By Venkatesh Raghavan*

By Venkatesh Raghavan*

New Delhi: In the last full budget before the 2024 general elections, Finance Minister Nirmala Sitharaman plays Santa Claus for middle and lower incomes.

The Union Budget 2023-24 pins the fiscal deficit for the financial year 2023-24 at 5.9% as compared to the previous year’s 6.9% of GDP. In terms of aggregate figures, the deficit is estimated to stand at INR 17.87 lakh crore in contrast with the previous fiscal year’s INR 17.55 lakh crore.

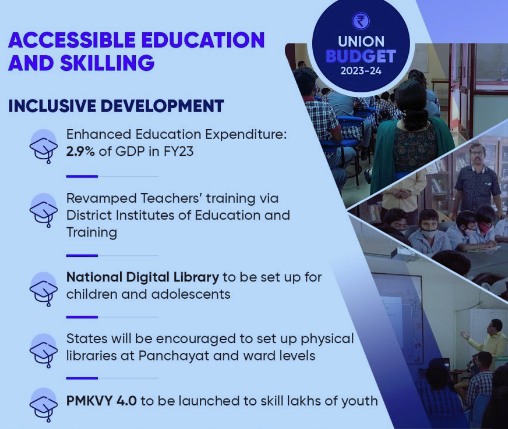

The government’s spending plan on key social infrastructure sectors that include education and housing too registered a robust hike. For the forthcoming fiscal year of 2023-24, the Finance Minister announced INR 1,12,899 crore. The figure is a record and also registers a growth of 8.26% in comparison with the 2022-23 fiscal year.

The Finance Minister described the budget as a “Vision for Amrit Kaal” – an empowered and inclusive economy. She added that the economic agenda for achieving this vision focuses on three things and those are facilitating ample opportunities for citizens, especially the youth, to fulfil their aspirations, secondly, providing a strong impetus to growth and job creation and finally strengthening macro-economic stability.

Sitharaman listed seven priorities of the Union Budget – 1) Inclusive Development 2) Reaching the Last Mile 3) Infrastructure and Investment 4) Unleashing the Potential 5) Green Growth 6) Youth Power 7) Financial Sector.

The Union budget has a fair share of olive branches for the middle class in the form of tax rebates and rural poor, with social sector schemes targeted at their welfare. In addition, the government’s push is towards the creation of infrastructure that includes the construction of roads, highways, and railway lines.

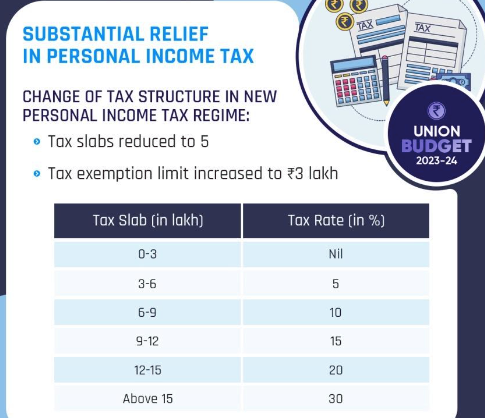

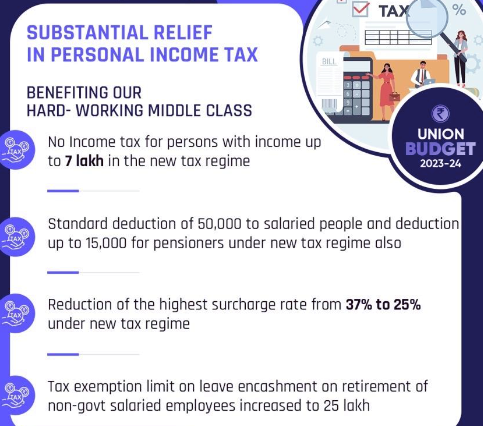

The middle-income group gets relief, with the government increasing the nil annual tax slab from INR 2.5 lakhs to INR 3 lakhs. Further, the tax slab of 5% has been enhanced for the INR 3 lakhs INR 6 lakhs annual income group. Higher tax slabs, however, retain the same levy with a maximum of 30 per cent.

Continuing to dwell on providing relief to the weaker sections, the government has doubled the deposit limit for senior citizen savings schemes to INR 30 lakhs. Besides, the monthly income account scheme has a ceiling of INR 9 lakhs for a single account. Formerly, the limit stood at INR 4.5 lakhs for a single account. The limit for joint accounts has been steeped from INR 9 lakhs to INR 15 lakhs. On the investor front, the government has planned to set up a dedicated Web portal that will facilitate investors’ reclaim of unclaimed shares and unpaid dividends.

The IT sector that will be pressed into service for relief to investor sentiments, in turn, will enjoy an increased allocation of INR 16,549.04 crore as compared to the previous fiscal year’s INR 11,719.95 crore. As compared to figures for 2021-22, the allocation nearly stands doubled. On the physical infrastructure front too, the Finance Minister has announced a significant increase in allocation. Road transport and highways will receive a 36% hike in allocation and stand at an estimated INR 2.7 lakhs crore. The National Highway Authority of India (NHAI) has been allotted INR 1.62 crores.

