NITI Aayog releases report on investment opportunities in India’s healthcare sector

New Delhi: India is now faced with a dual burden of disease. While communicable diseases still account for a significant proportion of the disease burden (33% of Disability Adjusted Life Years [DALYs] lost), a rising morbidity and mortality cost is now attributable to NCDs [Non Communicable Diseases] (55% of [DALYs] lost), according to a report, ‘Investment Opportunities In India’s Healthcare Sector‘, which was released by the NITI Aayog here today..

The report mentions that India currently has around 60 Million diabetics, a number that is expected to swell to 90 Million by 2025. It is estimated that every fourth individual in India aged above 18 years has hypertension. Nearly 5.8 Million Indians die from NCDs (heart and lung diseases, stroke, cancer and diabetes) every year. The rising NCD burden is estimated to cost India USD 4.58 Trillion before 2030. Lifestyle disorders are on the rise due to a combination of rising incomes, accelerated pace of urbanisation and increased life expectancy. The fat consumption in diets is increasing, which alongside reduced physical activity, is leading to an upswing in obesity, cardiovascular diseases and cancer.

While on the one hand, India has the largest population of youth compared to any country in the world, on the other, the number of senior citizens (60+ years) is also growing. In fact, it is estimated that the share of senior citizens in India’s population will double from 8.6% in 2011 to 16% by 2041.9,10 In 2050, India is expected to have 300 Million senior citizens. In the country life expectancy is likely to exceed 70 years by 2022 and the country’s population is projected to increase to 1.45 Billion by 2028, making it the most populous nation globally.

“Several factors are driving the growth of the Indian healthcare sector including an ageing population, a growing middle class, the rising proportion of lifestyle diseases, an increased emphasis on public-private partnerships as well as accelerated adoption of digital technologies, including telemedicine, besides heightened interest from investors and increased FDI inflows over the last two decades… The Covid-19 pandemic is providing an impetus to the expansion of telemedicine and the home healthcare market in the country. All these factors, together make India’s healthcare industry ripe for investment,” NITI Aayog CEO Amitabh Kant wrote in the foreword of the report.

“Several factors are driving the growth of the Indian healthcare sector including an ageing population, a growing middle class, the rising proportion of lifestyle diseases, an increased emphasis on public-private partnerships as well as accelerated adoption of digital technologies, including telemedicine, besides heightened interest from investors and increased FDI inflows over the last two decades… The Covid-19 pandemic is providing an impetus to the expansion of telemedicine and the home healthcare market in the country. All these factors, together make India’s healthcare industry ripe for investment,” NITI Aayog CEO Amitabh Kant wrote in the foreword of the report.

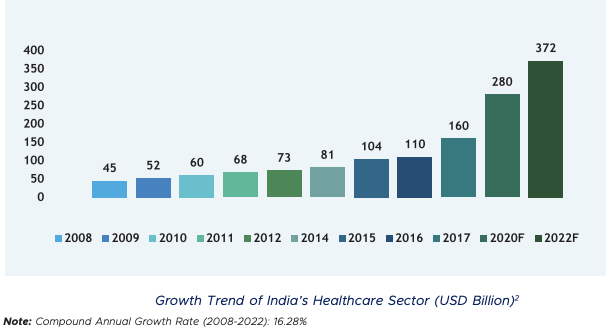

The Report points out that Healthcare has become one of the largest sectors of the Indian economy, in terms of both revenue and employment, and has been growing at a Compound Annual Growth Rate of around 22% since 2016. “At this rate, it is expected to reach USD 372 billion in 2022,” the report states, adding that it has become one of the largest sectors of the Indian economy, in terms of both revenue and employment. It employs 4.7 million people directly and the sector has the potential to generate 2.7 million additional jobs in India between 2017-22 — over 500,000 new jobs per year.

The report outlines the range of investment opportunities in various segments of India’s healthcare sector, including hospitals, medical devices and equipment, health insurance, telemedicine, home healthcare and medical value travel. It further pointed out that the healthcare sector has received heightened interest from investors (venture capital and private equity) over the last few years, with the transaction value increasing from USD 94 Million (2011) to USD 1,275 Million (2016) – a jump of over 13.5 times.

According to the report growth in multi-specialty and single-specialty hospitals in the country has taken place mainly on the back of private equity (PE) funding. A flurry of investments happened post the year 2000, mainly from overseas funds, when India allowed 100% FDI in the hospital sector. Till 2019, more than 110 PE and Venture Capital investors had invested in the healthcare delivery space in India. The value of merger and acquisition deals in hospitals jumped by a record 155% to INR 7,615 Crore (USD 1.09 Billion) in FY19.

In the first section, this report provides an overview of India’s healthcare sector, including insights about its employment generation potential, the prevailing business and investment climate as well as the overarching policy landscape. The second section highlights the key drivers of growth for the sector and the third elaborates upon the enabling policies and investment opportunities in seven key segments—hospitals and infrastructure, health insurance, pharmaceuticals and biotechnology, medical devices, medical tourism, home healthcare as well as telemedicine and other technology-related health services.

In the hospital segment, the expansion of private players to tier-2 and tier-3 locations, beyond metropolitan cities, offers an attractive investment opportunity. With respect to pharmaceuticals, India can boost domestic manufacturing, supported by recent Government schemes with performance-linked incentives, as part of the Aatmanirbhar Bharat initiative. In the medical devices and equipment segment, expansion of diagnostic and pathology centres as well as miniaturized diagnostics have high potential for growth. Further, medical value travel, especially wellness tourism, has bright prospects, given India’s inherent strengths in alternative systems of medicine. Technology advancements such as Artificial Intelligence (AI), wearables and other mobile technologies, along with Internet of Things, also offer numerous avenues for investment.

– global bihari bureau