In India, the 2023 wheat acreage is anticipated to exceed last year’s record level

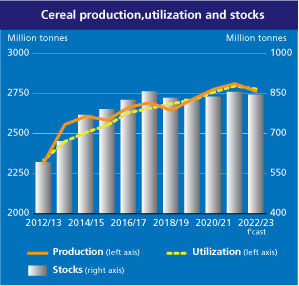

Rome: Despite raising its forecast for world cereal production by 8.3 million tonnes (0.3 per cent) this month to 2,765 million tonnes, albeit still 1.7 per cent lower year-on-year in 2022, the Food and Agriculture Organization (FAO) of the United Nations predicted global cereal supplies to tighten in 2022/23.

The increase in production is predominantly related to wheat, reflecting upward revisions made for Australia and the Russian Federation, which raised the forecast for the global wheat output to 794 million tonnes and reinforced the expectations for a record-high outturn in 2022, FAO stated in its new ‘Cereal Supply and Demand Brief’, released today.

For coarse grains, global production is pegged at 1 459 million tonnes in 2022, moderately down compared to the preceding forecast in December and now 3.3 per cent below the level in 2021. The most recent cut reflects lower maize production estimates for the European Union, the United States of America and the Russian Federation, which more than offset an upward revision for China.

The forecast for the world barley outturn has been raised moderately, resting on an upturn in harvest prospects in Australia, while the forecast for global sorghum production remains unchanged from December. As for rice, assessments released by Chinese officials in December, point to a lower level of plantings than previously envisaged by FAO, especially in north-eastern producing areas, which added to some yield decreases caused by heat and dryness in the southern parts of the country.

The downward revision for rice production in China more than offset upward revisions made for several other countries, most notably Bangladesh, where authorities report positive outcomes for the second most important crop of the season, despite some rainfall-related setbacks at the planting stage. As a result, global rice production is now forecast in the order of 512 million tonnes (milled basis), down 1.2 million tonnes lower than the December 2022 forecast and 2.6 per cent from the 2021 all-time high.

Looking ahead to production in 2023, the bulk of the winter wheat crop has been planted in the northern hemisphere and early indications point to area expansions in several major producing countries, driven primarily by the elevated prices. While fertilizer prices dropped in recent months, they continue to be high, which could result in reduced application rates with likely adverse implications for yields.

In the United States of America, the 2023 winter wheat planted area is estimated to be the largest area in eight years, up 11 per cent year-on-year. Drought conditions are affecting the main producing Central Plains and are forecast to continue in the next months; however, the dry weather has partly receded elsewhere, leading to improvements in crop conditions.

In Canada, while the bulk of the wheat crop is planted in spring, and although a pullback in winter sowings is foreseen, total wheat plantings are predicted to expand by 2 per cent in 2023, underpinned by remunerative crop prices.

In the European Union, official winter wheat area estimates are not yet available, but aided by generally conducive weather and supported by prevailing price incentives, sowings are anticipated to remain above the previous three-year average and close to the 2022 level.

In the United Kingdom of Great Britain and Northern Ireland, expectations indicate a 1 per cent upturn in winter wheat sowings, supported by beneficial weather and robust output prices.

In the Russian Federation, ample domestic availabilities and low domestic prices could result in a small cutback in wheat plantings.

In Ukraine, severe financial constraints, infrastructure damage and obstructed access to fields in parts of the country have resulted in an estimated 40 per cent year-on-year reduction in the 2023 winter wheat area.

In India, spurred by higher market and government-guaranteed prices, as well as beneficial sowing conditions, the 2023 wheat acreage is anticipated to exceed last year’s record level.

In Pakistan, 2023 wheat sowings are foreseen to remain higher than the five-year average, with standing water from the large-scale floods in 2022 causing less hindrance than initially anticipated.

