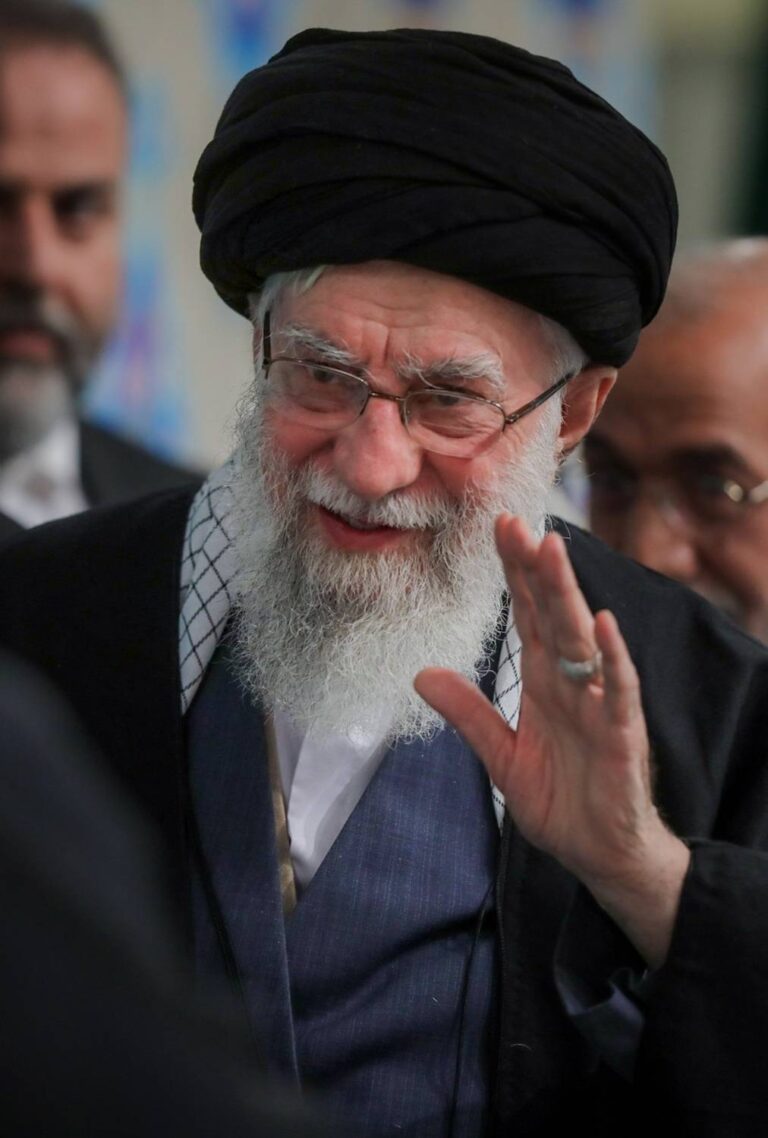

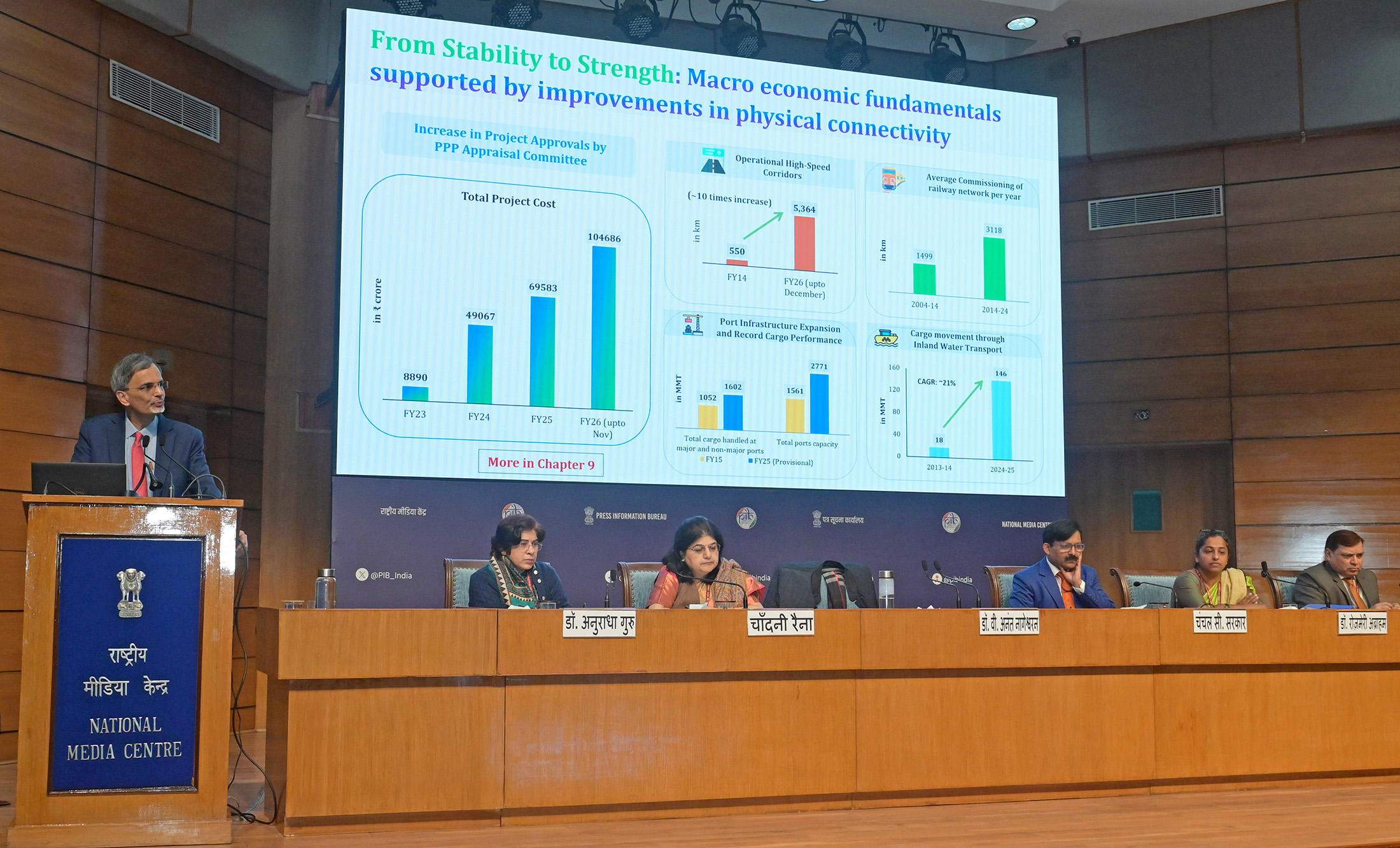

The Chief Economic Adviser to the Government of India, Dr. V. Anantha Nageswaran addressing a Press Conference on Economic Survey 2025-26 at National Media Centre, in New Delhi on January 29, 2026.

India Fastest-Growing Major Economy for Fourth Year

Consumption and Investment Drive India’s FY26 Expansion

Economic Survey Flags Strong Services, Stable Inflation Outlook

India’s economy is projected to grow by 7.4 per cent in FY26, supported by strong domestic consumption and sustained investment, according to the Economic Survey tabled in Parliament today. While inflation has eased and public finances have stabilised, the report warns that global uncertainty, geopolitical tensions and fragmented trade pose continuing risks. The outlook for FY27 points to steady but cautious growth in a volatile international environment.

New Delhi: India’s Gross Domestic Product (GDP) is estimated to grow by 7.4 per cent in the financial year 2025–26 (FY26), driven primarily by strong domestic consumption and sustained investment, according to the Economic Survey 2025–26 tabled in Parliament by Union Minister for Finance and Corporate Affairs Nirmala Sitharaman. The estimate reaffirms India’s position as the fastest-growing major economy for the fourth consecutive year.

The Survey projects real GDP growth in FY27 in the range of 6.8 to 7.2 per cent, with India’s potential growth assessed at around 7 per cent. It notes that domestic demand continues to underpin economic expansion in FY26. Based on the First Advance Estimate, the share of Private Final Consumption Expenditure (PFCE) in GDP rose to 61.5 per cent in FY26. This reflects a supportive macroeconomic environment marked by low inflation, stable employment conditions and rising real purchasing power.

