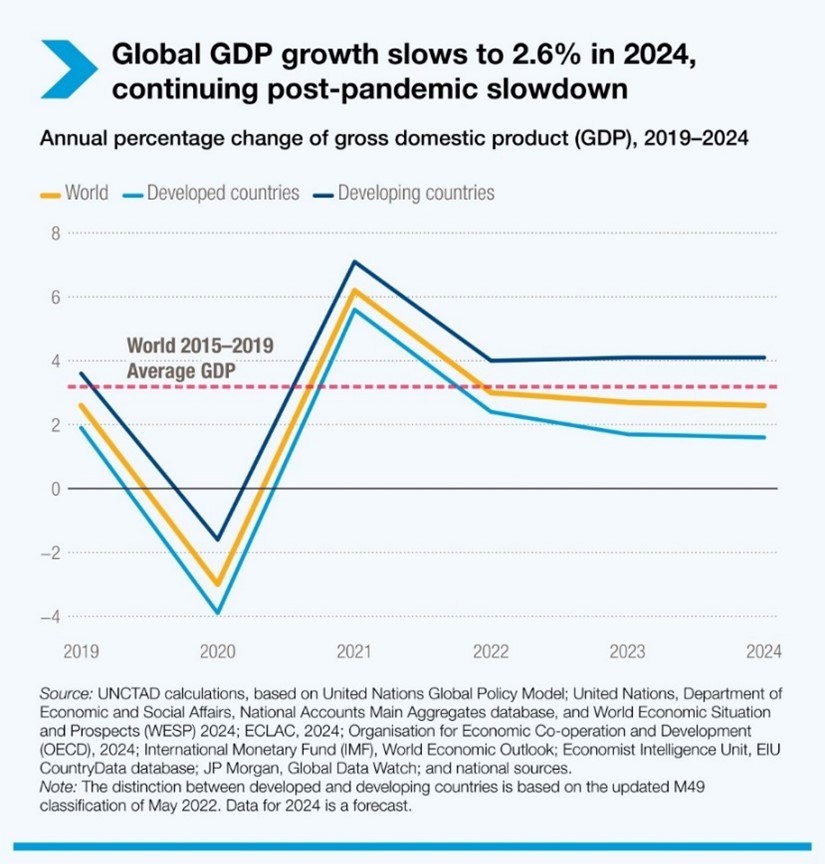

Geneva: While the global economic slowdown in 2023 was less severe than originally projected, the United Nations Trade and Development (UNCTAD) in its latest report warns that further growth deceleration could be expected this year due to falling investments and subdued global trade dynamics.

Looking to 2024, the prospect of interest rate cuts could improve the fiscal outlook for governments and businesses, but monetary policy alone cannot solve all pressing global challenges, it stated, pointing to the ongoing crises linked to sovereign debt, ever-growing inequalities, and climate change.

Food insecurity persists as an acute concern across developing countries. If current market trends persist, some 600 million people will be chronically undernourished by 2030, according to projections by the UN Food and Agriculture Organization.

Strategies to revive investment and trade, support full employment and fair income distribution are crucial to driving robust growth and meeting Sustainable Development Goals (SDGs). The report underscored the need for concerted multilateral action, along with a balanced policy mix of fiscal, monetary, demand-side and investment-boosting measures to achieve financial sustainability, create jobs, and improve income distribution.

Rebeca Grynspan, Secretary-General of UN Trade and Development, ahead of the Spring Meetings of the International Monetary Fund and the World Bank where she will participate, strongly urged concerted multilateral action and a balanced policy mix underlining that global policy coordination remains the key to safeguarding the global economy amid shifting trade patterns, soaring debt, and mounting cost of climate change all of which disproportionately affect developing countries.

To restore trust in the multilateral system and prevent further fracture, UN Trade and Development Secretary-General Grynspan spotlights two critical areas.

“We call for coordinated multilateral efforts to address the asymmetries of international trade and market concentration,” she said. “Borrowing countries need more fiscal flexibility to reach the Sustainable Development Goals. This can only be achieved through an inclusive and global reform of the global financial safety net.”

