Geneva: World Trade Organization (WTO) economists today scaled back projections for growth in global merchandise trade in 2023 amid a continued slump that began in the fourth quarter of 2022.

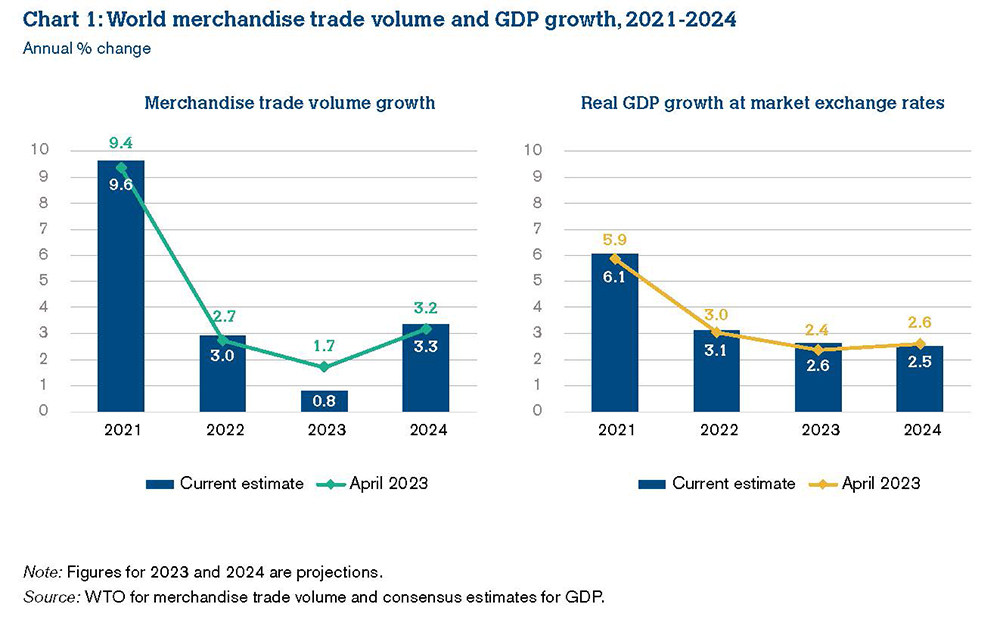

The volume of world merchandise trade is now expected to grow by 0.8% this year, less than half the 1.7% increase forecasted in April 2023. The 3.3% growth projected for 2024 remains nearly unchanged from the previous estimate, according to the latest WTO trade forecast released here today. Risks to the forecast include a sharper-than-expected slowdown in China and a resurgence of inflation in advanced economies, which would require keeping interest rates higher for a longer period.

WTO furthermore expects real-world GDP to grow by 2.6% at market exchange rates in 2023 and by 2.5% in 2024, as set out in the WTO’s “Global Trade Outlook and Statistics — Update: October 2023”.

WTO Director-General Ngozi Okonjo-Iweala said: “The projected slowdown in trade for 2023 is cause for concern, because of the adverse implications for the living standards of people around the world. Global economic fragmentation would only make these challenges worse, which is why WTO members must seize the opportunity to strengthen the global trading framework by avoiding protectionism and fostering a more resilient and inclusive global economy. The global economy, and in particular poor countries, will struggle to recover without a stable, open, predictable, rules-based and fair multilateral trading system.”

World trade and output slowed abruptly in the fourth quarter of 2022 as the effects of tighter monetary policy were felt in the United States, the European Union and elsewhere, but falling energy prices and the end of Chinese pandemic restrictions raised hopes of a quick rebound. However, so far, these hopes have not materialized, as strained property markets have prevented a stronger post-COVID-19 recovery from taking root in China, and as inflation has remained sticky in the United States and the EU. Together with the after-effects of the war in Ukraine and the COVID-19 pandemic, these developments have cast a shadow over the outlook for trade in 2023 and 2024. The trade slowdown appears to be broad-based, involving a large number of countries and a wide array of goods, specifically certain categories of manufactures such as iron and steel, office and telecom equipment, textiles, and clothing. A notable exception is passenger vehicles, sales of which have surged in 2023. The exact causes of the slowdown are not clear, but inflation, high-interest rates, US dollar appreciation, and geopolitical tensions are all contributing elements.

The WTO now hopes that trade growth should pick up next year accompanied by slow but stable GDP growth. Sectors that are more sensitive to business cycles should stabilize and rebound as inflation moderates and interest rates start to come down. However, signs are starting to emerge of supply chain fragmentation, which could threaten the relatively positive outlook for 2024. For example, the share of intermediate goods in world trade, an indicator of global supply chain activity, fell to 48.5% in the first half of 2023, compared to an average of 51.0% over the previous three years. Furthermore, the share of Asian bilateral partners in US trade in parts and accessories — a key subset of intermediate inputs — fell to 38% in the first half of 2023, down from 43% in the same period of 2022.

WTO Chief Economist Ralph Ossa said: “We do see some signs in the data of trade fragmentation linked to geopolitical tensions. Fortunately, broader deglobalization is not here yet. The data suggest that goods continue to be produced through complex supply chains, but that the extent of these chains may have plateaued, at least in the short run. Positive export and import volume growth should resume in 2024, but we must remain vigilant.”

World commercial services trade is not covered by the forecast. However, preliminary data show that growth in the sector may be moderating following last year’s strong rebounds in transport and travel. World commercial services trade was up 9% year-on-year in the first quarter of 2023 compared to a 19% year-on-year rise in the second quarter of 2022.

– global bihari bureau