Rural consumption has remained steady, supported by agricultural performance, while urban consumption has shown gradual improvement, aided by the rationalisation of direct and indirect taxes. Together, these trends indicate that consumption growth has been broad-based. The Survey also points out that financial inclusion has deepened alongside rising consumption, with more than 55 crore bank accounts opened under the Pradhan Mantri Jan Dhan Yojana and a widening tax base reflected in the increase in income-tax filers to about 9.2 crore in recent years.

Investment Momentum and Capital Formation

Investment has also remained a key anchor of growth. The share of Gross Fixed Capital Formation (GFCF) is estimated at 30.0 per cent in FY26. Investment activity strengthened in the first half of the year, with GFCF expanding by 7.6 per cent, exceeding the pace recorded in the corresponding period last year and remaining above the pre-pandemic average of 7.1 per cent. The Survey further notes that public capital expenditure continued to crowd in private investment, supported by infrastructure spending and Production Linked Incentive schemes across multiple sectors.

Agriculture and Rural Economy

On the sectoral front, agriculture and allied services are estimated to grow by 3.1 per cent in FY26. Agricultural activity in the first half of the year was supported by a favourable monsoon. Agricultural Gross Value Added (GVA) grew by 3.6 per cent in the first half of FY26, higher than the 2.7 per cent recorded in the first half of FY25, though below the long-term average of 4.5 per cent. Allied activities such as livestock and fisheries continued to expand at relatively stable rates of around 5 to 6 per cent. As their share in agricultural GVA has increased, overall agricultural growth has increasingly reflected a combination of volatile crop output and more stable allied sector expansion. The Survey also recorded that foodgrain production reached a new high, strengthening rural incomes and supporting consumption demand.

Industrial Performance and Manufacturing Trends

The industrial sector has shown signs of strengthening. Manufacturing grew by 8.4 per cent in the first half of FY26, surpassing the full-year estimate of 7.0 per cent. Construction activity remained resilient, supported by sustained public capital expenditure and momentum in infrastructure projects. The manufacturing sector’s share has remained steady at around 17 to 18 per cent in constant price terms, while its Gross Value of Output has stayed broadly stable at about 38 per cent, comparable to services.

For FY26 as a whole, industrial growth is expected to rise to 6.2 per cent from 5.9 per cent in FY25. High-frequency indicators for the third quarter of FY26, including the Purchasing Managers’ Index (PMI) for manufacturing, Index of Industrial Production (IIP) for manufacturing and e-way bill generation, point to strengthening activity supported by robust demand. Construction indicators such as steel consumption and cement production have also recorded steady growth. Looking ahead, industrial momentum is expected to remain firm, aided by Goods and Services Tax (GST) rationalisation and a favourable demand outlook.

Services Sector and Exports

On the supply side, services continue to be the main driver of growth. In the first half of FY26, GVA for services rose by 9.3 per cent, with growth for the full year estimated at 9.1 per cent. All service sub-sectors recorded growth above 9 per cent except for trade, hospitality, transport, communication and related services, which remain about 50 basis points below their pre-pandemic average due to earlier pandemic-related disruptions. The Survey also highlighted the sharp rise in services exports, which touched record levels, reinforcing India’s growing role in global services trade.

Inflation Trends and Price Stability

The Survey notes that demand-led growth has coincided with a marked easing of inflation. Headline Consumer Price Index (CPI) inflation declined to 1.7 per cent during April–December FY26, driven mainly by lower vegetable and pulse prices, supported by favourable farm conditions, supply-side interventions and base effects. Core inflation showed persistence, influenced largely by price increases in precious metals. Adjusting for these, underlying inflation pressures appeared softer, indicating limited demand-side overheating. The inflation outlook remains benign, supported by favourable supply conditions and gradual pass-through of GST rate rationalisation.