The private sector too is bound to receive an enhanced allocation in the form of capital expenditure (Capex) that is aimed at increased fund supply for acquiring, upgrading and maintaining physical assets. The increase in capex has resulted in an allocation of INR 10 lakh crores, which is registered as a steep 33% hike as compared to the previous fiscal year.

The government in pursuit of its growth trajectory has also lent focus to the go-green programmes that industries are globally opting for. A fund of INR 35,000 crores has been allotted to invest in effectuating a seamless transition to green energies. The allotment will also be available to use for energy security under the aegis of the Ministry of Petroleum and Natural gas. The green option will also be complemented by exploiting India’s rich demographic dividend. The PM Kaushal Vikas Yojana 4.0 aims at skilling lakhs of youth and in addition, provides for new age skill-oriented courses.

The rural pockets, too, are slated to receive adequate fund allocation. The FM has announced an 11% hike in agricultural credit for the fiscal year 2023-24. The target fund amount allocated roughly stands at INR 20 lakhs crores. Farmers will receive a 2% subsidy on interest for the loan amounts they have availed of. In addition, the farming community will be able to avail of short-term loans up to INR 3 lakh at a comparatively low rate of 7% per annum interest.

The announcement is also complemented by the Reserve Bank of India’s (RBI’s) decision to hike the ceiling for collateral-free agricultural loans from INR 1 lakh to INR 1.6 lakh. The farming sector also observed the ease of carrying out transactions, with an increased amount being spent on the digital economy. The government disclosed that there was a 76% hike in digital transactions.

For farmers, especially small and marginal farmers, and other marginalized sections, the government is promoting a cooperative-based economic development model and for this the government has already initiated computerization of 63,000 Primary Agricultural Credit Societies (PACS) with an investment of Rs 2,516 crore.

On the import front, the government has made purchases of vehicles, including those running on electricity expensive with a hike of 10% in duty. In addition, the items attracting more duty include Naphtha; styrene, Vinyl Chloride Monomer, Compounded Rubber, Articles of precious metals, imitation jewellery, electric kitchen chimneys, bicycles, toys and parts of toys.

Items that attracted cheaper levies included aircraft, semi-manufactured platinum and gold equipment, waste and a scrap of precious metal, raw material for aquaculture and assembling part of certain categories of television cameras.

The Union Budget sounds good to the health and family welfare ministry with an allocation of INR 89,155 crore. This is an increase of 12% over the previous year’s allotment. The enhanced allocation will be distributed between the department of health and family welfare and the department of health research.

The Finance Minister announced that one hundred and fifty-seven new nursing colleges will be established in co-location with the existing 157 medical colleges established since 2014. She also informed that a Mission to eliminate Sickle Cell Anaemia by 2047 will be launched, which will entail awareness creation, universal screening of 7 crore people in the age group of 0-40 years in affected tribal areas, and counselling through collaborative efforts of central ministries and state governments. On Medical Research, she said that facilities in select ICMR Labs will be made available for research by public and private medical college faculty and private sector R&D teams for encouraging collaborative research and innovation.

On the Education front, Sitharaman said that teachers’ training will be re-envisioned through innovative pedagogy, curriculum transaction, continuous professional development, dipstick surveys, and ICT implementation. She added that the District Institutes of Education and Training will be developed as vibrant institutes of excellence for this purpose.

On the Housing front, the Prime Minister’s Awas Yojana has announced a 66% growth with nearly 79,000 crore being allotted for affordable housing schemes across the weaker economic strata of society. In the previous year, the ambitious plan stood at creating upward of 80 lakh houses. The final budget before the election year for the Modi government bears a steep enhancement on the housing front.

*Senior journalist

*सरकार की बजट में कृषि के लिए कुछ पहल अच्छी,लेकिन कृषि में निराशा*

कृषि क्षेत्र को बजट 2023 में किसान सम्मान निधि में बढ़ोतरी,फसल खरीद में पैसा न बढ़ाए जाने को लेकर निराशा है। मोटे अनाज को प्रोत्साहन तब तक नहीं मिल सकता,,जब तक खरीद सुनिश्चित न की जाए

बायो फर्टिलाइजर,बागवानी पर फोकस किसानो के लिए अच्छा कदम है। एग्रीकल्चर एक्सीलेटर फंड की शुरुवात एक पहल है।इससे कृषि चुनौतियों का सामना करने में आसानी होगी।सरकार एक तरफ जैविक खेती को प्रोत्साहन दे रही है दूसरी तरफ जैव प्रौद्योगिकी को बढ़ावा देना गलत है। जिससे पर्यावरणीय नुकसान की आशंका है।

कुल मिलाकर इस बार का बजट भी एक रुटीन प्रक्रिया है

भवदीय

धर्मेंद्र मलिक