Geneva: India reported a drop in Foreign Direct Investment (FDI) inflows (-47%), but stable numbers of new project announcements, keeping it in the top 5 of global greenfield project destinations in 2023, according to the 46th Global Investment Trends Monitor, released today by the United Nations Conference on Trade and Development (UNCTAD).

However, international investment project announcements were down across the board in developed countries in 2023, and lower values of greenfield project announcements (mainly industry) will affect 2024 FDI flows, Mergers and Acquisitions (M&A) values were $280 billion lower than in 2022, directly depressing FDI flows, and project finance deals were $157 billion lower in 2023.

International project finance and M&As suffered the most from higher financing costs in 2023, with 21% and 16% fewer deals, respectively. Greenfield project announcements were also 6% lower in number. However, they were 6% up in value and showed higher numbers in manufacturing in an initial sign of recovery following a long-term declining trend.

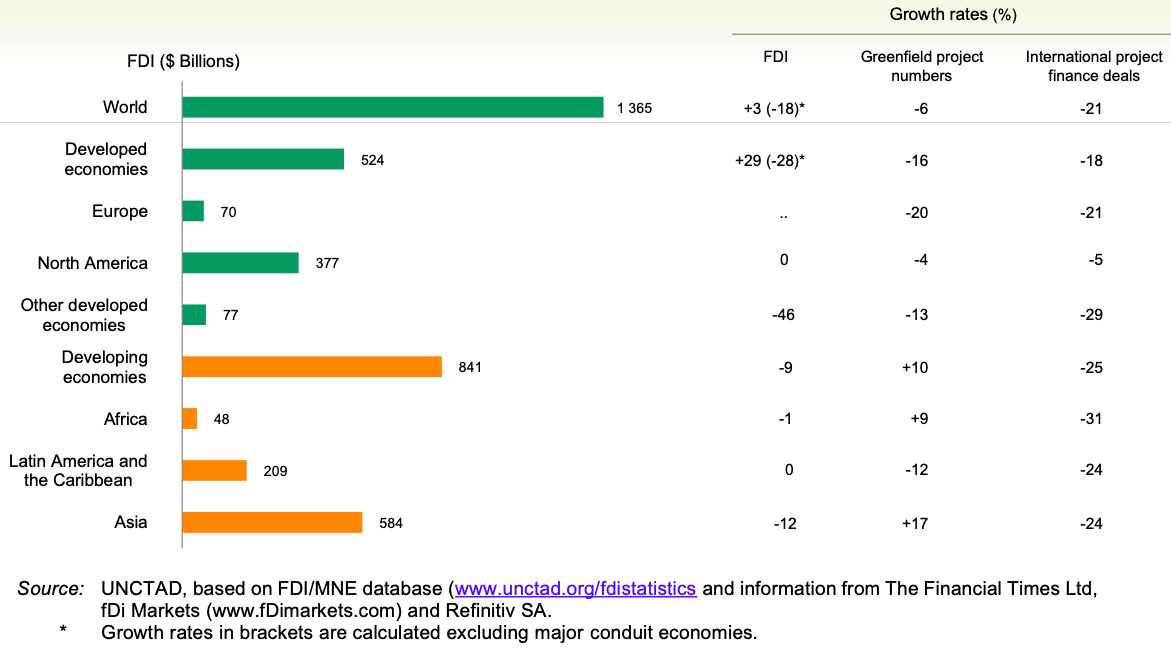

Investment trends by region, 2023 versus 2022

In the United States, the largest FDI recipient, FDI inflows in 2023 were down by 3%, greenfield project numbers by 2% and project finance deals by 5%. China reported a rare decline in FDI inflows (-6%) but showed growth in new greenfield project announcements (+8%). ASEAN, normally an engine of FDI growth, reported a 16% decline in FDI. However, the attractiveness of the region for manufacturing investment was underlined by a 37% jump in greenfield project announcements, with strong growth in Vietnam, Thailand, Indonesia, Malaysia, the Philippines, and Cambodia. In West Asia, FDI remained stable (+2%) due to continued buoyant investment in the United Arab Emirates, which saw greenfield announcements rise by 28% to the second-highest number after the United States. Greenfield numbers also jumped in Saudi Arabia, by 63%. FDI flows to Africa were almost flat at an estimated $48 billion (-1%). Greenfield project announcements increased, mostly due to strong growth in Morocco, Kenya, and Nigeria. However, project finance deals fell by one-third, more than the global average decline, weakening prospects for infrastructure finance flows. In Latin America, Brazil reported 22% lower FDI inflows. While greenfield project numbers held steady, international project finance plummeted, with 40% fewer deals than in 2022. Mexico reported an increase in FDI, as well as a further increase in new greenfield project announcements, solidifying its position among the top global recipients.

Global foreign direct investment (FDI) flows in 2023, at an estimated $1.37 trillion, showed a marginal increase (+3%) over 2022, defying expectations as recession fears early in the year receded and financial markets performed well.

However, economic uncertainty and higher interest rates did affect global investment. The headline increase was due largely to higher values in a few European conduit economies; excluding these conduits, global FDI flows were 18% lower.

In developed countries, FDI in the European Union jumped from negative $150 billion in 2022 to positive $141 billion because of large swings in Luxembourg and the Netherlands. Excluding those two countries, inflows to the rest of the EU were 23% down, with declines in several large recipients. Inflows in other developed countries also stagnated, with zero growth in North America and declines elsewhere.

FDI flows to developing countries fell 9%, to $841 billion, with declining or stagnating flows in most regions. FDI decreased by 12% in developing Asia and 1% in Africa. It was stable in Latin America and the Caribbean as Central America bucked the trend.

– global bihari bureau