New Delhi: India revised its approach to managing Waqf properties —defined as the enduring dedication of movable or immovable assets for purposes deemed pious, religious, or charitable under Muslim Law, with the passage of the Waqf (Amendment) Bill 2025 in the Lok Sabha after midnight of April 2, 2025, and in the Rajya Sabha in the wee hours today.

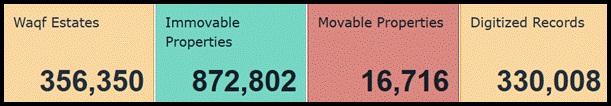

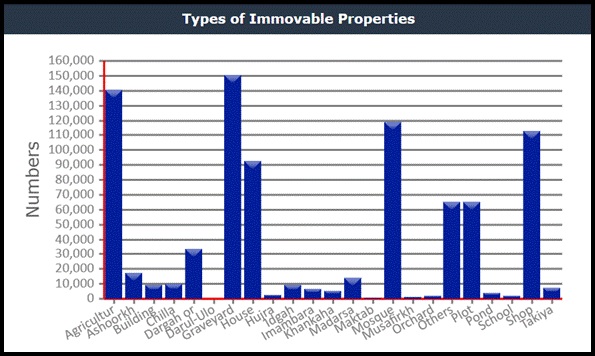

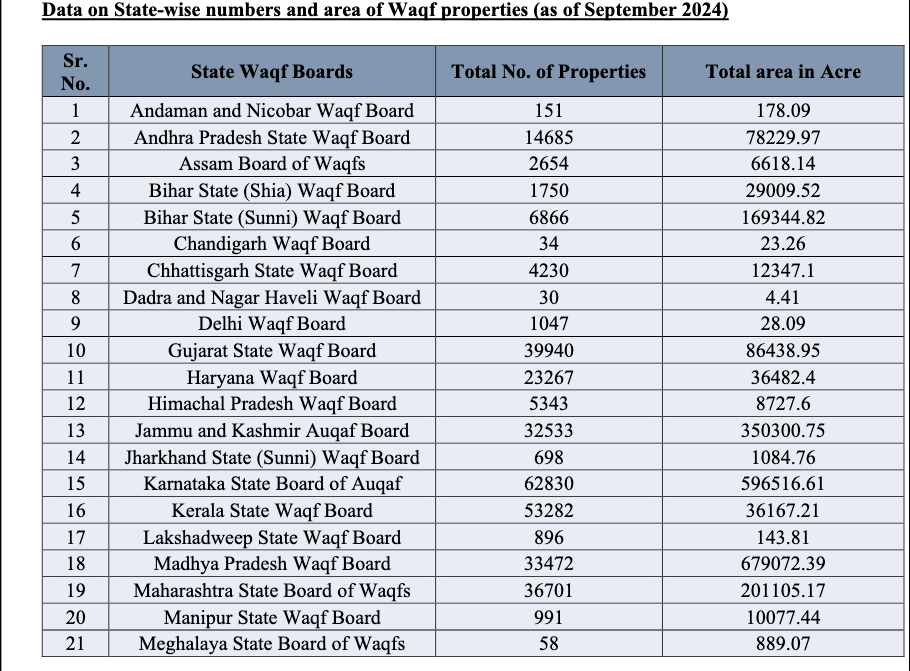

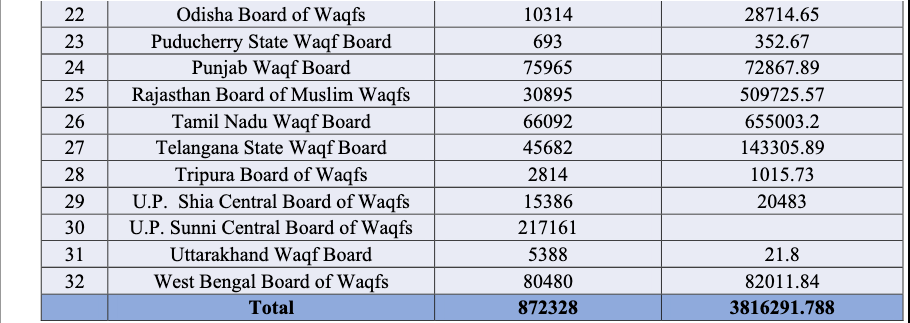

This new legislation aims to enhance the administration of approximately 872,000 Waqf properties, which span over 3.8 million acres, with a “strong” emphasis on transparency, operational efficiency, and adherence to international standards.

