When the Bears prevailed

Stock Watch: A Bearish Market

![]() By Amit Sinha*

By Amit Sinha*

Weekly Insights – Technical

17 April 2023 – 21 April 2023

Indian Stock Market Indices status as of day closing 21 April 2023:

Sensex: 59,655 (+22.71) +0.04%

Nifty 50: 17,624 (-0.40) +0.00%

Nifty Bank: 42,118 (-151.50) -0.42%

It was a Bearish market last week when Indian Stock Indices after continuous nine days of upswing took a little breather and formed a series of 5 days of consolidation or pause in the upward trend. The market saw a tough battle between Bulls and Bears on an intraday basis and ultimately Bears overpowered the Bulls market at the end of each 5 days of the trading session.

The graph of Nifty50 below shows the Bearish trend, depicting the movement of strength from Bulls to Bears on a daily time frame from April 13 onwards till April 21, 2023

Nifty50 is not letting go of its crucial 17,500 mark and the market is finding buyers at every dip towards 17,600 levels. The Bulls and Bears battle ended with the Bulls defending the 200 DMA (Daily Moving Average) .

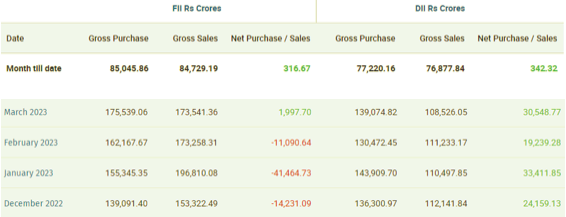

As of April – MTD (Month to Date) basis, the net cash purchase of FIIs is about 316 crores and DIIs has been 342.32 crores.

The World Market particularly the USA ( Dow Jones and Nasdaq) market and the Indian Stock market is going through the posting of equities earnings season and its quarterly performance results. These results are impacting the stock movement on daily basis.

In India, two more reasons attributed to the low and jittery performance of Bulls versus Bears are that all eyes were on quarterly results from Reliance Industries and the ICICI bank. Reliance Industries and ICICI Bank have heavy weightage in Nifty50 (10.34%) and Bank Nifty (8.04%) respectively which could trigger either side’s good or bad momentum due to its quarterly performance. Reliance Industries results came on post-Friday (April 21, 2023) session and ICICI bank’s results also came out late Friday evening. If we recall, the TCS and Infosys, prior to last week had come out with below market expectations and hence their shares’ value plummeted and also brought the NIFTY I.T and Nifty50 down from their high of 17,700-17,800 levels. Therefore the market was watching circumspectly the outcome of Reliance & ICICI results.

Reliance Industries posted record annual consolidated revenues at ₹976,524 crores ($118.8 billion), up 23.2% YoY, supported by continuing growth momentum across all businesses.

Next Week Market / Trading Session Outlook

Market Sentiment is expected to turn more positive in the coming Monday (April 24, 2023) session onwards after the results of both market leaders – Reliance Industries and ICICI Bank, which were above market expectations. There could be a cheerful mood triggering a good upswing in the indices.

The IT sector has been the weakling due to weak quarterly results of TCS, Infosys, its leaders in the sector. The sector has been underperforming this year since the beginning and therefore not letting Nifty50 scale up considerably.

However, the market is looking forward to setting an up-trend in the coming weeks as every dip, particularly in the stronger banking sector; as it is performing like a knight in shining armour.

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.