Geneva: The outlook for trade and GDP in the remainder of 2023 is clouded by downside risks, including heightened geopolitical tensions, food and energy insecurity, increased risk of financial instability, and high levels of external debt, according to the latest edition of the World Trade Statistical Review, the World Trade Organization’s (WTO) annual flagship publication featuring key data on global trade in merchandise and commercial services, released here today.

Geneva: The outlook for trade and GDP in the remainder of 2023 is clouded by downside risks, including heightened geopolitical tensions, food and energy insecurity, increased risk of financial instability, and high levels of external debt, according to the latest edition of the World Trade Statistical Review, the World Trade Organization’s (WTO) annual flagship publication featuring key data on global trade in merchandise and commercial services, released here today.

“As a succession of crises buffet the global economy, with the COVID-19 pandemic giving way to the war in Ukraine, inflation, monetary tightening, and widespread debt distress, world trade has lost momentum, with trade growth slowing in 2022 and remaining weak into early 2023. That said, global trade growth has remained positive, underscoring how trade has been a force for economic recovery and resilience. Nevertheless, numerous downside risks, from geopolitical tensions to potential financial instability, are clouding the medium-term outlook for both trade and overall output,” WTO Director-General Ngozi Okonjo-Iweala said in the foreword to the report.

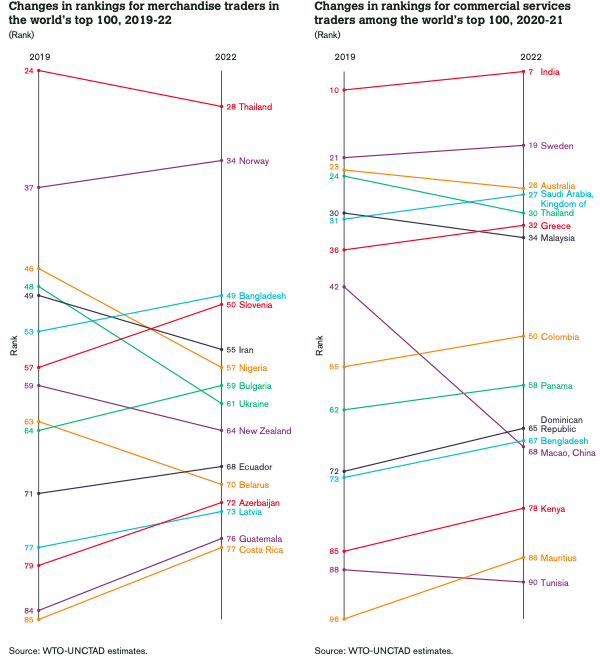

The report highlighted India’s rise to 7th position in the ranking of services traders in 2022 thanks to a double-digit growth of 32 per cent, boosted by computer services exports.

Significantly, even as China remained the top merchandise exporter in 2022, its share in world exports declined to 14% (from 15% in 2021). The United States (8% of world trade) and Germany (7%) were ranked in second and third positions.

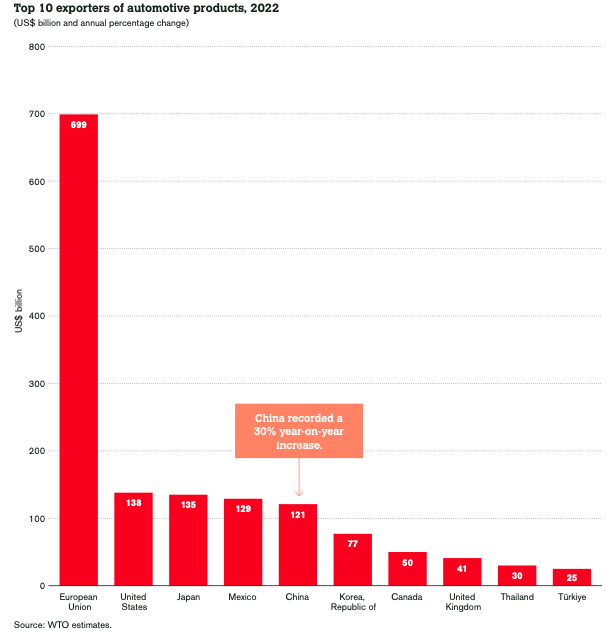

Among the top 10 exporters of automotive products in 2022, China increased its exports the most, recording a 30 per cent increase. The United States overtook Japan as the second-largest exporter of automotive products in 2022.

While China remained the largest merchandise trader in 2022, Guatemala and Costa Rica achieved significant increases in the world rankings, which moved up eight places to 76th and 77th, respectively. This was mostly due to an increase in Costa Rica’s exports of medical instruments and appliances and in its imports of electrical machinery and equipment. Guatemala’s rise was prompted by an increase in imports of petroleum products.

Least-developed countries (LDCs)’exports of goods increased by 41 per cent in 2022 compared with pre-pandemic levels in 2019 while commercial services remained depressed (-14 per cent). This was due to the subdued recovery of international travel to Asian LDCs (74 per cent below 2019). By contrast, travel exports of African LDCs performed better, remaining only 9 per cent below their value in 2019.

The value of merchandise trade expanded at a faster pace across the globe than volume in 2022, inflated in part by high global commodity prices.

Trade in goods and services amounted to US$ 31.0 trillion in 2022, a 13% rise year-on-year. While trade in goods exceeded pre-pandemic levels already in 2021, the trade in services caught up in 2022.

The share of manufactured goods in world merchandise exports fell to 63% in 2022 (versus 68% in 2018) mainly due to high energy prices limiting demand. Trade in transport services continued to grow in 2022, although at a slower pace than in 2021 as shipping rates returned to pre-pandemic levels.

Intra-regional merchandise trade represented 65% of Europe’s world trade in 2022, the highest amongst the major world regions. The lowest was for Africa (14% in 2022, down from 16% in 2018).

The report mentioned that trade and output growth slowed in 2022 and remained weak in the first months of 2023, weighed down by the war in Ukraine, high inflation and monetary policy tightening in major economies. Merchandise trade volume growth fell to 2.7% in 2022 from 9.4% in 2021, while GDP growth at market exchange rates dropped to 3.0% from 5.9% previously.

The trade slowdown culminated in a 2.1% quarter-on-quarter slump in the fourth quarter of 2022 and a further 0.3% decline in the first quarter of 2023, as high energy prices and rising interest rates dampened consumption and investment.

In contrast to trade in volume terms, the trade in current US dollar terms rose at double-digit rates in 2022. The value of world merchandise exports increased by 11% to US$ 24,905 billion, partly due to spiking prices for energy and other primary products. Meanwhile, commercial services exports rose 16% to US$ 7,076 billion as the gradual easing of restrictions relating to the COVID-19 pandemic led to a recovery in international travel expenditure.

The World Trade Statistical Review 2023 presents recent trends in international trade and GDP at a time of geopolitical and macroeconomic strains and technological challenges affecting the global economy and supply chains. The data cover merchandise and services trade broken down by geographical origin, main product groups and sectors, along with related data on key economic developments such as GDP growth, commodity prices, and exchange rate fluctuations.

– global bihari bureau