Rome: The wheat outlook for 2024 remains favourable, according to the latest Cereal Supply and Demand Brief released by the Food and Agriculture Organization of the United Nations (FAO), here today.

FAO’s forecast for global wheat production in 2024 has been lowered to 791 million tonnes. At this level, the 2024 world wheat outturn is still anticipated to exceed the 2023 output, albeit by a smaller margin of nearly 0.5 per cent.

In Asia, conducive weather conditions continued to prevail, underpinning expectations of near-record wheat outturns in India and Pakistan and bolstering favourable production outlooks in Near East Asian countries.

The recent downgrade reflects the latest official data from the European Union, indicating a larger drop in wheat plantings than previously foreseen; however, weather conditions generally improved in March and early April, helping to firm yield prospects.

Overall wheat production is pegged at 128.4 million tonnes in 2024, about 4 per cent down year on year. Compared to the preliminary outlook, a downward revision was also made to the wheat production forecast for Australia, based on the latest projections from the country indicating more restrained growth in 2024, following the dry weather-affected harvest in 2023.

A recent lack of rainfall in the Russian Federation has led to some dryness in key producing southern areas, prompting a small cut to the production forecast to 93 million tonnes, although this outturn would still exceed the five-year average.

In Ukraine, amid generally conducive weather conditions, wheat production is still foreseen to fall to a well below-average level of 20.2 million tonnes, reflecting the destructive effects of the war, now in its third year, on productive capacities, as well as weaker profit margins for wheat.

In the United States of America, notwithstanding slight downgrades to winter wheat crop conditions in parts of the southern Plains, the overall wheat production outlook remains favourable and an aggregate output of close to 52 million tonnes is expected.

In Canada, assuming a return to trend yields after the lows of 2023, production is seen to rise to 34.6 million tonnes in 2024. In North Africa, recent localized rainfall arrived too late to materially improve crop conditions following widespread seasonal rainfall shortages since late 2023, and wheat yield prospects remain poor.

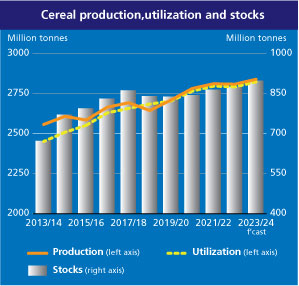

FAO today slightly raised its forecast for the world’s total cereal production in 2023 to 2,846 million tonnes, a 1.2 per cent increase from the previous year. The revision primarily reflects new encouraging information from Myanmar and Pakistan.

Despite a downward revision of 4.6 million tonnes from the previous month, FAO’s forecast for world cereal stocks ending in 2024 is now pegged at 890 million tonnes, still 2.1 per cent above their opening levels. This downward revision is mostly attributed to anticipated declines in maize inventories in Brazil and the United States of America and, to a lesser extent, barley stocks in Kazakhstan.

The forecast for world cereal utilization is increased to 2,829 million tonnes, mostly reflecting higher than previously anticipated feed use of maize and barley. Global maize utilization is now expected to rise 1.6 per cent over the year, while that for wheat rises by 1.9 per cent and that for rice dips mildly.

FAO Food Price Index up marginally in April

Meanwhile, the benchmark for world food commodity prices edged higher in April 2024, as rising meat prices and modest upticks for vegetable oils and cereals more than offset decreases for sugar and dairy products.

The FAO Food Price Index, which tracks monthly changes in the international prices of a set of globally-traded food commodities, averaged 119.1 points in April, up 0.3 per cent from its revised March level, while down 9.6 per cent from its year-earlier level.

The FAO Cereal Price Index rose 0.3 per cent from March, ending a three-month declining trajectory. Global wheat export prices stabilized in April as strong competition among major exporters offset concerns about unfavourable crop conditions in parts of the European Union, the Russian Federation and the United States of America. Maize export prices increased, influenced by high demand amidst mounting logistical disruptions as a result of infrastructure damages in Ukraine and concerns about the production in Brazil ahead of the main harvest. The FAO All-Rice Price Index declined by 1.8 per cent, due largely to falls in Indica quotations driven by harvest pressure.

The FAO Vegetable Oil Price Index also increased by 0.3 per cent from March, reaching a 13-month high, as higher quotations for sunflower and rapeseed oil offset slightly lower prices for palm and soy oil.

The FAO Meat Price Index increased by 1.6 per cent in April from the previous month, as international poultry, bovine and ovine meat prices all rose. World pig meat prices fell marginally, reflecting slack internal demand in Western Europe and persistently lacklustre demand from leading importers, especially China.

The FAO Sugar Price Index declined 4.4 per cent from March to stand 14.7 per cent below its April 2023 level. The decrease was mostly related to improved global supply prospects, notably due to larger-than-previously-

The FAO Dairy Price Index decreased marginally, by 0.3 per cent, ending six consecutive months of increases, led by sluggish spot import demand for skim milk powder and by lower world cheese prices, impacted by the strengthening of the United States dollar. World butter prices, by contrast, increased amid steady import demand.

– global bihari bureau