By Anabel González*

By Anabel González*

Geneva: As 2023 begins, the World Trade Organization (WTO) stands poised to reach a new agreement on investment facilitation for development (IFD). Over 110 WTO members have been working hard to pin a deal that would help countries across regions improve their investment climate and attract foreign direct investment (FDI). As global growth is projected to slow this year to its third-weakest pace in nearly three decades and with governments’ fiscal space tightening, an agreement to facilitate investment could help overturn challenging prospects by boosting growth and investment, particularly in developing and least-developed countries. A final push is needed to get the deal done. It could happen soon.

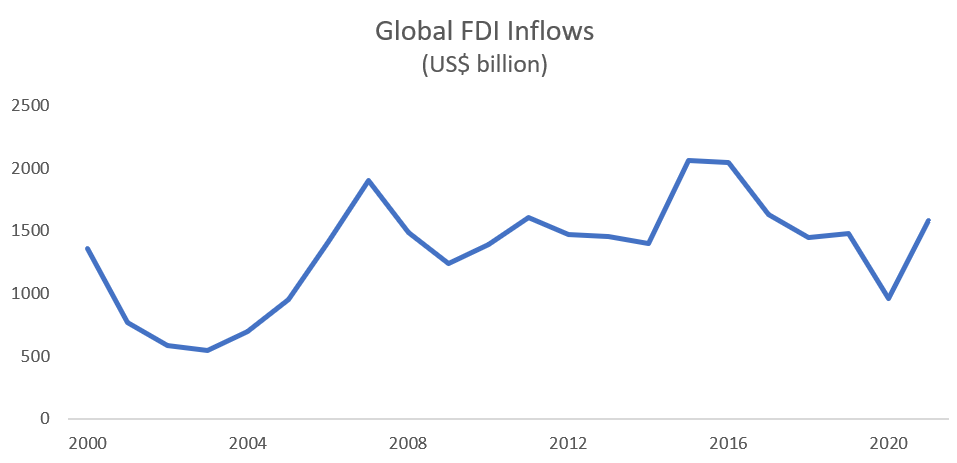

Private investment is key to foster growth, as well as to finance the digital and energy transitions. For poor countries, it is key to attain Sustainable Development Goals. Under the right conditions, FDI fosters economic transformation to spearhead growth and prosperity through rising productivity and efficient use of resources; increased global trade integration via improved access to international markets and participation in global value chains; local technology transfer and innovation spillovers; and creation of jobs and enhancement of new skills, know-how and management techniques. Given the potential contribution of FDI to sustainable growth, most countries aim at scaling up private investment. Unfortunately, even before the pandemic, FDI flows had already weakened. The war in Ukraine, rising inflation and concerns over a potential recession, have further dampened investor sentiment, and countries need to redouble efforts to bring in new investments.

Enter the WTO agreement on IFD. While reforms to attract increased FDI depend on each country’s circumstances, key determinants of international investors’ locational decisions, such as the size of the market or the availability of skilled human resources, cannot be rapidly improved by governments, especially poorer ones. It is within their reach, however, to implement investment facilitation best practices to reduce transaction costs and help target, attract, and retain sustainable FDI flows. In recognition of this, the IFD agreement aims at bringing greater transparency and predictability to investment measures, speeding up and streamlining investment-related administrative procedures, and enhancing international cooperation, information sharing and the exchange of best practices.

For sure, many governments are already working at the national level to enhance investors’ experience, for example via online single investment windows or ‘red carpet’ programs implemented by investment promotion agencies. At the bilateral and regional levels, countries have also explored collaborative approaches to investment facilitation, either as stand-alone initiatives, like Brazil’s pioneer cooperation and facilitation investment agreements or the Asia-Pacific Economic Cooperation Investment Facilitation Action Plan or as part of broader projects, like the provisions on investment facilitation in the African Continental Free Trade Agreement protocol on investment. An IFD would complement these and other efforts to facilitate investment at the bilateral, regional, or continental level.

The benefits of agreeing on investment facilitation provisions at the WTO are significant. First, it creates clear and consistent global benchmarks for investment facilitation. Second, it can help anchor domestic reform efforts at the international level, decreasing policy uncertainty and sending a clear signal to investors. Third, it provides a global forum to share best practices on investment facilitation and fostering regulatory cooperation. And fourth, given how it is structured, an IFD deal would allow developing and least-developed economies to access technical assistance and capacity building to facilitate investment. Several international organizations are ready to conduct needs-assessment and provide the necessary support for the implementation of the future IFD agreement.

The 110-plus WTO members participating in the negotiations of the accord on IFD are very close to finishing the negotiations on its text. The outstanding issues are solvable provided participating members remain focused and ready to compromise. It should be feasible to move to closure on the substance of all main provisions of the agreement in the first half or so of 2023. Governments also need to decide how to incorporate the IFD into the WTO rulebook, given that not all members of the organization have joined this initiative. However, as participating countries aim to apply the IFD on a non-discriminatory basis, ways of moving forward will likely be found.

An agreement to facilitate investment at the WTO, encompassing two-thirds of its membership or more, would be an important tool to foster investment and growth. Preliminary estimates by the German Institute of Development and Sustainability, show that the IFD agreement could generate global welfare gains of between 0.56 and 1.74 per cent, depending on the depth of a potential deal, with the highest welfare increase for low and middle-income countries. Amid a challenging global economic context, with many countries still facing the lingering effects of the pandemic, the war in Ukraine and tightening financial conditions, a deal that helps unleash private investment is to be welcomed and cannot come soon enough.

*Renowned global expert on trade, investment and economic development, and Deputy Director-General of the World Trade Organization, Geneva