Geneva: To cope with current crises and insulate itself against future shocks, Africa must diversify its economies, recommends the United Nations Conference on Trade and Development (UNCTAD)’s Economic Development in Africa Report 2022 – Rethinking the Foundations of Export Diversification in Africa: THE CATALYTIC ROLE OF BUSINESS AND FINANCIAL SERVICES, released here today.

Soaring food and energy prices are hitting African countries especially hard as they struggle with the impact of the COVID-19 pandemic, climate change and the war in Ukraine.

Noting that the continent of 1.4 billion people is among the least diversified regions in the world with regard to exports, the report acknowledges that leveraging high knowledge-intensive services to increase productivity and improve competitiveness in the private sector will be key to achieving higher value-added diversification and growth on the continent.

The report shows that the level of services trade in Africa is low. Between 2005 and 2019, services accounted for only 17 per cent of total exports in Africa, of which travel and transport accounted for about two-thirds, representing a high concentration of traditional services sectors in its total trade in services, and limited access to a variety of fundamental competitive services inputs from within the continent.

The knowledge-intensive services, which include eight of the 12 services categories, have the potential to add higher value to the export of services, enable innovation in business operations and production systems and drive sector growth. Such services, however, are underrepresented in African services exports, accounting for only 20 per cent of the continent’s total exports of services.

For decades, export diversification has been a policy priority for Africa. However, fewer than half of all African countries have succeeded. While some countries have added new product lines to their export basket, insufficient progress has been made in steering the industrial sector into high-value-added manufactured goods that are key to successful sector growth and effective integration into the high-value segments of regional and global value chains.

Despite efforts to achieve export diversification, African countries remain predominantly dependent on exports of primary products in the agricultural, mining and extractive industries. The report says that this has adverse impacts on inclusive growth in the long term, as it dims the prospects of industrialization and human capital development, among others.

Forty-five African economies are commodity-dependent, with highly volatile revenues due to the nature of the market, characterized by periods of price boom and bust. While many parts of Africa have enjoyed positive economic growth in recent years, such growth was in part due to a commodity super-cycle.

“The high concentration of exports in a small number of commodity products can create macroeconomic instability, especially during times of commodity price volatility and global shocks, such as those affecting supply and demand. The disruptive effect of these shocks on the trade balance, export revenues and financial flows can in turn generate a negative impact on productivity, economic growth, revenues (both government and income) and investment. Commodity price shocks are also associated with lower levels of financial sector development in commodity-dependent countries.,” the report warns.

Neglecting the potentially transformative role of high knowledge-intensive services, such as information and communications technology, business services and digital financial services, is among the key reasons why export diversification remains a challenge in Africa, it says.

Moreover, many export diversification programmes overlook the potential of the private sector and financial services to reach their objectives. “The private sector, which includes small and medium-sized enterprises (SMEs), can provide innovative and efficient ways of diversifying and transforming African economies; financial services can serve as a sustainable channel through which SMEs can mobilize financing to enter new markets, diversify exports, upgrade productive activities and improve competitiveness,” the report notes.

In the region, there are about 50 million formal micro, small and medium-sized enterprises with an unmet financing need of $416 billion every year. Although financing poses a challenge to all developing regions, the problem is worse in Africa. Exporting firms, particularly new entrants and small-scale exporting firms, need to secure external financing to cover the large costs to enter export markets. Those costs include information costs (to better understand the required regulations and standards of a potential foreign market), compliance costs (to redesign exporting products that meet demand standards for a specific market and establish new processes to comply with foreign market regulations and standards) and other costs related to trade barriers (customs, logistics, lead time and tariffs).

Given the specific financing needs of African firms and the difficulty to obtain funding from traditional financial sources, such as the corporate banking sector, the report calls for more innovative financial instruments, practices and technology that could be optimized to secure access to credit and external financing.

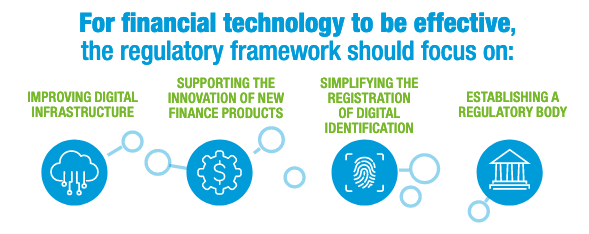

“It is time to explore fresh financing options to improve the prospects for African SMEs contributing to diversification. Financial technology and alternative financing could be transformative, provided that the appropriate legal and institutional frameworks are in place, not only by facilitating the financing and growth of SMEs but also by leveraging the potential of these firms to drive export diversification,” the report says. It mentions that on a positive note, despite the impact of the coronavirus pandemic of 2020 on markets and businesses, the outlook for financial technology and alternative finance has continued to improve favourably in Africa.

According to the report, investments by African financial technology companies soared to a record of over $2 billion in 2021 (a 200 per cent increase from 2020), and about 60 per cent of the $5.2 billion of venture capital transactions in 2021 were injected into the financial technology sector alone. Venture capital growth in Africa in 2021 stood at 215 per cent, higher than in any other region. Africa has over 500 active financial technology companies, including a handful of unicorns, start-ups with a market value of over $1 billion.

The report shows that effectively addressing barriers to services trade under the African Continental Free Trade Area will be key to unleashing the transformative role of services in enhancing the diversity and complexity of African economies.

“The Economic Development in Africa Report 2022 serves Africa’s effective integration into high-end global value chains. I hope that this report will prove a valuable guide to policymakers to drive the export diversification of goods and services by empowering private businesses to step into new markets and thrive,” said Rebeca Grynspan, Secretary-General of United Nations Conference on Trade and Development.

– global bihari bureau