New Delhi: India managed to intact its Gross Domestic Product (GDP– constant prices) growth at 9.7 per cent in H1 2022-23 reaching Rs 75.02 lakh crore as against ₹68.36 lakh crores during the corresponding period of the previous year, according to the latest quarterly report of the Public Debt Management Cell of the Ministry of Finance, which pertains to the quarter July-September (Q2 FY23).

As per the estimates of Gross Domestic Product (GDP) for the second quarter (July-September) of 2022-23, released by the National Statistical Office (NSO) on November 30, 2022, the real GDP at constant prices showed a growth of 6.3 per cent during the Q2 2022-23 as compared to growth of 8.4 per cent in Q2 2021-22.

GDP at current prices in Q2 2022-23 was estimated at ₹ 65.3lakh crore, as against ₹ 56.2 lakh crore in Q2 2021-22, showing a growth of 16.2 per cent as compared to growth of 19.0 per cent in Q2 2021-22. Gross Value Added (GVA) at the basic price (at current prices) in Q2 2022-23, is estimated at ₹ 58.6 lakh crore, as against ₹ 50.4 lakh crore in Q2 2021-22, showing a growth of 16.2 per cent.

The report mentions that retail inflation, as per the Headline Consumer Price Index (CPI), was gradually easing, which peaked at 7.8% on a year-on-year basis in April 2022. CPI rose from 6.7 per cent in July 2022 to 7.4 per cent in September 2022 before easing to 6.8 per cent in October 2022 on a y-o-y basis.

The elevated retail inflation was broad-based with all the subcomponents witnessing an increase during the second quarter of 2022, along with ‘food and beverages’ registering a sharp growth.

The Consumer Food Price Index (CFPI) was up from 6.7 per cent in July 2022 to 8.6 per cent in September 2022. However, the Wholesale Price Index (WPI)-based inflation continued to shrink during the quarter from 14.1 per cent in July 2022 to 10.7 per cent in September 2022 and 8.4 per cent in October 2022. The decline in WPI inflation was witnessed across all major commodity groups.

The index of industrial production (IIP) witnessed a growth of 3.1 per cent in September 2022 as compared to 2.2 per cent registered in July 2022, led by growth in all three major sectors – mining and quarrying, manufacturing and electricity sector. The electricity sector witnessed a growth of 11.6 per cent in September 2022 as against a growth of 2.3 per cent in July 2022. The manufacturing sector and mining and quarrying sector too registered a growth of 1.8 per cent and 4.6 per cent respectively in September 2022. Within the use-based goods, capital goods witnessed a growth of 10.3 per cent followed by primary goods which surged by 9.3 per cent and infrastructure goods grew by 7.4 per cent in September 2022 on a y-o-y basis. On the other hand, consumer durables shrunk by 4.5 per cent and consumer non-durables contracted by 7.1 per cent in September 2022,

India’s merchandise trade posited “robust” growth post-pandemic in 2021-22 which continued in Q1:2022-23 before softening in Q2:2022-23 mirroring a growth slowdown in global trade. The cumulative value of merchandise exports stood at USD 110.86 billion in Q2 2022-23, while merchandise imports stood at USD 194.92 billion during the same period. The trade deficit at USD 84.1 billion in Q2 2022-23 widened compared to USD 44.8 billion in the corresponding quarter of 2021-22. The significantly higher deficit in Q2 2022-23 was due to higher import bill payments on account of a surge in both oil and non-oil imports. The widening of non-oil imports outgo payments reflects buoyant domestic demand apart from elevated international commodity prices and depreciation of the rupee.

The net foreign direct investment remained stable at USD 20225 million during April- September 2022-23. Foreign Portfolio Investment (FPI) which is sensitive to rate hikes across advanced economies witnessed a decline as reflected in an outflow of amount USD 8387 million during April-September 2022-23 in comparison to an inflow of investment of USD 4280 million in April-September 2021-22. However, on the back of a larger quantum of inflow, FPI turned net buyer in Q2:2021-22 (Rs 6244 crores) which pulled the overall net outflow for H1:2021-22. Further on a sequential basis, in comparison to H2:2021-22, this year H1: 2022-23 saw a lower quantum of FPI outflows.

India’s foreign exchange reserves stood at USD 532.66 billion as on September 30, 2022, moderated from USD 638.64 billion on September 24, 2021. Between July 1, 2022, and September 30, 2022, the Rupee depreciated by 3.11 per cent. The value of the Rupee against the Dollar as on July 1, 2022, stood at 79.09 as against 81.55 as on September 30, 2022.

Government Finances

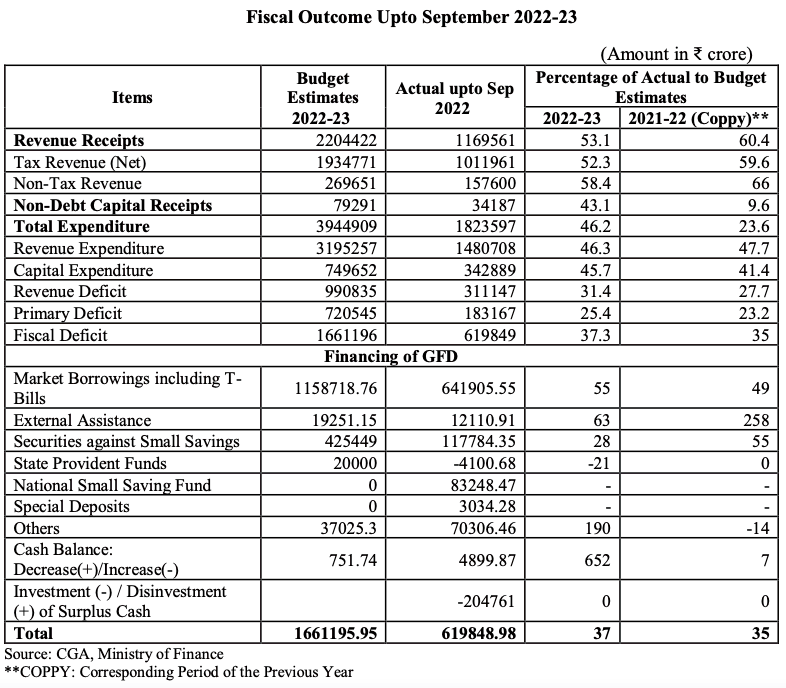

The gross fiscal deficit (FD) of the Central Government for FY 2022-23 was budgeted at ₹16,61,196 crore or 6.4 per cent of GDP as compared to the revised estimate of ₹15,91,089 crore (6.71 per cent of GDP) for FY 2021-22. The Central Government’s fiscal deficit in the first half of FY 2022-23 reached 37.3 per cent of the full-year target. On Government’s expenditure side, capital expenditure touched 45.7 per cent of the full-year budget target in FY 2022-23 in contrast to 41.4 per cent in the corresponding period last year. Out of the total revenue expenditure of Rs 14.8 lakh crore, nearly 30 per cent of the expenditure (Rs. 4.4 lakh crore) was on account of interest payments.

– global bihari bureau