Geneva: Noting that global crises are fracturing foreign investment and impacting developing economies, the United Nations Trade and Development (UNCTAD) today called for “innovative investment strategies” to foster inclusive and sustainable economic growth.

UNCTAD urged developing countries to revise their economic development strategies; and highlighted the importance of policies that attract and make the most of Foreign Direct Investment (FDI), promoting investment in Sustainable Development Goals.

It called on global policymakers, business leaders, and development agencies to enhance collaboration at global and regional levels and work towards a more open and fairer global investment environment.

A UNCTAD report entitled “Global economic fracturing and shifting investment patterns”, examined the complex landscape of global FDI, and shed light on ten transformational shifts in investment priorities across industries and regions, shaped by trends in global value chains and geopolitical dynamics. Launched today by UN Trade and Development (UNCTAD), it emphasized the necessity of integrating sustainability and development into investment strategies.

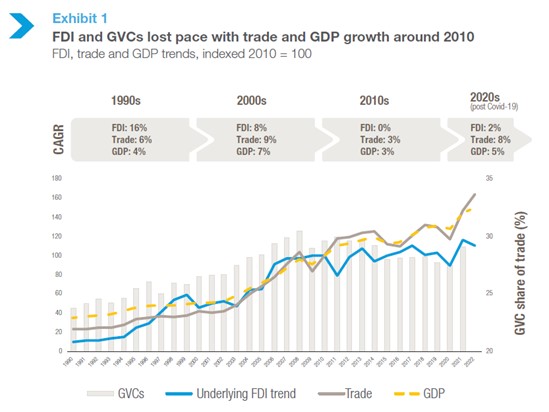

Identifying three diverging trends in global foreign investments, UNCTAD highlighted these key FDI trends that have evolved over the past two decades. It pointed out that the growth of FDI and global value chains (GVCs) were no longer aligned with GDP and trade growth, indicating a significant shift in the global economy. Further, it noted that since 2010, global GDP and trade continued to expand at an annual average of 3.4% and 4.2% respectively, even amidst rising trade tensions. By contrast, FDI growth stagnated near 0%, amid rising protectionism, growing geopolitical tensions and increased investor caution.

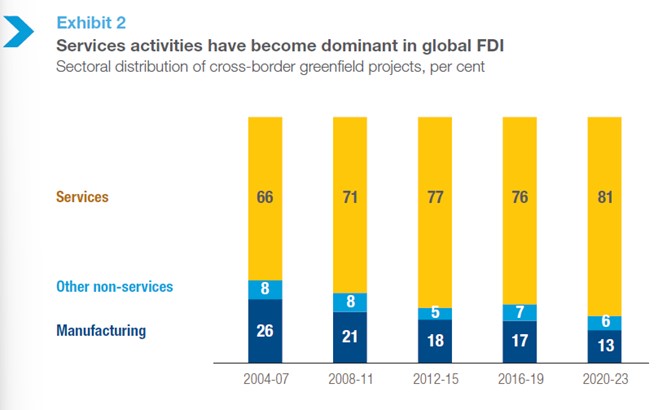

Additionally, there was a growing gap between the manufacturing and services sectors, with investments increasingly leaning towards services.

From 2004 to 2023, the share of cross-border greenfield projects in the services sector grew from 66% to 81%. Simultaneously, FDI in manufacturing stagnated for two decades before going down significantly, with a negative compound annual growth rate of -12% in the three years after the outbreak of the COVID-19 pandemic.

The decline in manufacturing severely impacted smaller economies, hindering their ability to participate in global production, upgrade production methods and adopt new technologies, and the report highlighted that finally the geography of global FDI had been significantly reshaped by China’s reduced role as a recipient country.

Multinational corporations have shown diminishing enthusiasm for launching new investments in China. However, the country still holds a dominant position in global manufacturing and trade, which signifies a transformation in its international production model.

From divergence to fracturing

The transition from divergence to fracturing in global investment patterns has emerged as a key concern, according to the report. It referred to recent global conflicts and crises, that disrupted usual investment patterns, leading to unstable investment relationships and limited chances to benefit from strategic diversification. It cautioned that investment decisions were now more frequently influenced by geopolitical factors, at times overriding economic determinants, complicating standard approaches to investment promotion and hindering FDI-based development.

Sustainability push but smaller developing countries increasingly bypassed

The report mentioned that despite progress toward sustainability and the Sustainable Development Goals, the impacts on developing nations were mixed. The growing trend of FDI to environmental technologies offered new opportunities but failed to fully address the slowdown in other industries, especially affecting developing and least developed countries, increasing the vulnerability of their economies.

The expansion of the services sector mainly benefited larger developing economies that could effectively compete, creating an imbalance that leaves smaller ones at a disadvantage, accentuating disparities and underscoring the need for policies that provide all developing countries equal opportunities.

Implications for development

The narrowing focus of FDI, both geographically and sectorally, sidelined smaller and less developed nations, heightening their economic fragility. Furthermore, traditional reliance on manufacturing investments no longer guaranteed sustained growth and economic development.

Call to bridge investment gaps

In response to the pressing need to bridge investment disparities across sectors and regions, UN Trade and Development called for immediate action to ensure that investment benefits were distributed more equitably and were aligned with overarching developmental objectives.

– global bihari bureau