Real wages are still below pre-pandemic levels

Most advanced economies’ central banks have aggressively raised interest rates since early 2022 to combat inflation. However, this approach didn’t fully consider supply chain issues from COVID-19 and increased market dominance, leading to higher prices and profits.

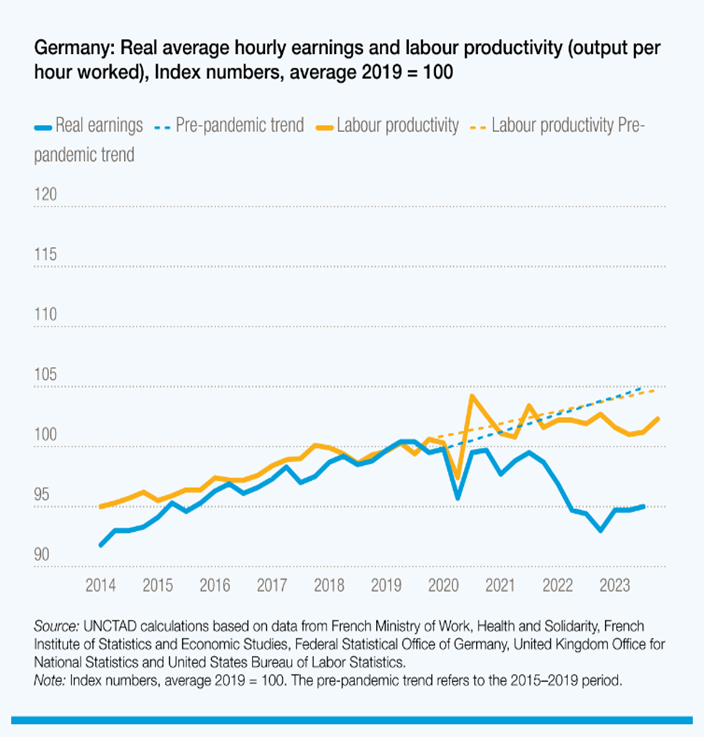

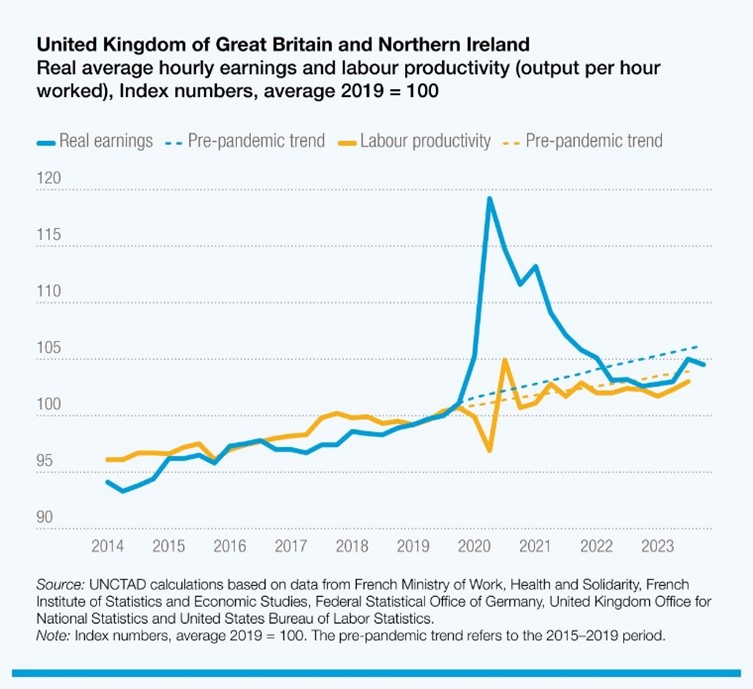

In 2023, despite stable employment, inflation decreased, indicating that supply-related issues, not just demand, contributed to earlier inflation. The report also found no evidence of a feared cycle where rising wages drive up prices, with real wages still below pre-pandemic levels and lagging behind productivity growth.

