New Delhi: Rural inflation has consistently surpassed urban inflation in India, primarily due to elevated food prices and a greater proportion of the food basket, with rural areas at 54.2% compared to 36.3% in urban regions. According to the SBI Ecowrap report released by the Economic Research Department of the State Bank of India, twelve states experienced rural inflation exceeding the national rural average, and ten states reported urban inflation above the national urban average.

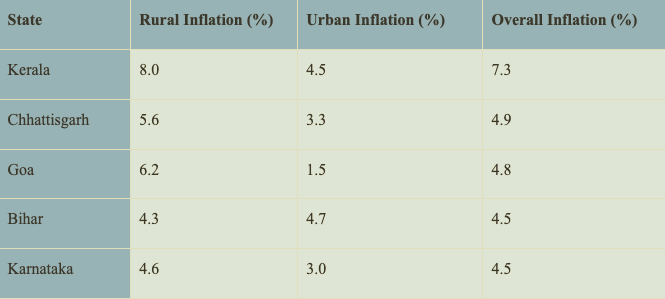

The highest urban and rural inflation rates were observed in Kerala at 7.3% and Chhattisgarh at 4.9%, while the lowest rates were found in Telangana at 1.3% and Delhi at 1.5%.

The report mentions that India’s economic metrics for February 2025 indicate a slowdown in inflation, enhanced industrial production, and robust corporate profits. Although the short-term inflation trends appear promising, challenges such as imported inflation and the depreciation of the rupee may arise in the future.

Anticipated rate reductions by the Reserve Bank of India could stimulate growth, creating a favourable atmosphere for expansion of capital expenditure and industrial activity. The changing economic environment points to a prudent yet hopeful perspective for the upcoming months. The SBI Ecowrap report anticipates that the Reserve Bank of India (RBI) may implement consecutive rate cuts in April and August 2025, with a total anticipated reduction of at least 75 basis points. This cycle of rate cuts may resume in October 2025 after a pause in August 2025.

The Consumer Price Index (CPI) inflation, which tracks the changes in prices of household goods and services, decreased to a seven-month low of 3.6% in February 2025, largely due to a significant drop in vegetable prices.

The inflation rate for Food and Beverages decreased by 185 basis points month-on-month, settling at 3.84%, primarily due to a significant drop in vegetable prices. The Consumer Price Index (CPI) for vegetables experienced a notable decline, entering negative territory at -1.07% for the first time in 20 months. This reduction can be largely attributed to decreased prices of garlic, potatoes, and tomatoes. The substantial fall in garlic prices may be associated with dietary shifts during the Maha Kumbh, which could have resulted in lower consumption of non-vegetarian foods. Conversely, fruit inflation reached a decade-high of 14.8%, likely driven by heightened demand during fasting periods linked to the Maha Kumbh. Deflation in fuel and light has persisted for 18 months. Additionally, inflation for non-vegetarian food items, including eggs, meat, and fish, has slowed, possibly due to the Maha Kumbh period. While overall inflation has eased, core inflation has risen above the 4.0% threshold for the first time in 14 months, now at 4.08%. Core inflation reflects the persistent components of inflation and indicates a more stable underlying trend.

Conversely, imported inflation surged from 1.3% in June 2024 to 31.1% in February 2025, driven by increasing prices of precious metals, oils, fats and chemical imports. However, the contribution of energy prices to imported inflation remains negative and in declining in absolute amount.

CPI inflation is anticipated to further decline to 3.9% in the fourth quarter of FY25 and to average 4.7% for the entire fiscal year 2025. Inflation for FY26 is projected to be between 4.0% and 4.2%, while core inflation is expected to range from 4.2% to 4.4%.

Released on March 12, 2025, the latest edition of SBI’s Ecowrap presents a comprehensive analysis of India’s economic situation as of February 2025. It addresses critical topics including Consumer Price Index (CPI) inflation, industrial growth, imported inflation, and corporate performance. The findings indicate a notable reduction in inflation, particularly in the food and beverage sector, while also forecasting upcoming trends in monetary policy and industrial output.

The report indicates that India’s Index of Industrial Production (IIP) experienced a growth of 5.0% in January 2025, marking the highest increase in eight months, in contrast to the 3.2% growth recorded in December 2024. This expansion was primarily fueled by several sectors: the manufacturing sector grew by 5.5%, the mining sector by 4.4%, and primary goods also saw a growth of 5.5%. Additionally, consumer durables, which are goods intended for long-term use, increased by 7.2%, while intermediate goods rose by 5.23%. However, the consumer non-durables sector, which encompasses goods for immediate consumption, experienced a decline of 0.2%, reflecting a lack of demand in that area.

Sectoral Growth Trends

In the third quarter of fiscal year 2025, sectors such as Capital Goods, Consumer Durables, Fast-Moving Consumer Goods (FMCG), Healthcare, and Pharmaceuticals experienced significant year-on-year growth. The Interest Coverage Ratio for publicly listed companies increased by 20 basis points during this period, indicating enhanced profit margins and greater financial stability. Over 4,000 corporations within the listed sector reported a revenue increase of 6.2%, with earnings before interest, taxes, depreciation, and amortization (EBITDA) and profit after tax (PAT) rising by 11% and 12%, respectively, when compared to the same quarter in the previous fiscal year. Additionally, corporations outside the Banking, Financial Services, and Insurance (BFSI) sector, comprising more than 3,400 listed entities, recorded revenue and PAT growth of 5% and 9%, respectively, in Q3FY25, marking a recovery from prior negative growth trends.

Monetary Policy Outlook & Corporate Capex Cycle

The favourable combination of robust balance sheets, adequate interest coverage, and a declining interest rate environment is anticipated to facilitate the upcoming capital expenditure cycle for Indian industries. Enhanced corporate profit margins and improved liquidity conditions position Indian companies favourably for growth in capital investments. Furthermore, the overall EBITDA margin saw an increase of 44 basis points in Q3FY25, rising to 14.84% from 14.4% in the preceding quarter.

– global bihari bureau