Rome: The Food and Agriculture Organization of the United Nations (FAO) foresees a stable outlook for most food commodity markets in 2024-25, and predicts supplies of most of the world’s major food commodities to be adequate during this period.

Rome: The Food and Agriculture Organization of the United Nations (FAO) foresees a stable outlook for most food commodity markets in 2024-25, and predicts supplies of most of the world’s major food commodities to be adequate during this period.

The prediction is significant given the prevailing extreme weather, rising geopolitical tensions, sudden policy changes and other factors that could all potentially tip the delicate global demand-supply balances and impact prices and global food security.

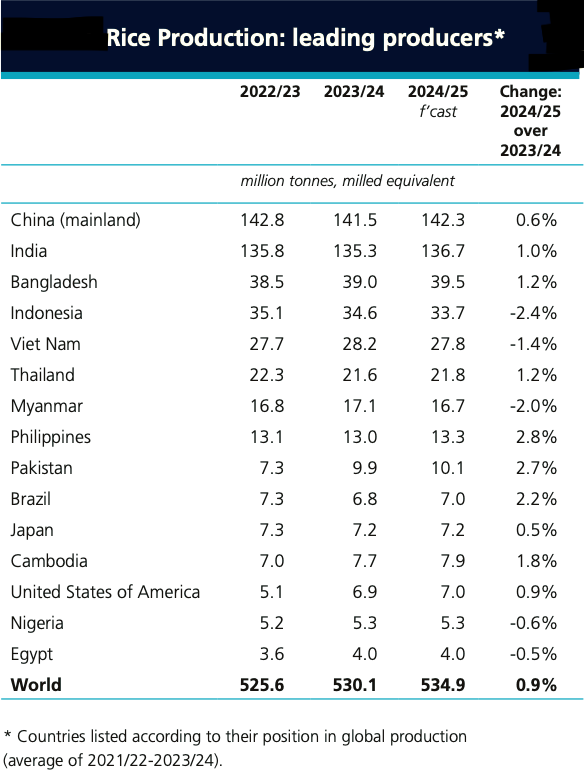

According to the latest FAO Food Outlook, a biannual publication which offers updated forecasts for the production, trade, utilization and stocks of major food staples, on the production side, world outputs of rice and oilseeds are expected to be at record levels, while those of wheat and maize will likely decline modestly.

The Food Outlook provides detailed market assessments for wheat, coarse grains, rice, oil crops, sugar, meat, dairy products and fisheries. It also provides FAO’s preliminary estimate for the global food import bill in 2024, forecast it to rise by 2.5 per cent to exceed $2 trillion. Those projections are driven by relatively favourable macroeconomic conditions, including steady global economic growth, and lower food commodity prices.

According to the report, the global wheat markets are expected to contract in 2024/25 as global wheat production, utilization, trade and stocks are all forecast to decline from their respective 2023/24 levels. Nonetheless, ample supplies and lower demand for feed and other uses globally are likely to maintain a soft tone in wheat markets.

According to the report, the global wheat markets are expected to contract in 2024/25 as global wheat production, utilization, trade and stocks are all forecast to decline from their respective 2023/24 levels. Nonetheless, ample supplies and lower demand for feed and other uses globally are likely to maintain a soft tone in wheat markets.

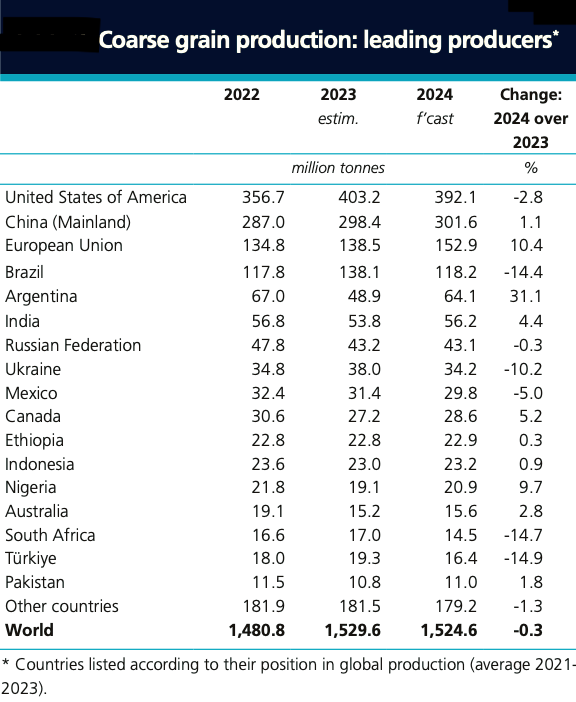

The outlook for global coarse grain markets points to another season of abundant supplies with stocks seen reaching their highest level since 2017/18. International trade in coarse grains will likely decline in 2024/25, with anticipated smaller export availabilities in Brazil and Ukraine and weaker import demand from China.

International rice prices have remained elevated amid lingering export curbs and strong purchases by some Asian countries. However, early prospects for 2024-25 points to world production reaching a fresh peak, which could revive rice utilization growth and push stockpiles to a record high.

Global meat production is forecast to expand marginally in 2024, driven by an increase in poultry meat production, notwithstanding possible negative impacts stemming from extreme weather events, the spread of animal diseases and thin profit margins. Meanwhile, the global meat trade will likely rebound as demand is expected to exceed domestic supplies in leading meat-importing countries.

