Union Finance and Corporate Affairs Minister Nirmala Sitharaman departs from North Block to Rashtrapati Bhavan and Parliament House, along with the Minister of State for Finance and Corporate Affairs, Anurag Singh Thakur, and senior officials to present the General Budget 2021-22, in New Delhi on February 01, 2021.

Read the full budget speech here

Also read:

Union Budget 2021-22: Key Highlights

-

Revised estimates (RE) 2020-21 for expenditure AT 34.50 lakh crore as against budgetary estimates (BE) 2020-21 of 30.42 lakh crore

-

Fiscal deficit pegged at 9.5% of GDP in re 2020-21

-

BE 2021-22 for expenditure at 34.83 lakh crore, including capex of 5.54 lakh crore

-

BE 2021-22 peg fiscal deficit at 6.8% of GDP

-

BE 2021-22: 12 Lakh crore gross borrowing from the market

-

Amendment to the FRBM Act; target to reach fiscal deficit level below 4.5% of GDP by 2025-26

-

Corporate tax rate slashed to make it among the lowest in the world

-

Burden of taxation on small taxpayers eased by increasing rebates

- National Faceless Income Tax Appellate Tribunal Centre to be established

- Over 1 lakh taxpayers opted to settle tax disputes of over Rs. 85,000 crore through Vivad Se Vishwas Scheme until 30th January 2021

- Reducing Disputes, Simplifying Settlement:

-

- Time limit for re-opening cases reduced to 3 years from 6 years

- Serious tax evasion cases, with evidence of concealment of income of Rs. 50 lakh or more in a year, to be re-opened only up to 10 years, with approval of the Principal Chief Commissioner

- Dispute Resolution Committee to be set up for taxpayers with taxable income up to Rs. 50 lakh and disputed income up to Rs. 10 lakh

- Rules to be notified for removing hardships faced by NRIs regarding their foreign retirement accounts

-

- Relaxation to NRIs:

- Incentivising Digital Economy:

- Rules to be notified for removing hardships faced by NRIs regarding their foreign retirement accounts

- Incentivising Digital Economy:

-

Senior Citizens above 75 years of Age, Having Pension & Interest Income exempted from Filing Tax Return

-

Limit of turnover for tax audit increased to Rs. 10 crore from Rs. 5 crore for entities carrying out 95% transactions digitally

- Relief for Dividend:

- Dividend payment to REIT/ InvIT exempt from TDS

- Advance tax liability on dividend income only after declaration/ payment of dividend

- Deduction of tax on dividend income at lower treaty rate for Foreign Portfolio Investors

-

Decriminalisation of the Limited Liability Partnership (LLP) Act, 2008 proposed

-

Union Finance Minister says every possible measure shall be taken to smoothen the GST

-

Custom duty structure to be overhauled, over 400 old exemptions to be reviewed

-

Customs duty hiked proposed on some mobile parts, auto parts and cotton

-

Phased manufacturing plan for Solar Cells / Panels to be notified

-

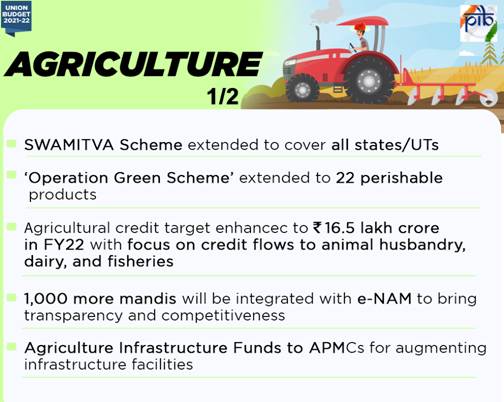

AIDC Cess proposed in the Union Budget to improve Agricultural Infrastructure

-

Taxation changes proposed to benefit MSMEs

-

Wellbeing along With Health forms One of The 6 Crucial Pillars of Aatma Nirbhar Bharat

