Geneva: India recorded a 13% increase in foreign direct investment (FDI), boosted by growth in greenfield project announcements at a time when Asia, the largest recipient of Foreign Direct Investment (FDI) among developing regions, saw inflows decline by 7% in 2024. China faced a 29% drop, now 40% below its 2022 peak. ASEAN countries (Brunei Darussalam, Burma, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand and Vietnam) saw modest growth, with FDI increasing by 2% to a record $235 billion.

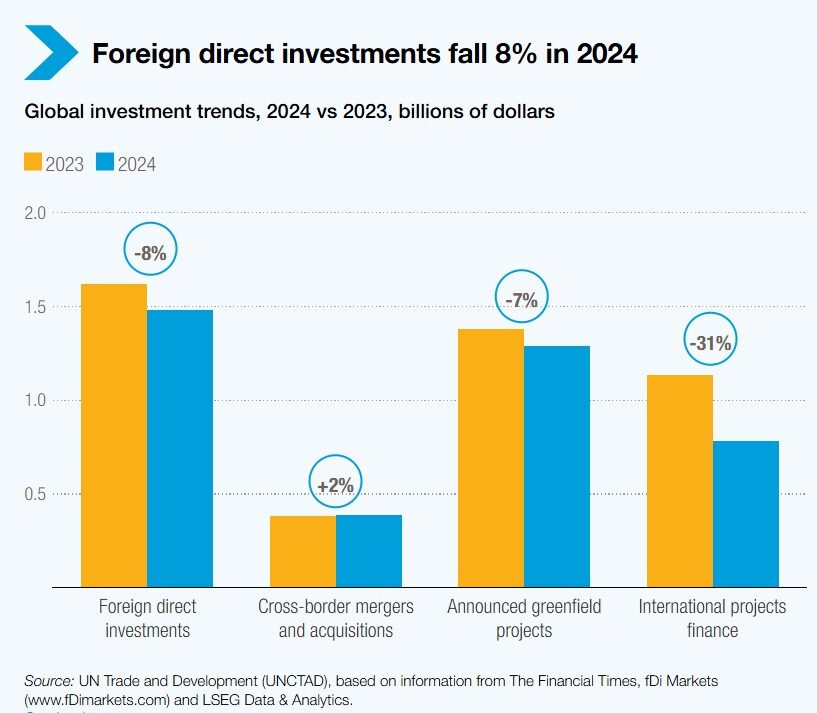

Overall, FDI is at a crossroads, according to the latest Global Investment Trends Monitor released by United Nations Trade and Development (UNCTAD) on January 20, 2025. In developing economies, FDI fell 2% in 2024, marking the second consecutive annual decline.

Global FDI rose 11% to an estimated $1.4 trillion but dipped by 8% in 2024 when excluding flows through European conduit economies – which often serve as transfer points for investments before they reach their final destination – reflecting a world grappling with shifting economic dynamics and persistent uncertainties.

This dip in FDI challenged progress on the Sustainable Development Goals that heavily rely on international project finance.

Developed economies experienced sharp contrasts. North America saw a 13% rise in FDI, driven by an 80% increase in US mergers and acquisitions (M&A). The value of greenfield projects – new investments in foreign markets – surged 93% in the US, reaching $266 billion, spurred by semiconductor megaprojects. The United Kingdom also saw a 32% increase in greenfield investments to $85 billion, and Italy posted a remarkable 71% jump to $43 billion.

Europe, however, faced steep declines. FDI fell 45% when excluding conduit economies, with 18 out of 27 European Union countries seeing drops. Germany’s FDI plunged 60% and Italy’s fell 35%. Even greenfield investments, vital for future growth, dropped 10% across Europe, though the region saw a 15% rise in total project value, signalling the significance of a few large-scale projects.

International project finance – a key driver for infrastructure and energy investments – also faced challenges, with deals dropping 26% in number and nearly a third in value across developed economies.

In Latin America and the Caribbean, FDI declined by 9%, with Brazil’s inflows falling by 5%. However, greenfield project numbers and values rose in Brazil, Argentina and Colombia, signalling potential future recovery. Despite weaker regional project announcements, Mexico’s FDI rose 11%, showing resilience in the face of broader challenges.

Africa stood out, recording an 84% surge in FDI to $94 billion, largely due to a single megaproject in Egypt. Excluding this project, the continent’s FDI rose 23%, though the overall figure remained modest at $50 billion.

Looking to 2025, moderate FDI growth is expected, supported by improved financing conditions and renewed Merger and Acquisition activity. However, risks and uncertainties – including geopolitical tensions and global economic instability – pose significant challenges.

The continued decline in greenfield investments and international project finance underscores the need for robust, diversified strategies to attract and sustain investment, especially in sectors critical for sustainable development. The report said the stakes are high for both developed and developing economies as they navigate this complex landscape.

– global bihari bureau