Global meat production is forecast to expand marginally in 2024, driven by an increase in poultry meat production, notwithstanding possible negative impacts stemming from extreme weather events, the spread of animal diseases and thin profit margins. Meanwhile, the global meat trade will likely rebound as demand is expected to exceed domestic supplies in leading meat-importing countries.

India’s carabeef (buffalo meat) and poultry meat production will likely increase, driven by strong domestic and foreign demand. India’s carabeef exports could expand in line with the consolidation of the country’s export markets in Asia and the Near East, primarily on account of export price competitiveness and market access under halal certifications.

Brazil, China, Australia and India are forecast to drive much of the bovine meat output expansion and will partially offset declines in the United States, Argentina, the European Union and Canada. In India, production is forecast to expand due to increased international demand for carabeef at competitive prices. By contrast, bovine meat output is projected to decline in the United States, Argentina, the European Union and Canada due to reduced cattle inventory and lower profitability.

India’s poultry meat production too is forecast to expand due to rising internal demand and disposable incomes among urban consumers.

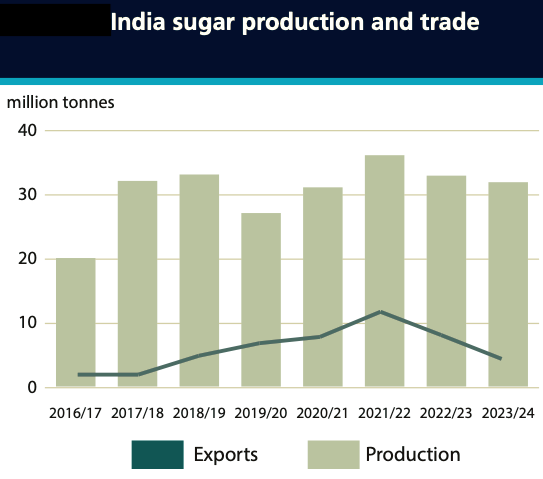

Improved global supply prospects for the 2023/24 season led to significant declines in international sugar prices. Driven by lower sugar quotations, world sugar consumption is foreseen to expand above its recent trend. Global trade in sugar is anticipated to expand, amid ample export availabilities and stronger global import demand.

In India, the world’s largest sugar-consuming country, consumption is expected to increase by 2.3 per cent to 28.5 million tonnes. This increase is supported by strong domestic demand, including from hotel, restaurant and catering service industries in general.

In 2023-24, forecasts of record world outputs for oilseeds and meals/cakes are expected to lead to a further stock accumulation in oil meals, whereas an anticipated marginal increase in oils/ fats production, amid below-potential palm oil outputs, could be outstripped by consumption growth, thus resulting in a somewhat tightening global supply-demand balance for vegetable oils.

World milk production is forecast at nearly 979 million tonnes in 2024, up 1.4 percent from 2023. Asia will continue to lead production growth, driven by rising dairy cow numbers and growing contributions of large-scale dairy farms. Meanwhile, global trade in dairy products is predicted to recover moderately despite subdued import demand foreseen for some leading importing countries.

India’s milk output is projected to increase to 243 million tonnes, up 2.8 per cent, or just over 6 million tonnes from 2023, assuming the average growth rate in milk cow numbers, normal monsoon rains and fodder availability and considering a 60.0 per cent chance of La Niña developing by June–August 2024.

In 2024, stable landings from capture fisheries are expected to be complemented by an expanding aquaculture sector. Stifled overall demand, coupled with an increased supply of some aquaculture species, has caused a fall in prices for certain aquatic products. Overall, rising production costs and stagnant consumer spending remain challenging.

The new edition of the report has a special chapter on the dynamic effects of shocks to shipping costs on the food import bill – a topical variable given conflict-derived volatility on the Black Sea and Red Sea routes and due to drought impacts on the Panama Canal. The analysis shows that these shocks have a positive impact on the value of the FIB in the short term, with a larger effect on the group of net food-importing developing countries (NFIDCs).

Focus on fertilizers

The Food Outlook also includes a special chapter focusing on fertilizers, offering a comprehensive review of global fertilizer trade between 2021 and 2023 and a short-term market outlook for 2024-25.

The chapter tracks the series of shocks, including the war in Ukraine, that directly or indirectly had an impact on primary nutrients such as nitrogen, phosphorus and potassium. Soaring natural gas prices were a major catalyst, rendering fertilizer production uneconomic, while other factors, including shipping and insurance costs as well as trade measures, also drove world fertilizer prices higher. The shocks led to a significant contraction in fertilizer trade in 2022 with a rebound in 2023 so similar levels of 2021.

The article shows that in April 2024, fertilizer prices as presented by a basket of nitrogen, phosphorus and potassium prices, averaged $327 per tonne, compared to $815 in April 2022. With the decline in prices, fertilizer trade volumes have rebounded with Nitrogen trade close to its 2021 level.

Overall, the short-term outlook for fertilizers suggests stability over the next six months, according to FAO, with improved availability and affordability across the three main ingredients. Future shocks to global fertilizer markets are likely to be determined by developments in energy markets due to geopolitical or other causes.

Recent restrictions and disruptions to maritime transportation have added pressure on international trade. The report analyses the dynamic effects of shocks to the shipping costs on the food import bill. The analysis distinguishes between modes of maritime transportation – dry bulk and container – and examines how these shocks affect net food-importing developing countries.

– global bihari bureau