Stock Watch: An overbought situation and a delayed ATH

![]() By Amit Sinha*

By Amit Sinha*

Weekly Analysis, Insights and Forecast

12 June 2023 – 16 June, 2023

Indian Indices –Barring the Information Technology (IT) sector, most of the stocks are in overbought territory and there is expected selling pressure now because of this overbought situation. Hence, even as Sensex touched 63,000 which is a new high in 2023, the expected extended rate pause stance by the Reserve Bank of India (RBI) did not help in uplifting the Indices.

The main reason for the Sensex touching 63,000 points was the FPIs (Foreign Portfolio Investors) as net buyers during the week and the market last week witnessed much-awaited profit booking all across major sectors.

A tilt favouring towards a near short-term bear market meant the break out in Nifty 50 over ATH (All Time High) got delayed due to the caveat of market breath losing strength in momentum. Overall the market is expected to remain at a precarious level and a cautious view will be meaningful as more profit booking is expected.

RBI’s monetary policy committee declared the status quo for the second time on June 9, 2023. Hence, the policy rate (REPO rate) remained unchanged at 6.50%, MDF (market development fund) rate remained unchanged at 6.75%, and the Bank Rate remained unchanged at 6.75%.

These, though, were on expected lines and already factored in by the market.

The risks to near-term inflation are showing moderation but there is imminent pressure for a marginal increase of 20-30 basis points up-tick on inflation as the El Nino effect cannot be ruled out.

RBI’s goal post target for inflation is 4%. However, it is predicted that inflation will be somewhere around 5-5.25% for FY 2024, which is much within the realms of the inflation tolerance yardstick. India as compared to other major economies is doing much better with respect to Inflation numbers.

Nifty 50 is in the strangled range of 18,600 – 18,700 which is a very small tight range.

Bank Nifty is also seen in a similar strangled trapped range of 44,200- 44,000. No directional bias on either side is seen in the near future unless the above range is broken.

NIFTY 50 graph on a Daily Time Frame is depicted below:

THE BANK NIFTY graph on a Daily Time Frame is depicted below:

Next Week Outlook

The “Sell on Rise” and “Buy on Dips” strategies are playing out on intraday levels defining a level of resistance of Nifty 50 at 18,700 and support at 18,500. Bank Nifty is similarly consolidating tightly in the 500-800 points range between 44,500 to 43,800. Overall the market sentiment remains bullish and positive in a larger time frame and the Nifty 50 can break into a new high as soon as we get more positive global cues – US FED’s next move on interest rates is to be kept in mind along with the inflation data expected in the next week.

It also remains to be seen how long RBI maintains its stance of pause as we are witnessing other major economies across the globe like Canada and Australia still going on hiking the interest rates. There is expected to be a significant upheaval if the US FED in its upcoming FOMC (Federal Open Market Committee) statement does not state a pause in interest rates this month looking at rising jobless claims last week in the USA at 261,000 on June 8, 2023, from 233,000 as on June 1, 2023.

Economists are in sync and almost about 80% of the US market believes that the US FED on its policy deliberations outcome on Wednesday, June 14, 2023, will end the 15-month rate hiking cycle and leave the rates unchanged at 5%-5.25% until December 2023. But this will be a huge risk to the market if the prediction is proved incorrect. The US markets are heavily priced in a potential pause and a negative skew can make the market bleed – very volatile and risky in the US stock market as well as the Indian stock market.

On another front, any impetus of demand boost from China shall be a welcome move as the current trade slowdown in China is pointing towards global woes.

The popular premonition on uncoupled analysis is that the Indian Indices will continue this consolidation and do not expect a major breakout or a one-sided directional rally till the levels are breached or till the start of the July corporate earnings report of major stocks. Sectorial leadership is changing every week as witnessed from Banking to Auto, Consumer goods to Capital goods in the last few weeks.

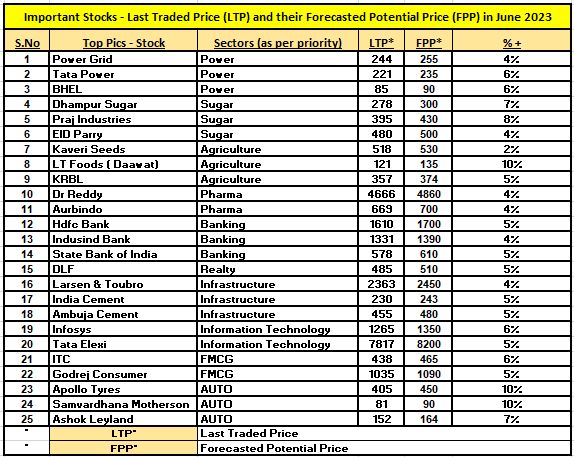

As for a favourable risk-to-reward ratio for trading and investments, the following stocks as per analysis seems to be at reasonable levels to accumulate. It’s not a buy or sell recommendation.

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.