The wage-price spiral has not materialized – but labour productivity generally outpaced real wage growth

Rising protectionism, disrupted maritime routes due to geopolitical tensions and climate change threaten global trade

In 2023, the global economy grew by 2.7%, but international trade in goods decreased by 1%. Although there has been some recovery in 2024, it’s unlikely that merchandise trade will be a significant driver of growth this year.

Also read: Global trade update shows encouraging signs: UNCTAD

Global maritime trade routes, crucial for the world’s commerce, are facing increasing challenges. Most recently, escalating attacks on ships in the Red Sea since November 2023 have been compounding already existing disruptions in the Black Sea caused by the war in Ukraine. Additionally, climate-induced drought is affecting trade through the Panama Canal.

Despite some improvement, subdued growth is expected in global merchandise trade this year. Prospects for services trade are relatively better.

The report also warned of rising protectionism, trade tensions and geopolitical uncertainty. These risks not only hamper economies but also imperil concerted multilateral solutions at a time when international trade collaboration is needed more than ever.

Reforming the global debt architecture

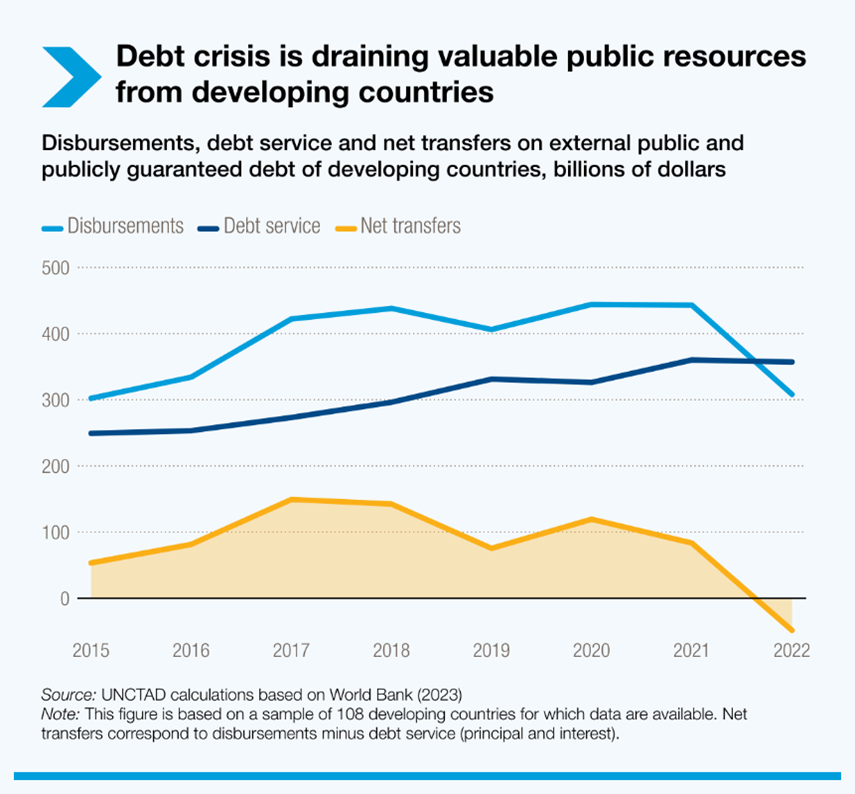

Many developing countries are grappling with significant debt and development challenges at a time of declining aid flows.

In 2022, nearly half of the surveyed developing nations for which data is available experienced negative net transfers on public and publicly guaranteed debt. Outflows to external creditors, including bilateral, multilateral, and private lenders, surpassed incoming disbursements by almost $50 billion, an amount equivalent to the GDP of several countries combined.

Furthermore, private creditors in particular showed less interest in lending to developing countries.

Between 2021 and 2022, net transfers on public and publicly guaranteed debt from private creditors switched from an inflow of over $40 billion to an outflow of nearly $90 billion, exposing flaws in the current debt and financial architecture.

