Stock Watch: Indian Stock Indices continue their robust rally

![]() By Amit Sinha*

By Amit Sinha*

Weekly Insights – Technical

06 April -13 April

Indian Stock Market Indices status as of day closing April 13, 2023

Sensex: 60,431 (+38.23) +0.06%

Nifty 50: 17,828 (+42.10) +0.09%

Nifty Bank: 42,132 (+574.60) +0.20%

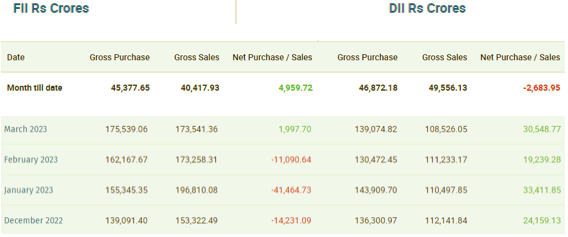

Indian Stock Indices continued their robust rally on the heels of the Reserve Bank of India’s Monetary Policy decision last week to take a pause on the interest rate hikes. The last trading session on Thursday, April 13, 2023, ended with the FIIs (Foreign institutional investors) buying in equities worth Rs.221.85 crores whereas DIIs (Domestic institutional investors) sold Rs. 273.68 crores worth of equities.

As of April 2023 – MTD (Month to Date) basis, the net buys of FIIs is about 5000 crores which is a very positive and reversal sign from the earlier months. The following data depicts their rising interest trend:

Last week’s highlight

March 2023 Indian Retail Inflation: The data was released which was a much-needed relief to the market as the inflation rate plummeted to a 15-month low of 5.66 % in March. In January 2023 the inflation rate had rocketed to 6.52%. In addition to this favourable news, the CPI (Consumer Food Price Index) also fell to 4.79% over 5.79% as was in February 2023.

The aggressive interest rate hikes by RBI thus confirm that their policy has given fruitful results in containing India’s inflation however the market is still expecting on the side-lines, another rate hike in the next 2-3 months to contain the inflation rate further.

TCS (Tata Consultancy) Quarterly Results (Q4FY23): India’s biggest IT company declared its last quarterly results and it was much below street expectations. Q4 growth of 0.6% Quarter on Quarter (QoQ) in constant currency (CC) was a tad below estimate. Q4 margin was flat QoQ due to on-site sticky costs; TCV (Total Contract Value) is strong but revenue conversion is likely to be challenging in the near term. Discretionary projects were on hold and are expected to resume only after the winter holidays in the USA.

EBIT (earnings before interest and taxes) margins declined 120 basis points (bps) in FY23 to 24.1% due to headwinds such as wage hikes, supply-side challenges & higher travel expense increases while tailwinds were pricing, currency & pyramid optimisation.

ICICI Direct Research posted their views on TCS results:

The company’s Q4 performance was weak compared to ours as well as market expectations. The US market outlook for the near term is weak not only from BFSI but also from the retail sector perspective where few clients have paused some programs. The order book, however, continues to be healthy and the company do not see a slowdown over there, however, conversion to revenue could be delayed as clients are taking a cautious stance on spending. CEO appointment for 5 years provides some stability at the top while some of the margin expansion levers will continue to play which is expected to provide support for the margins in the medium term. A higher dividend payout is likely to support the share price in the near term.

Impact: Negative

Nifty50 chart on Weekly Time frame as on 13th April 2023 (closing)

US Stock Market – On USA’s Retail Inflation rate of 5% last month was another good news to cheer the market. This is nearly the lowest rate in the last two years. Compared to February 2023 figure of 6%, it’s welcome news for the US economy, hoping for a soft landing and avoiding recession. The recent spate of banking crises also not seeing any traction further to add to any financial stress.

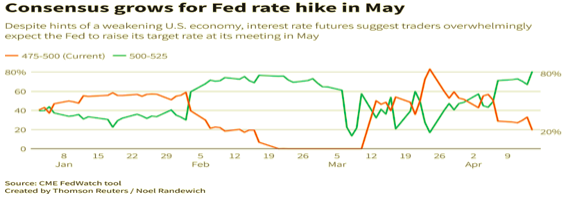

As for the target rate of inflation, the US FED Reserve’s top priority is looking at lowering the rate to close to 2 to 2.5% which was prior to the Covid-19 pandemic. There is a growing consensus that US FED Reserve will hike another 25 basis points in May 2023 and then there could be further pause anticipated. So, Wall Street still remained jittery in its last weekly trading session.

Next Week Market/Trading Session Outlook

Indian Stock Market – So far in April, the Bulls are in charge of the banking sector leading the rally whereas the IT sector is totally laggard due to the USA‘s fearful recession mood. Next week is going to be a volatile market session as the IT sector Versus Banks will play a major role in the daily trading of equities, which will shape the top nifty50 index movement.

The market is expected to react to HDFC Bank and Infosys Quarterly Results (Q4FY23) next week as their results will be declared this weekend.

The overall market trend is very positive and looking forward to gaining more traction in the coming weeks as every dip sees a buy-in equities. There is no sign or news expected of any major collapse.

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the views and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.