-

Rs. 2,23,846 Crore allocated to Health Sector

-

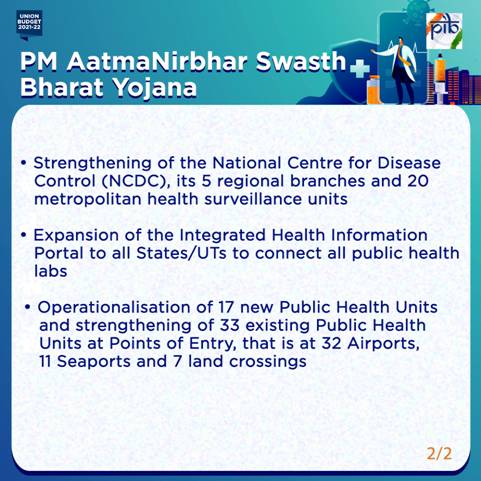

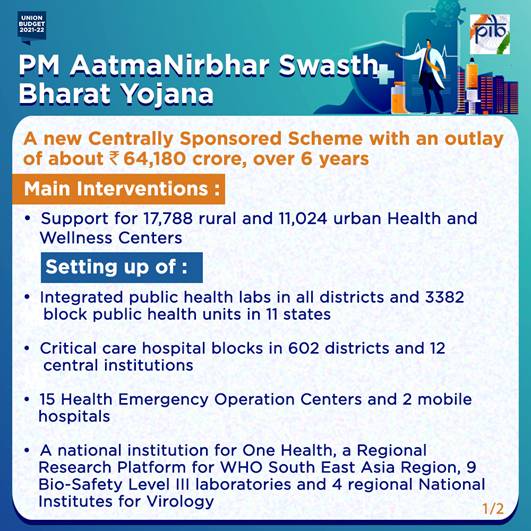

Centrally Sponsored Scheme, PM Aatma Nirbhar Swasth Bharat Yojana announced with an Outlay of Rs 64,180 Crore over 6 Years

-

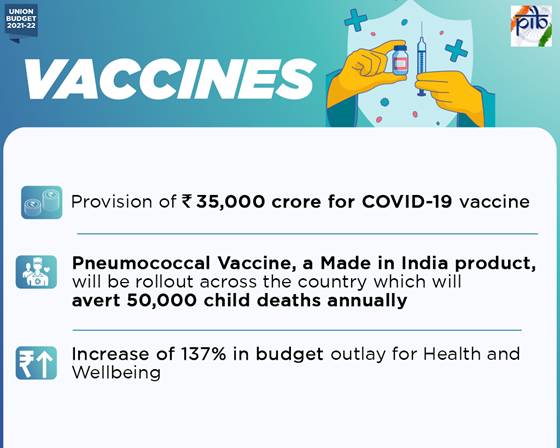

Rs. 35,000 Crore Allocated for Covid-19 Vaccine

-

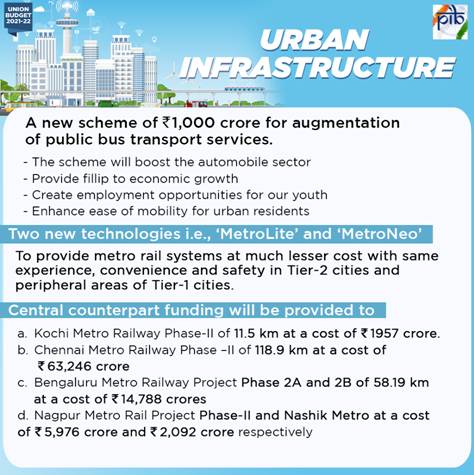

Jal Jeevan Mission (Urban) announced with an outlay of Rs. 2,87,000 Crore

-

Rs. 1,41,678 Crore allocated to urban Swachh Bharat mission 2.0

-

Rs. 2,217 Crore to tackle the burgeoning problem of air pollution

-

Voluntary vehicle scrapping policy announced

-

Conciliation Mechanism to be Set Up for Quick Resolution of Contractual Disputes with Government/CPSEs