The Union government explains this initiative as part of a broader series of legal reforms designed to regulate these properties, which are of profound religious, social, and economic importance.

The regulation of Waqf properties is currently governed by the Waqf Act of 1995, which is enforced by the Central Government. This framework includes the Central Waqf Council (CWC), which offers policy guidance to both the government and State Waqf Boards (SWBs) without having direct oversight of the properties. The SWBs are tasked with the management and safeguarding of Waqf properties in their states, and Waqf Tribunals function as exclusive judicial bodies that adjudicate disputes with ultimate jurisdiction.

The 2025 bill, along with the Mussalman Wakf (Repeal) Bill 2024, addresses issues in the 1995 Act and its 2013 amendment, such as legal disputes and inefficiencies. It builds on schemes by the Ministry of Minority Affairs: the Quami Waqf Board Taraqqiati Scheme (QWBTS), providing grants-in-aid through the Central Waqf Council for manpower deployment to computerise and digitise records, and the Shahari Waqf Sampatti Vikas Yojana (SWSVY), offering interest-free loans to Waqf Boards and institutions for commercial projects on Waqf properties. These schemes received Rs 23.87 crore and Rs 7.16 crore respectively from 2019-20 to 2023-24.

Current Structure and Recent Changes

Under the 1995 Act, State Waqf Boards, established per Section 9(1), manage properties locally, while the Central Waqf Council, created in 1964 under the 1954 Act, provides oversight. Waqf Tribunals resolve disputes, with decisions equivalent to civil court rulings and not challengeable in civil courts.

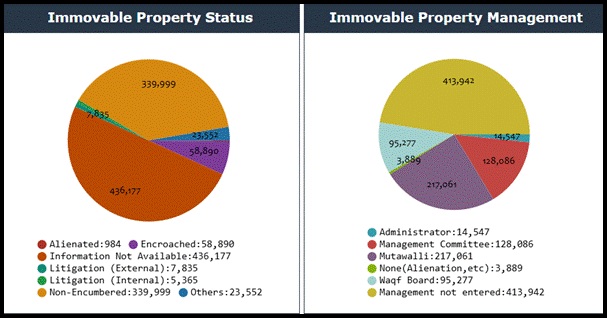

The 1995 Act also outlines the powers and functions of the Central Waqf Council, State Waqf Boards, the Chief Executive Officer, and the duties of the mutawalli. The 2013 amendment added provisions: Tribunals now include three members, one an expert in Muslim law; State Waqf Boards require two women members; sales or gifts of Waqf properties are prohibited; and lease terms are extended from 3 to 30 years for better use. Data from the Waqf Assets Management System of India (WAMSI) portal, as of March 14, 2025, shows 8.72 lakh properties reported by 30 States/Union Territories and 32 Boards, with 4.02 lakh classified as “Waqf by user.” Only 9,279 ownership documents and 1,083 Waqf deeds have been uploaded.

The 2025 bill seeks to update this framework, leveraging QWBTS for digitization and administration enhancement, and SWSVY for development loans, aiming to improve record-keeping and property use while reducing legal disputes.

Historical Background

Waqf regulation began with the Mussalman Wakf Validating Act of 1913, allowing Muslims to create Waqfs for family benefit, eventually leading to charitable purposes, though it was not highly effective. The Mussalman Wakf Act of 1923 introduced rules for accounting and transparency. The Mussalman Wakf Validating Act of 1930 strengthened the legal validity of family Waqfs, supporting the 1913 Act. The 1954 Act introduced State Waqf Boards and later the Central Waqf Council, centralizing oversight post-independence, with amendments in 1959, 1964, 1969, and 1984 refining administration. The 1995 Act repealed the 1954 Act and its amendments, establishing Tribunals and a comprehensive governance structure. Each law responded to the administrative needs of its time.

Scope and Context

According to the Union government, the 8.72 lakh Waqf properties represent a significant asset base, yet incomplete documentation and management challenges persist. The 2025 reforms, supported by ongoing Ministry of Minority Affairs schemes for automation and modernization, continue a pattern of updates since 1913, “focusing on administration and societal benefit”.

The changes from 1913 to 2024 show an effort to protect and manage Waqf properties, with each law addressing current problems while maintaining the purpose of Waqf endowments, the Union government says.

– global bihari bureau