Stock Watch: Choppy Waters

![]() By Amit Sinha*

By Amit Sinha*

Weekly Analysis, Insights and Forecast – Technical

05 June 2023 – 09 June 2023

Indian Indices – The Indices witnessed a choppy trade last Friday and in the closing session eked out little gains. Financial analysts on a broader term suggest that the market is going to be range-bound but can expect spikes within the stipulated strangle range of Nifty 50 between 18,400 levels and 18,550 levels.

The May month concluded with the middle cap and small cap stocks as the main gainers with 5% and 3% gains respectively. Except for the PSU stocks, broad-based recovery was seen all across the sectors resulting in Nifty 50 being at only 1% down at 18,534; from its ATH of 18,887. Bank Nifty on the other hand is at the distribution or consolidation stage at 43,937 after making a new ATH at 44,498.

Even as a robust economic outlook and positive indicators are keeping the momentum high, particularly in FMCG, Auto and Pharma sectors, the Volatility Index (VIX), which is a sign of volatility in the indices, was seen lowering to 11.13 levels. This suggests a choppy trading session expected in a small range.

FIIs’ relentless buying into the Indian equity segment in the last two months is a very welcome trend, encouraging Domestic Institutional Investors (DIIs). This boosts the expectation of better returns on the investments than any other investments in the short to mid-term.

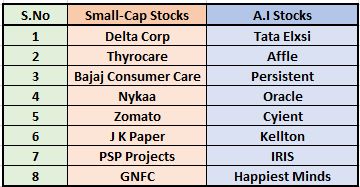

The main theme emerging, however, is an investment in Small Cap Stocks (having a general market capitalisation of fewer than 5000 crores) which is the wild card in the financial market. Long-term wealth creation by investing in selected small-cap stocks is the new mantra that investors are eyeing right now. Small cap stocks which are performing well and have less PE (price to earnings ratio) than their sectorial PE are one of the main criteria for the stock selection.

Some small-cap stocks worth keeping on the radar for their growth potential here are Delta Corp, Thyrocare, Bajaj Consumer Care, Nykaa, Zomato, J K Paper, PSP projects, and GNFC, among others.

Another theme for long-term play and investments is into AI (Artificial Intelligence) sector and stocks like Tata Elxsi, Affle, Persistent, Oracle, Bosch, Cyient, Kellton, IRIS technologies and Happiest Minds are strong considerations in this sector for high growth.

The below chart of Nifty Small Cap 100 depicts ‘Higher Highs’ and ‘Lower Lows’ on a monthly time frame

Some global factors which are in the limelight and will affect the performing indices further

- Falling Oil Prices

Globally crude oil prices have fallen drastically almost 13% over last month, down from $ 85 a barrel to $ 74 a barrel. As a thumb rule lower economic growth leads to lower oil demand. India is at gain as a net importer of Oil. Therefore, falling crude prices will also help in India’s current account deficit. Oil marketing companies in India are surely going to take full advantage and the leading oil marketing companies like IOC, BPCL, and HPCL are the main beneficiaries at the primary level.

Moreover, the oil-dependent sectors which also will gain an advantage are Aviation Industry, Paints Industry, Tyres, Lubricants as well as some FMCG sectors. We can look forward to some relatively good traction in stocks like Pidilite, Asian Paints, Berger Paints, Indigo Airlines, MRF, Apollo Tyres, Hindustan Unilever, Nestle, Dabur etc.

There are mixed signals over whether the oil supplies will reduce. OPEC (Organization of the Petroleum Exporting Countries) is promising a rate cut but largely it is to be Russia which does not seem to be participating so there is no likelihood of any cuts.

- United States and European Union economies’ weaknesses

The fear of recession is mounting and accelerating in the US and EU economies. The US debt ceiling controversy is now averted due to a deal struck between President Joe Biden and the Speaker of the US House of Representatives Kevin McCarthy.

The US House passed a sweeping bill that suspended the federal government’s $31.4 trillion debt ceiling in exchange for spending cuts. The deadline to avert this crisis was June 5, 2023.

However, the debt ceiling which now has been laid to rest till January 1, 2025, its immediate repercussion is still going to affect the economy as there will be more printing of US Dollars currency, bringing more money into circulation and this will, in turn, add to the ongoing problem of inflation. So, we should expect another rate hike of 25 basis points by the US FED in this June month aiming to pull back inflation.

- China’s economic growth disappoints

China’s economic growth has disappointed global markets. There is a large unwinding seen in their stocks and commodities as China fails to deliver as per the growth expectations put forth by global investors and analysts. Further contraction is not ruled out in the manufacturing and softer services sector as business activity is slowing down. Beijing is showing signs of reluctance to deploy any large–scale stimulus to boost the economy.

Forecast as per analysis for next week in Indices is looking at consolidation of Nifty at around 18,500 but looking at previous patterns one may expect a bounce in the coming week. 18650- 18,850 is technically the immediate hurdle for Nifty 50 whereas immediate support is at 18,400 – 18,300 levels. This is depicted in the Nifty 50 chart below.

Bank Nifty is also in similar range-bound consolidation as it has made three consecutive days of lower highs formation with an inside candle on the daily time frame on the last Friday session (June 2, 2023). The graph below for Bank Nifty Chart on a daily time frame depicts the lower highs formation.

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.

Very well written .