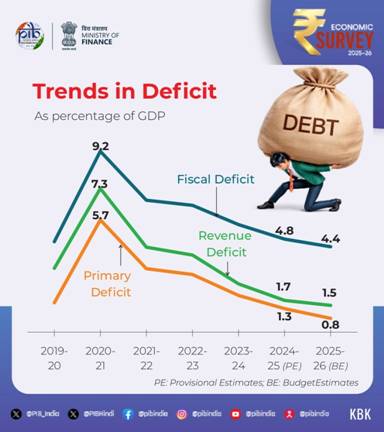

Fiscal Policy and Public Spending Quality

Fiscal policy has played a key role in supporting growth. Gross tax revenue collections progressed resiliently, with direct tax collections reaching nearly 53 per cent of the budgeted annual target by November 2025. Indirect tax collections also remained robust, with GST collections recording multiple all-time highs in absolute terms. Centre’s revenue receipts rose to about 9.2 per cent of GDP, supported by improved compliance and a broader tax base. Recent reforms, including the restructuring of personal income tax and GST rationalisation, supported consumption while sustaining revenues. On the expenditure side, capital outlays rose sharply, reaching nearly 60 per cent of the budgeted allocation by November 2025, while growth in revenue expenditure remained contained, improving the quality of public spending.

Markets have responded to fiscal discipline through lower sovereign bond yields, with spreads over United States bonds declining by more than half. Along with a lower policy repo rate, these yields are expected to act as a stimulus by reducing borrowing costs. Credit rating agency S&P Ratings upgraded India’s rating from ‘BBB-’ to ‘BBB’, while CareEdge Global assigned India a ‘BBB+’ rating, citing robust economic performance and fiscal discipline.

Monetary Policy Transmission and Banking Health

Monetary support was provided through a cumulative reduction of 125 basis points in the policy repo rate since February 2025, alongside liquidity injections through cash reserve ratio reductions of ₹2.5 lakh crore, open market operations of ₹6.95 lakh crore and foreign exchange swaps of about USD 25 billion. These measures were transmitted to the banking system, with the weighted average lending rate on fresh rupee loans declining by 59 basis points and on outstanding loans by 69 basis points between February and November 2025.

The banking sector strengthened further, with gross non-performing asset ratios falling to a multi-decade low of 2.2 per cent. The half-yearly slippage ratio remained stable at 0.7 per cent, while profitability improved on the back of higher profit after tax and strong net interest margins.

External Sector and Trade Balance

Against a backdrop of global trade uncertainty, India’s total exports of merchandise and services reached a record USD 825.3 billion in FY25 and continued to show momentum in FY26. Services exports rose to a historic high, while India remained the world’s largest recipient of remittances, strengthening the external balance. Despite higher tariffs imposed by the United States, merchandise exports grew by 2.4 per cent during April–December 2025, while services exports rose by 6.5 per cent. Merchandise imports increased by 5.9 per cent over the same period. The rise in the merchandise trade deficit was offset by a higher services trade surplus and strong remittance inflows. As a result, the current account deficit remained moderate at 0.8 per cent of GDP in the first half of FY26.

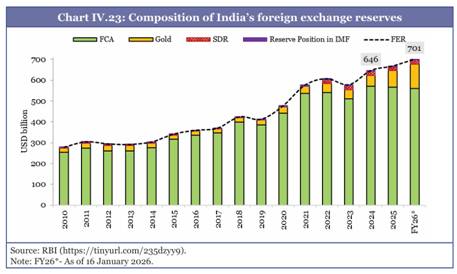

India’s external position remains comfortable in the short term. Foreign exchange reserves covered more than 11 months of imports as of mid-January 2026 and about 94 per cent of external debt outstanding as of end-September 2025. The government has pursued a diversified trade strategy through agreements with the United Kingdom, Oman and New Zealand, and recently concluded a free trade agreement with the European Union after three years of negotiations, subject to ratification by the European Parliament. Negotiations with the United States are also underway.

Structural Reforms and Labour Market Changes

The Survey also highlighted the notification of Labour Codes as a major regulatory reform, consolidating 29 central labour laws into four codes aimed at simplifying compliance, enhancing labour market flexibility and extending social security while retaining safeguards for wages and occupational safety.

Strategic Policy Framing in an Uncertain Global Order

Beyond headline growth projections, the Economic Survey introduces a broader conceptual framework for policymaking under conditions of persistent global uncertainty. It argues that India’s recent macroeconomic stability has coincided with an international environment in which sound domestic fundamentals no longer guarantee insulation from external shocks.

The Survey suggests that public policy must increasingly focus on building institutional resilience rather than only maximising growth. It notes that traditional macroeconomic tools may prove insufficient in a world characterised by fragmented trade, weaponised tariffs and volatile capital flows. This framing implicitly recognises that fiscal and monetary buffers come with opportunity costs and that insurance against shocks can constrain near-term policy flexibility.

