![]() By Amit Sinha*

By Amit Sinha*

Weekly Analysis, Insights and Forecast

19 June 2023 – 23 June 2023

Indian Indices –Nifty50 intra-day trading hit a record closing at 18,826 on Friday, June 16, 2023, trading session, marking a high closing. However, the lifetime record of 18,888 is yet to be surpassed and it looks very promising that it will scale it either on Monday, June 19 or within one or two trading sessions.

After achieving a lifetime high on a closing basis, we might witness a temporary unwinding and consolidation towards 18,500 before we go on to levels of 19,000-19,300 towards the end of July 2023.

Markets ended on fourth straight week highs riding on easing inflation worries, strong macroeconomic data and positive global cues, boosting positive sentiments all across. Midcaps (+0.7%) and Smallcaps (+1%) were major echoing gainers in the bullishness.

The total market cap of all firms listed on the Bombay Stock Exchange hit a lifetime high of Rs. 291.89 Lakh Crore, increasing by 16% from March 28 to June 15, 2023, in terms of the rupee and the dollar.

Except for IT (-0.4%) and Real Estate (-0.2%), all the other sectors ended in green. Banking and NBFC stocks single-handedly pushed markets higher: +1% each. FMCG (+0.8%) stocks closed up for a fourth straight day. Nifty50 to achieve and sustain over 19,000 will need greater support from Bank Nifty which is struggling after its ATH of 44,151. The next level to sustain for the Bank Nifty index is crucially placed above 44,500.

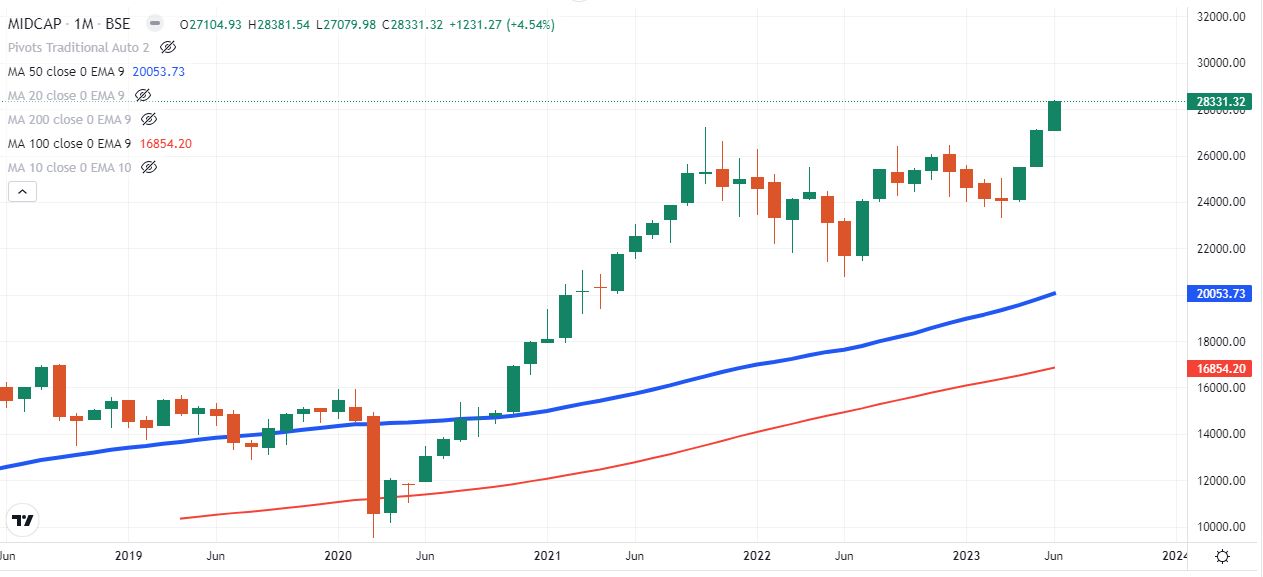

The most promising index looking to further pave the way for a 25% rally on the upside from here is going to the Mid-Cap sector, followed by Small Cap. On the other hand, the Large Cap index seems to be on an overbought and stretched valuation barring a few stocks where still an upside of 8% to 10 % is still targetable due to their underperformance in the last earnings quarter and looking for a positive growth financials in upcoming quarter results in July 2023.

