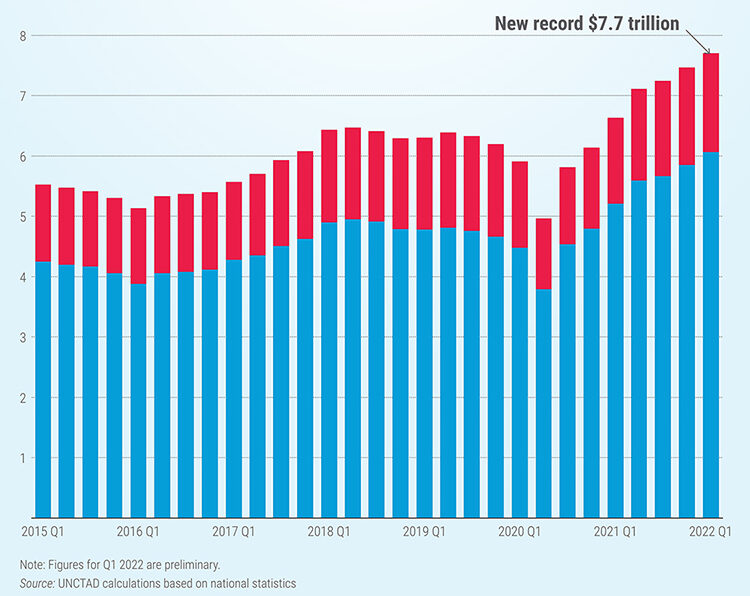

Geneva: Tightening policies and geopolitical frictions may end the present positive trend for international trade, the United Nations Conference on Trade and Development (UNCTAD) has warned. Even as the value of global trade rose to a record $7.7 trillion in Q1 2022, an increase of about $1 trillion relative to Q1 2021, UNCTAD’s Global Trade Update published today, says the evolution of world trade for the remainder of 2022 is likely to be affected by slower-than-expected economic growth due to rising interest rates, inflationary pressures and concerns over debt sustainability in many economies.

Meanwhile, the World Trade Organization today reported that the G20 economies continue to exercise restraint in the use of trade-restrictive measures despite increasing economic uncertainty aggravated by the COVID-19 pandemic and the war in Ukraine. The 27th WTO Trade Monitoring Report on G20 trade measures issued today shows that the stockpile of G20 import restrictions in force has grown steadily since 2009 — both in value terms and as a percentage of world imports. By mid-May 2022, 10.9 per cent of G20 imports were affected by import restrictions implemented by G20 economies since 2009 and which remain in force.

With regard to trade remedy initiations, the average number in the reporting period was the lowest since 2012 after reaching a peak in 2020. The report indicates that trade remedy actions remain an important trade policy tool for G20 economies, accounting for 46% of all non-COVID-19 related trade measures on goods recorded.

WTO Director-General Ngozi Okonjo-Iweala called on G20 countries, and WTO members at large, to show that the international community can work together to de-escalate tensions and ensure a solid economic recovery.

UNCTAD’s Global Trade Update report meanwhile states that the war in Ukraine is affecting international trade by putting further upward pressure on the international prices of energy and primary commodities.

In the short term, because of the inelastic global demand for food and energy products, rising food and energy prices would likely result in higher trade values and marginally lower trade volumes. Other factors expected to influence global trade this year are continuing challenges for global supply chains, regionalization trends and policies supporting the transition towards a greener global economy, according to the report.

The growth in Q1 2022, which represents a rise of about $250 million relative to Q4 2021, is fuelled by rising commodity prices, as trade volumes have increased to a much lower extent.

However, the report notes that though expected to remain positive, trade growth has continued to slow during Q2 2022.

“The war in Ukraine is starting to influence international trade, largely through increases in prices,” it says. While rising interest rates and the winding down of economic stimulus packages will likely have a negative impact on trade volumes for the rest of 2022, volatility in commodity prices and geopolitical factors will also continue to make trade developments uncertain, it warns.

According to the report, trade growth rates in Q1 2022 remained strong across all geographic regions, although somewhat lower in East Asia and Pacific regions. Export growth has been generally stronger in commodity-exporting regions, as commodity prices have increased. The trade in merchandise goods reached about $6.1 trillion, an increase of about 25% relative to Q1 2021, and a jump of about 3.6% relative to Q4 2021.

The value of merchandise exports from developing countries was about 25% higher in Q1 2022 than in Q1 2021. In comparison, this figure is about 14% for developed countries. Merchandise trade between developing countries also strongly grew during Q1 2022. The trade in services grew to about $1.6 trillion, an increase of about 22% relative to Q1 2021, and a rise of about 1.7% relative to Q4 2021.

The report shows that most economic sectors recorded substantial year-over-year increases in the value of their trade in Q1 2022. High fuel prices are behind the strong increase in the value of trade in the energy sector. Trade growth was also above average for metals and chemicals. By contrast, trade in the transportation sector and in communication equipment has remained below the levels of 2021 and 2019.

– global bihari bureau