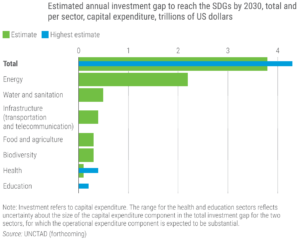

Geneva: Developing countries are facing a widening annual investment deficit and the investment gap across all sectors of the Sustainable Development Goals (SDGs) has nearly doubled since 2015 even as these nations are working to achieve the SDGs by 2030.

The gap is now about $4 trillion per year – up from $2.5 trillion in 2015 when the SDGs were adopted. The increase stems from both inadequate investment and additional needs, the World Investment Report 2023, published today by the United Nations Conference on Trade and Development (UNCTAD) stated.

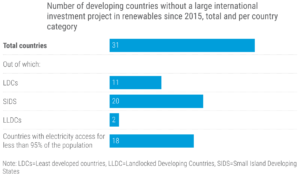

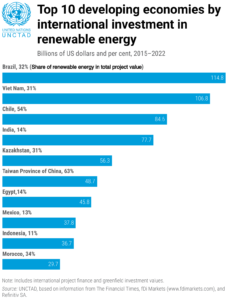

Although renewable energy investments have nearly tripled since the adoption of the Paris Agreement in 2015, most of the money has gone to developed countries. Hence, the widening SDG investment gap in developing countries stands in contrast to positive trends observed in sustainability investment in global capital markets.

Although renewable energy investments have nearly tripled since the adoption of the Paris Agreement in 2015, most of the money has gone to developed countries. Hence, the widening SDG investment gap in developing countries stands in contrast to positive trends observed in sustainability investment in global capital markets.

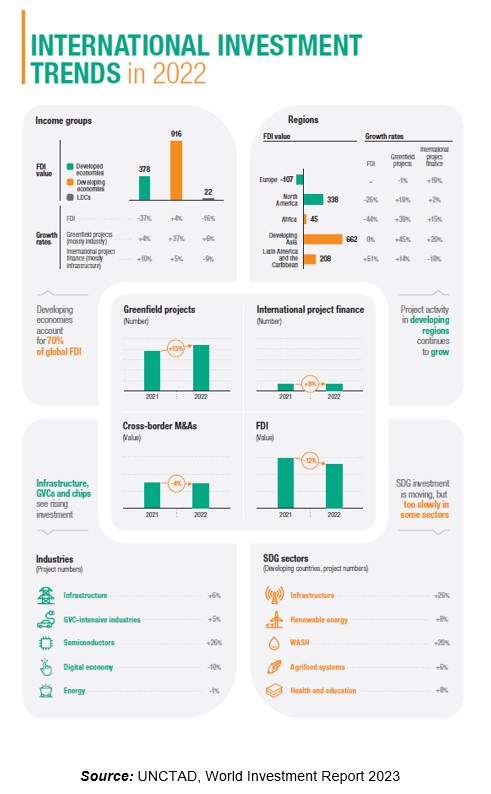

The report revealed that global foreign direct investment (FDI) fell 12% in 2022 o $1.3 trillion after a strong rebound in 2021, due mainly to overlapping global crises – the war in Ukraine, high food and energy prices, and soaring public debt.

The decline was felt mostly in developed economies, where FDI fell by 37% to $378 billion. But flows to developing countries grew by 4% – albeit unevenly, with a few large emerging countries attracting most of the investment while flows to the least developed countries declined. The sustainable finance market grew by 10% to $5.8 trillion in 2022 with Latin America and the Caribbean experiencing a significant increase.

FDI inflows in least-developed countries fell by 16% and in Africa, it fell to prior levels of $45 billion after anomalously high levels in 2021 caused by a single financial transaction. In North Africa, while Egypt saw FDI more than double to $11 billion and its announced greenfield projects more than doubled in number, to 161, flows to Morocco decreased by 6%, to $2.1 billion. In West Africa, Nigeria saw FDI flows turn negative to -$187 million as a result of equity divestments. Flows to Senegal remained flat at $2.6 billion. FDI flows to Ghana fell by 39% to $1.5 billion. In East Africa, flows to Ethiopia decreased by 14% to $3.7 billion even though the country remained the second-largest FDI recipient on the continent. FDI to Uganda grew by 39% to $1.5 billion on investment in extractive industries. FDI to Tanzania increased by 8% to $1.1 billion. In Central Africa, FDI in the Democratic Republic of the Congo remained flat at $1.8 billion, with investment sustained by flows to offshore oil fields and mining. In Southern Africa, flows returned to prior levels after the anomalous peak in 2021 caused by a large corporate reconfiguration in South Africa. FDI in South Africa was $9 billion – well below the 2021 level but double the average of the last decade. Cross-border M&A sales in the country reached $4.8 billion from $280 million in 2021. In Zambia, after two years of negative values, FDI rose to $116 million.