Global Risk Scenarios and Forecast Uncertainty

For the first time, the Survey outlines multiple stylised scenarios for the international economic environment in FY27. These range from a relatively orderly global adjustment to more adverse outcomes driven by geopolitical escalation and financial stress.

It cautions that India’s macroeconomic indicators, while stable, may still face lagged effects from global disruptions transmitted through trade channels, capital flows and energy markets. Slower growth in major partner economies and renewed protectionism could intermittently weaken export momentum and business confidence even if domestic demand remains supportive.

Productivity Constraints and the Limits of Capital-Led Growth

The Survey places sharper emphasis on productivity as a binding constraint on medium-term growth. While public investment and capital formation have supported expansion in recent years, it argues that sustaining growth near 7 per cent will increasingly depend on improvements in labour productivity and technological diffusion rather than on capital accumulation alone.

It points to uneven productivity across sectors, particularly between formal and informal enterprises, and warns that without deeper reforms in land markets, labour mobility and urban infrastructure, investment-driven growth could face diminishing returns.

Demographic Dividend: Opportunity and Risk

The Survey reiterates that India’s demographic profile remains a potential growth advantage but flags risks if employment creation does not keep pace with the expanding working-age population. It notes that future job generation must increasingly come from manufacturing, services and technology-driven sectors rather than agriculture.

It also draws attention to regional variations in demographic trends and labour participation, suggesting that national averages mask wide differences in human capital outcomes across states. Education and skilling systems, the Survey argues, will need to adapt rapidly to changing labour market requirements, particularly in digital and green sectors.

Artificial Intelligence and Structural Change

A thematic section of the Survey examines the macroeconomic implications of artificial intelligence and automation. While technological adoption could boost productivity and competitiveness, it also introduces transitional risks for employment in routine and clerical occupations.

Rather than presenting artificial intelligence as an unqualified growth engine, the Survey frames it as a disruptive force requiring regulatory foresight, reskilling policies and institutional preparedness. It cautions that gains from technological change may remain unevenly distributed without targeted human capital investment.

Climate Transition and Growth Trade-offs

The Survey treats climate and energy transition as core macroeconomic variables rather than peripheral policy issues. It links future growth prospects to India’s capacity to balance emissions reduction commitments with energy security and industrial competitiveness.

While noting progress in renewable energy deployment and green investment, it acknowledges that the transition imposes fiscal and regulatory pressures on sectors such as transport, power and heavy industry. It also flags that climate policies abroad, including carbon border measures, could reshape India’s trade competitiveness.

State Finances and Subnational Risks

Greater attention is given to state government finances. The Survey notes improvements in fiscal discipline but cautions that rising social sector obligations and infrastructure commitments could strain state budgets if revenue growth moderates.

It highlights growing divergence in debt sustainability and administrative capacity across states, suggesting that uneven subnational performance could become a macroeconomic vulnerability if not addressed through coordinated fiscal frameworks.

Reform Outcomes and Conditional Optimism

FY26 was described as a challenging year on the external front due to heightened global trade uncertainty and high tariffs affecting exporters and business confidence. The government responded with measures such as GST rationalisation, faster deregulation and compliance simplification. FY27 is expected to be a year of adjustment as firms and households adapt, with domestic demand and investment gaining strength, though external uncertainties persist.

Globally, growth is expected to remain modest over the medium term, with inflation trending downward and monetary policies becoming more accommodative. The Survey cautioned that geopolitical tensions, trade fragmentation and financial vulnerabilities continue to pose risks. For India, these translate into external uncertainties rather than immediate macroeconomic stress, though slower growth in trading partners and volatility in capital flows could affect exports and investor sentiment.

Despite these risks, the domestic economy remains on a stable footing. Inflation has moderated to historically low levels, balance sheets of households, firms and banks have improved, and public investment continues to support activity. Consumption remains resilient, and private investment intentions are strengthening. The cumulative impact of reforms in recent years has lifted India’s medium-term growth potential closer to 7 per cent.

Taking all these factors into account, the Economic Survey projects real GDP growth in FY27 in the range of 6.8 to 7.2 per cent, indicating steady growth amid global uncertainty, requiring caution but not pessimism.

– global bihari bureau