-

Rs. 3,768 Crore Allocated for The First Digital Census in The Country

-

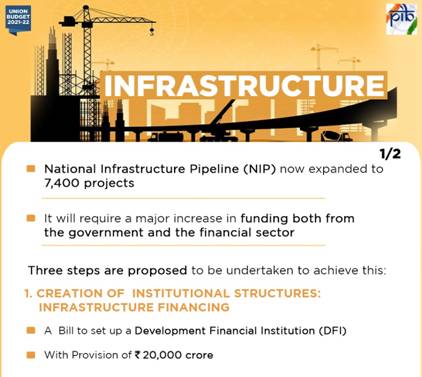

34.5 % Increase in Capital Expenditure with BE of Rs. 5.54 Lakh Crore

-

More Than Rs. 44,000 Crore for Projects/Programmes/Departments showing Good Progress

-

More Than Rs. 2 lakh Crore for states and autonomous bodies for Capital Expenditure

-

FDI limit in Insurance sector increased from 49% to 74% and Foreign Ownership and control allowed with safeguards

-

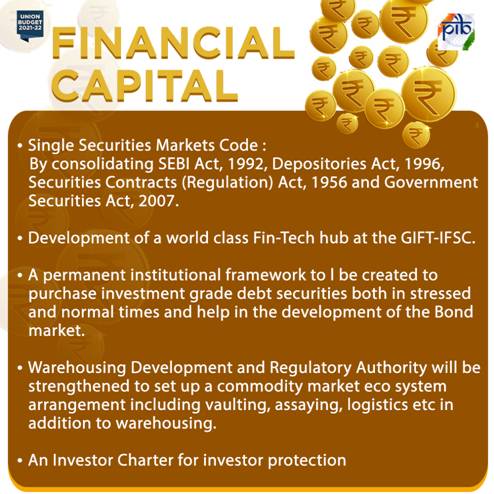

Government to Introduce Single Securities Markets Code

-

Support for development of a world class fin-tech hub at Gift-IFSC

-

A permanent institutional framework to be created to purchase Investment Grade Debt Securities

-

Warehousing Development and regulatory authority to set up a commodity market Eco system arrangement

-

To develop an investor charter as a right of all financial investors

-

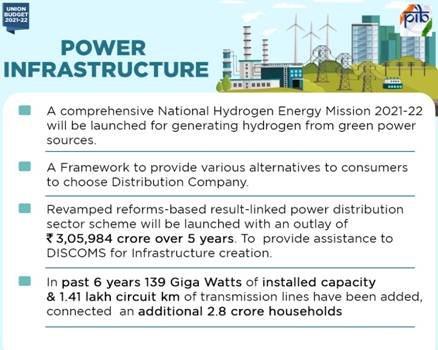

Capital infusion of Rs 1,000 Crore to solar energy corporation of India and Rs 1,500 Crore to Indian Renewable Energy development agency

-

Pandemic’s Impact on Economy: Weak Revenue Flow Combined with High Expenditure on Essential Relief

-

Policy of Strategic Disinvestment announced; Clear Roadmap for Strategic and Non-Strategic Sectors

-

Rs.1000 Crore to be provided for Welfare Scheme for tea workers of Assam and West Bengal especially Women and Children

-

Public Private Patnership Mode for Operational Services at Major Ports

-

Defence allocation in the budget has been increased to Rs 4,78,195.62 crore for the Financial Year 2021-22.

-

Excluding Defence Pension, the total allocations for Defence Services and other organisations/Departments under Ministry of Defence for the FY 2021-22 is Rs 3,62,345.62 crore which is an increase of Rs 24,792.62 crore over the Current FY 2020-21.

-

The allocation under capital expenditure which relates to modernisation and infrastructure development of Armed Forces has been significantly increased.

-

The allocation under Capital of Rs 1,35,060.72 crore for FY 2021-22 represents an increase of 18.75 per cent over FY 2020-21 and 30.62 per cent over FY 2019-20. This is the highest ever increase in capital outlay of Defence in the last 15 years.

-

Source: Press Information Bureau

– global bihari bureau