Geneva: With slowing growth in major economies weighing on the post-pandemic recovery, world services trade activity weakened in the fourth quarter of 2022 and is likely to remain soft in the opening months of 2023, according to the latest WTO Services Trade Barometer released here today.

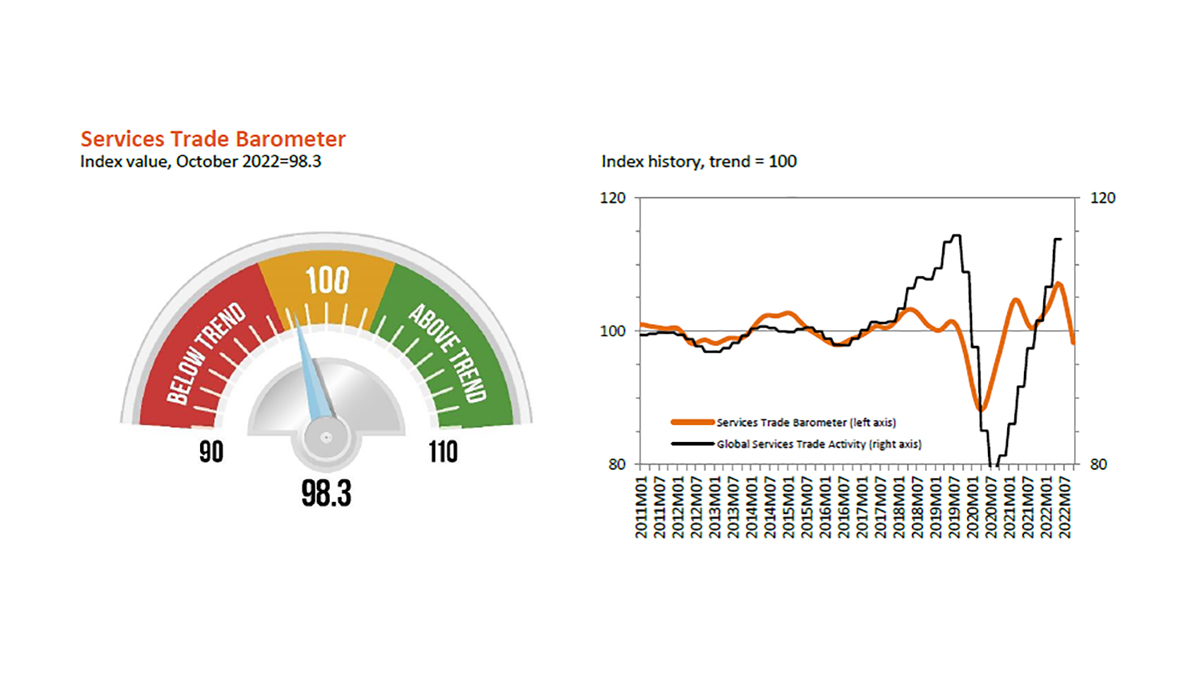

The Barometer index reading for the month of October fell to 98.3, slightly below its baseline value of 100 and well below the previous reading of 105.5 from the last release in June. The findings are in line with the Goods Trade Barometer issued in late November 2022 which indicated slowing merchandise trade volume growth in the closing months of 2022 and into 2023.

The Barometer index reading for the month of October fell to 98.3, slightly below its baseline value of 100 and well below the previous reading of 105.5 from the last release in June. The findings are in line with the Goods Trade Barometer issued in late November 2022 which indicated slowing merchandise trade volume growth in the closing months of 2022 and into 2023.

World services trade volume finally surpassed its pre-pandemic peak in the second quarter of 2022 and was expected to remain strong in the third quarter, buoyed by spending on travel, information and communication technology (ICT) services, and financial services. However, the Barometer rather indicates that year-on-year growth in real commercial services began moderating in the third quarter and may slow further in the fourth — as well as into the new year — due to declining growth prospects in major service industry economies.

Among the services barometer’s component indices, financial services (107.8) was most resistant to the slowing global economy, remaining firmly above trend. Indices for passenger air transport (105.2) and ICT services (103.2) also finished the above trend, although the passenger index has fallen back closer to its baseline value of 100 representing on-trend expansion.

In contrast to these positive signals, the component indices for construction services (92.9), container shipping (92.8) and services Purchasing Managers’ Index (PMI) (91.1) all fell deep into contraction territory.

The Services Trade Barometer highlights turning points and changing patterns in world services trade. Unlike its counterpart for goods, the fluctuations registered by the services indicator coincide with movements in actual trade flows, rather than anticipating them. Readings of 100 indicate growth in line with medium-term trends. Readings greater than 100 suggest above-trend growth while those below 100 indicate the opposite.