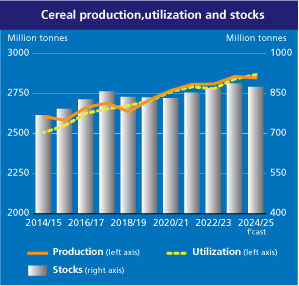

Rome: The global cereal production estimate for 2024 is set at 2,849 million tonnes, reflecting a slight decline of 0.3% compared to the previous year.

However, this figure is higher than earlier predictions, thanks to unexpectedly robust wheat yields in Australia and Kazakhstan, according to an updated Cereal Supply and Demand Brief published today by the Food and Agriculture Organization of the United Nations (FAO), revealing new projections for 2024 and insights into crop conditions for 2025..

The forecast for world rice production for the 2024-25 season remains stable at 543.3 million tonnes, indicating a 1.6% annual increase primarily due to expanded planting areas. The wheat production forecast for 2025 remains unchanged from last month at 895 million tonnes, consistent with the revised 2024 estimate.

The forecast for world rice production for the 2024-25 season remains stable at 543.3 million tonnes, indicating a 1.6% annual increase primarily due to expanded planting areas. The wheat production forecast for 2025 remains unchanged from last month at 895 million tonnes, consistent with the revised 2024 estimate.

In the European Union, wheat output is projected to rise by 12% following weather-related declines in 2024, with increases also anticipated in Argentina, Egypt, and India, while Australia, the United States, and parts of Near East Asia are expected to see reductions. In the southern hemisphere, maize yields are expected to differ, with Brazil and South Africa likely to see increases, while Argentina faces a downturn.

The FAO’s latest forecast for global cereal utilization in 2024-25 is 2,868 million tonnes, marking a 0.9% rise from the previous season, largely driven by record-high rice consumption. World cereal stocks are anticipated to decrease by 1.5% to 873.3 million tonnes by the end of the 2025 season, primarily due to a significant reduction in coarse grain stocks. Conversely, inventories of wheat and rice are expected to grow.

The updated projections indicate that the world cereal stocks-to-use ratio for 2024-25 will be 30.1%, a slight decrease from the previous year but still reflecting a comfortable supply level, according to FAO.

Additionally, the organization has revised its forecast for global cereal trade in 2024-25 downward by 5.3 million tonnes to 478.9 million tonnes, representing a 6.7% decline from 2023-24 and the lowest level recorded since the 2019-20 season.

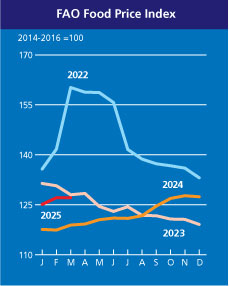

Meanwhile, the FAO Food Price Index, which serves as a key indicator of global food commodity price trends, showed little variation in March 2025 compared to its adjusted February 2025 figure.

This stability was attributed to decreases in global cereal and sugar prices, which balanced out a significant rise in vegetable oil costs, as reported by FAO today.

This stability was attributed to decreases in global cereal and sugar prices, which balanced out a significant rise in vegetable oil costs, as reported by FAO today.

In March, the index averaged 127.1 points, reflecting a 6.9% increase from the same month last year, yet it remained 20.7 percent lower than its peak in March 2022.

The Cereal Price Index fell by 2.6% in March and was down 1.1% from March 2024, with global wheat prices declining as fears regarding crop conditions in key Northern Hemisphere exporting countries subsided, although currency fluctuations moderated this drop.

Prices for maize, sorghum, and barley also decreased from February, while the FAO All-Rice Price Index saw a 1.7% decline due to weak import demand and sufficient export supplies.

Conversely, the Vegetable Oil Price Index rose by 3.7% from February, averaging 23.9 percent higher than the previous year, driven by strong global import demand for palm, soy, rapeseed, and sunflower oils.

The Meat Price Index experienced a 0.9 percent monthly increase and a 2.7 percent annual rise, largely due to higher pig meat prices in Europe following Germany’s recovery from foot-and-mouth disease and the euro’s appreciation against the U.S. dollar.

Besides, World poultry meat prices remained stable in March, despite ongoing challenges from avian influenza outbreaks in several major producing nations.

The FAO Dairy Price Index held steady from February, as lower international cheese prices were counterbalanced by rising costs for butter and milk powders.

Further, the FAO Sugar Price Index fell by 1.6 percent in March, primarily due to indications of declining global demand. Recent rainfall in key sugarcane growing areas of southern Brazil further contributed to the decline, while deteriorating production prospects in India and continuing concerns about the overall outlook for the crop in Brazil limited the price decline.

– global bihari bureau