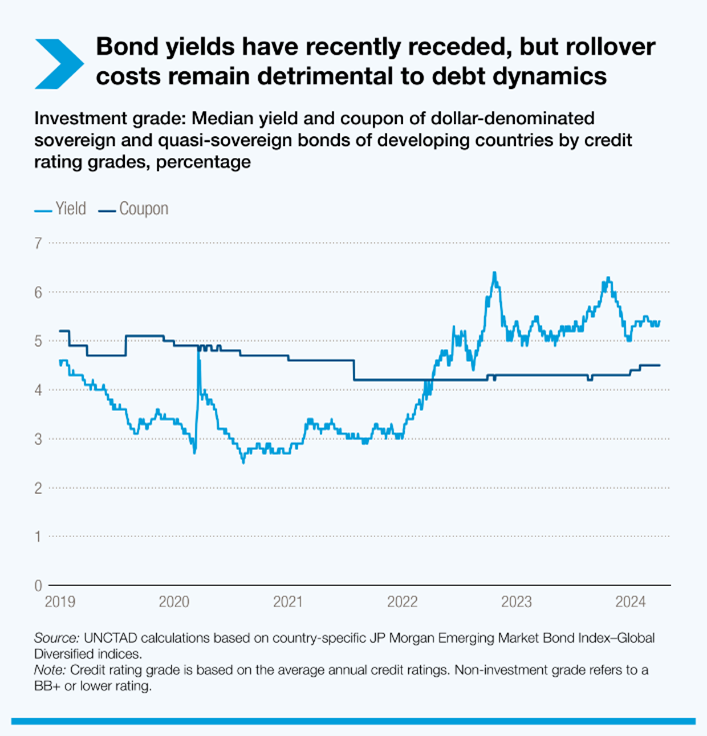

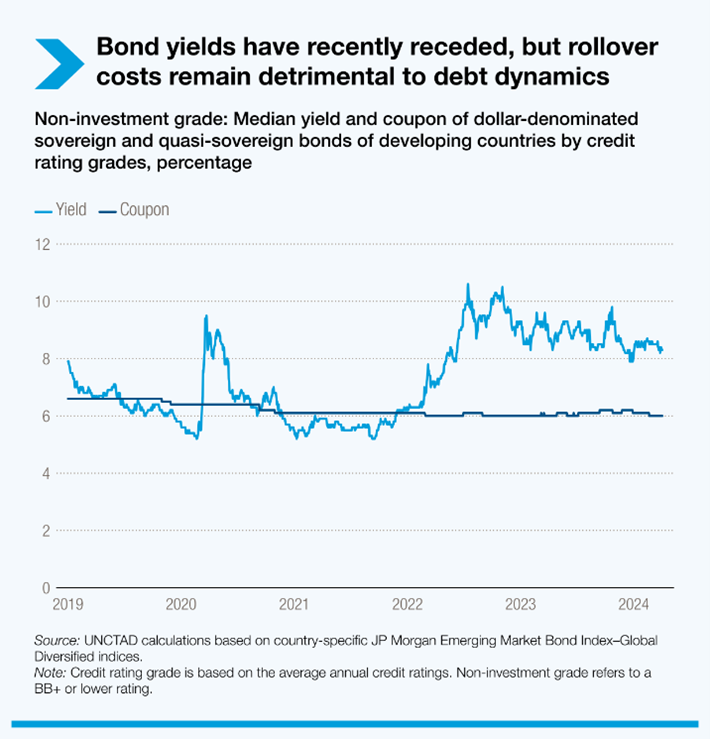

Even as some developing countries recorded strong bond issuance in the first months of 2024, uneven and costly market access persists.

The current debt crisis is rooted in structural issues, arising from sluggish economic growth, widespread tax avoidance, commodity dependence, and the cost of climate change.

UN Trade and Development calls for a stronger global financial safety net and the establishment of efficient multilateral frameworks for resolving sovereign debt issues.

Food prices continue to rise in developing countries, hurting low-income households.

In line with the global commodity cycle, food prices measured in dollars have partly declined, yet domestic prices continue to rise in many developing countries, aggravating the cost-of-living crisis faced by low-income households.

The Trade and Development Report identifies several factors contributing to the rise in global food prices and also harming many producers in developing countries. These factors include the significant concentration within global food value chains, stricter standards imposed by importing nations on food products, and the growing influence of finance on commodity markets.

– global bihari bureau