NIFTY MIDCAP (BSE) graph on a Monthly Time Frame is depicted below:

NIFTY SMALLCAP (BSE) graph on a Monthly Time Frame is depicted below:

The optimism in the Indian Stock market is stemming out from its peers’ performance in global markets downplaying the hawkish policy of the United States Federal Reserve and European Central Bank.

NIFTY50 graph on a Weekly Time Frame is depicted below heading towards its all-time high of 18,888:

Global Clues: US Federal Reserve on Wednesday, June 14, announced the predicted milestone of leaving the Banks’ interest rate steady by taking a pause after 10 consecutive rate hikes. The important takeaway from this was that this was just a temporary pause and they expected turbulence in the coming months with probably two more hikes of 25 basis points in July, September or November 2023 cannot be ruled out and will be deliberated during the Federal Open Market Committee (FOMC) meetings ahead.

The initial response in pause is more akin to a temporary skip, markets reacted overwhelmingly but it fizzled out on further hawkish commentary of imminent rate hikes. However, the FOMC Board of Governors Chair, Jerome H. Powell‘s press conference brought the Bulls back on the market stage again gulping the uncertainty and the market decided to move up gradually with a cautious stance. Labour market developments and inflation trends data will be the key factors to be watched out for in the coming weeks. A longer period of labour market resilience and sticky inflation would pave the way for more hawkish notes. The anticipated future rate change projection is open which will be based primarily on data-driven decisions.

European Central Bank (ECB) on June 15, 2023, decided to raise the European Central Bank (ECB) interest rates by 25 basis points aiming to tame down inflation towards the targeted 2%. This decision, as per the ECB’s Governing Council will continue to follow an inflation data-dependent approach which will determine the level and duration of restriction as appropriate.

China: Chinese Central Bank on Thursday, June 15, in its move to provide impetus to the slowing economy, lowered its short-term lending rates for the first time in 10 months aiming to bring in more liquidity in the banking system.

Germany, the fourth largest economy and New Zealand with shrinking economic growth have technically already entered into a recession zone.

Overall, analysts believe that globally there are inevitable signs pointing to a downturn in US and Europe economies and they will struggle to return to positive growth in the next few quarters which will invoke further rate hike decisions in US and Europe sooner than later.

Next Week Outlook

As the world’s top economies are staring at an economic slowdown, India as the main beneficiary of an extraordinary investment destination, is looking very attractive and is emerging as the best option for a positive growth and inflation outlook. India is poised to receive net inflows to the tune of $250-$270 Million due to the Financial Times Stock Exchange Group (FTSE) rebalancing. The Financial Times Stock Exchange (FTSE) Group is owned by London Stock Exchange (LSE). It is a financial organization specialising in managing asset exchanges and creating index offerings for the global financial markets.

The next immediate upsurge market is going to look forward in the next quarter in these five major sectors- healthcare, technology, renewable energy, education and defence as these are focal points projects to be discussed in Prime Minister Narendra Modi’s meeting with the US President Joe Biden from June 20, 2023, onwards i.e. next week. This visit is going to be bilaterally very significant in terms of trade agreements and cooperation between the two countries in the mentioned sectors.

As per a press release by the Government of India on June 14, 2023, the annual rate of inflation based on all India Wholesale Price Index (WPI) numbers is (-) 3.48% (Provisional) for the month of May 2023 (over May 2022) against (-) 0.92% recorded in April 2023. A decline in the rate of inflation in May, 2023 is primarily contributed by a fall in prices of mineral oils, basic metals, food products, textiles, non-food articles, crude petroleum and natural gas, and chemical and chemical products. This is pointing to the strongest deflationary pressure in the last three years. Hence, the overall Indian market’s positive sentiment remains high but the driving forces will likely be global.

As for a favourable risk-to-reward ratio for trading and investments, the following stocks as per analysis seems to be at good levels to accumulate. It’s not a buy or sell recommendation – ITC, Ashok Leyland, Indigo Aviation, Ramakrishna forgings, Bharat Forge, Hindustan Aeronautics, BEL, KEC Intl.,Torrent Pharma, BHEL, Samvardhana Motherson, Cochin Shipyard, Mazdock, Som Distilleries, KRBL.

Also read: Stock Watch: An overbought situation and a delayed ATH

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.