Flows to Latin America and the Caribbean increased by 51%, reaching $208 billion, the highest level ever recorded.FDI flows to Brazil rose by 70% to $86 billion – the second-highest level ever recorded – due to a doubling of reinvested earnings. FDI more than doubled to $15 billion in Argentina, doubled in Peru to $12 billion and rose by 82% in Colombia, to $17 billion. Flows to Mexico, the second-largest recipient in Latin America, increased by 12% to $35 billion, with a rise in new equity investment and reinvested earnings.

Flows to Latin America and the Caribbean increased by 51%, reaching $208 billion, the highest level ever recorded.FDI flows to Brazil rose by 70% to $86 billion – the second-highest level ever recorded – due to a doubling of reinvested earnings. FDI more than doubled to $15 billion in Argentina, doubled in Peru to $12 billion and rose by 82% in Colombia, to $17 billion. Flows to Mexico, the second-largest recipient in Latin America, increased by 12% to $35 billion, with a rise in new equity investment and reinvested earnings.

In the Caribbean (excluding financial centres), FDI increased by 53% to $3.9 billion, mainly driven by growth in inflows to the Dominican Republic, to $4 billion.

However, FDI inflows in developing countries in Asia were flat at $662 billion but still accounted for more than half of global FDI. In East Asia, inflows to China rose by 5% to $189 billion, mainly in manufacturing and high-tech industries and mostly from European multinational enterprises (MNEs). Flows to Hong Kong (China), though, fell by 16% to $118 billion. In South-East Asia, Singapore, the largest recipient, registered another record, up 8% to $141 billion. Flows to Malaysia grew by 39% to $17 billion – a new record for the country. FDI to Viet Nam and Indonesia rose by 14% and 4%, to $18 billion and $22 billion, respectively. However, FDI to the Philippines fell by 23% as a result of several divestments. In West Asia, flows to Saudi Arabia fell by 59% to $7.9 billion. FDI to the United Arab Emirates increased by 10% to $23 billion – the highest amount ever recorded. The country attracted the fourth-highest number of greenfield projects in the world. Flows to Türkiye rose by 9% to $13 billion. In South Asia, FDI flows to India rose by 10% to $49 billion as the country became the third-largest host country for greenfield project announcements and the second-largest for international project finance deals. FDI in Bangladesh grew by 20% to $3.5 billion. In Central Asia, flows to Kazakhstan almost doubled to $6.1 billion, mainly in extractive industries. FDI also rose in Uzbekistan, by 11%, to $3 billion.

The report, however, highlights that developing countries need renewable energy investments of about $1.7 trillion each year but attracted only $544 billion in clean energy FDI in 2022.

Although investments in renewables have nearly tripled since 2015, most of the money has gone to developed countries.

“A significant increase in investment in sustainable energy systems in developing countries is crucial for the world to reach climate goals by 2030,” Rebeca Grynspan, UNCTAD Secretary-General, said.

“A significant increase in investment in sustainable energy systems in developing countries is crucial for the world to reach climate goals by 2030,” Rebeca Grynspan, UNCTAD Secretary-General, said.

While analysing how investment policy and capital market trends impact investment in the SDGs, particularly in clean energy, the report calls for urgent support to developing countries to enable developing nations to attract significantly more investment for their transition to clean energy. It proposes a compact setting out priority actions, ranging from financing mechanisms to investment policies, to ensure sustainable energy for all.

While analysing how investment policy and capital market trends impact investment in the SDGs, particularly in clean energy, the report calls for urgent support to developing countries to enable developing nations to attract significantly more investment for their transition to clean energy. It proposes a compact setting out priority actions, ranging from financing mechanisms to investment policies, to ensure sustainable energy for all.

On financing, the report calls for the de-risking of energy transition investment in developing countries through loans, guarantees, insurance instruments and equity participation of both the public sector – through public-private partnerships and blended finance – and multilateral development banks.

Also, partnerships between international investors, the public sector and multilateral financial institutions can significantly reduce the cost of capital for clean energy investment in developing countries.

UNCTAD also emphasized the need for debt relief to offer developing countries fiscal space to make the investments necessary for the clean energy transition and to help them attract international private investment by lowering country risk ratings.

On a positive note, the report revealed that greenfield investment project announcements were up 15% in 2022, growing in most regions and sectors.

However, international investment in renewable energy generation, including solar and wind, although continued to grow, it was at a slower 8% than the 50% growth recorded in 2021. Notably, projects announced in battery manufacturing tripled to more than $100 billion in 2022. Besides, industries struggling with supply chain challenges, including electronics, semiconductors, automotive and machinery, saw a surge in projects, while investment in digital economy sectors slowed.

The report also notes that major oil companies are gradually selling fossil fuel assets – at a rate of about $15 billion per year – mostly to unlisted private equity firms and smaller operators with lower disclosure requirements. This calls for new dealmaking models to ensure responsible asset management.

– global bihari bureau