In southern hemisphere countries, most of the 2023 coarse grain crops were planted by late 2022. Driven by attractive prices, farmers in Brazil could increase the total maize plantings to a record high, with much of the increase concentrated in the key-producing Mato Grosso state. In Argentina, low soil moisture levels curtailed maize sowings of the early-planted crop, and consequently, the total maize area is expected to contract marginally in 2023. In South Africa, in part reflecting ample domestic supplies, there was a 3 per cent cutback in 2023 maize sowings; weather conditions have so far been favourable, auguring well for yield prospects.

World cereal utilization in 2022/23 is now forecast to drop by 0.7 per cent from the previous year, to amount to 2 779 million tonnes, with the total utilization of maize predicted to decline, while wheat use increases and rice utilization changes little year-on-year.

The forecast for world cereal stocks is pegged at 844 million tonnes at the end of the marketing year, pushing down the world stock-to-use ratio for 2022/23 to 29.5 per cent.

In its new brief, FAO predicts international trade in cereals in 2022/23 to decline by 8.2 million tonnes (1.7 per cent) from the previous year’s record level to 474 million tonnes, notwithstanding an upward revision of 2.0 million tonnes this month.

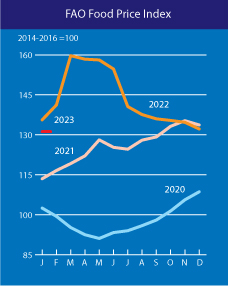

Meanwhile, global food prices declined in January 2023 for the tenth consecutive month, another FAO report noted today. The benchmark index of international food commodity prices (The FAO Food Price Index) declined and averaged 131.2 points in January 2023, 0.8 per cent lower than the previous month and 17.9 per cent below its peak reached in March 2022. The index tracks monthly changes in the international prices of commonly-traded food commodities. The price indices for vegetable oils, dairy and sugar drove the January decline, while those for cereals and meat remained largely stable.

Meanwhile, global food prices declined in January 2023 for the tenth consecutive month, another FAO report noted today. The benchmark index of international food commodity prices (The FAO Food Price Index) declined and averaged 131.2 points in January 2023, 0.8 per cent lower than the previous month and 17.9 per cent below its peak reached in March 2022. The index tracks monthly changes in the international prices of commonly-traded food commodities. The price indices for vegetable oils, dairy and sugar drove the January decline, while those for cereals and meat remained largely stable.

In January, the FAO Cereal Price Index was essentially unchanged (up a mere 0.1 per cent) from December and stood 4.8 per cent above its level of one year earlier. International wheat prices declined by 2.5 per cent as production in Australia and the Russian Federation outpaced expectations. World maize prices rose marginally due to strong demand for exports from Brazil and concerns over dry conditions in Argentina. International rice prices, however, jumped by 6.2 per cent from December 2022, influenced by tighter availabilities, strong local demand in some Asian exporting countries and exchange rate movements.

The FAO Vegetable Oil Price Index declined by 2.9 per cent in January. World prices of palm and soy oils dropped amid subdued global import demand, while those of sunflower seed and rapeseed oils declined due to ample export availabilities.

The FAO Dairy Price Index averaged 1.4 per cent lower than in December, with prices trending down for butter and milk powders on lighter demand from leading importers and increased supplies from New Zealand. World cheese prices rose slightly, driven by a recovery in food services and retail sales in Western Europe following the New Year holiday, as well as currency movements.

The FAO Meat Price Index moved fractionally in January (edging down just 0.1 per cent from December), as ample export availabilities weighed on poultry, pig and bovine meat prices, while ovine export prices rose due to stronger import demand.

The FAO Sugar Price Index dropped by 1.1 per cent from December. Strong harvest progress in Thailand and favourable weather conditions in Brazil outweighed the impact on prices due to concerns over lower crop yields in India, higher gasoline prices in Brazil, which support demand for ethanol, as well as the Brazilian real’s appreciation against the United States dollar.

– global bihari bureau