Geneva: World trade is expected to lose momentum in the second half of 2022 and remain subdued in 2023 as multiple shocks weigh on the global economy. WTO economists now predict global merchandise trade volumes will grow by 3.5% in 2022—slightly better than the 3.0% forecast in April. For 2023, however, they foresee a 1.0% increase—down sharply from the previous estimate of 3.4%.

Import demand is expected to soften as growth slows in major economies for different reasons. In Europe, high energy prices stemming from the Russia-Ukraine war will squeeze household spending and raise manufacturing costs. In the United States, monetary policy tightening will hit interest-sensitive spending in areas such as housing, motor vehicles and fixed investment. China continues to grapple with COVID-19 outbreaks and production disruptions paired with weak external demand. Finally, growing import bills for fuels, food and fertilizers could lead to food insecurity and debt distress in developing countries.

“Policymakers are confronted with unenviable choices as they try to find an optimal balance among tackling inflation, maintaining full employment, and advancing important policy goals such as transitioning to clean energy. Trade is a vital tool for enhancing the global supply of goods and services, as well as for lowering the cost of getting to net-zero carbon emissions,” Director-General Ngozi Okonjo-Iweala said.

“While trade restrictions may be a tempting response to the supply vulnerabilities that have been exposed by the shocks of the past two years, a retrenchment of global supply chains would only deepen inflationary pressures, leading to slower economic growth and reduced living standards over time. What we need is a deeper, more diversified and less concentrated base for producing goods and services. In addition to boosting economic growth, this would contribute to supply resilience and long-term price stability by mitigating exposure to extreme weather events and other localized disruptions. The success of the WTO’s 12th Ministerial Conference (MC12) in June is proof that with sufficient political will, members can cooperate and move forward together.”

The new WTO forecast estimates world GDP at market exchange rates will grow by 2.8% in 2022 and 2.3% in 2023 — the latter is 1.0 percentage points lower than what was previously projected.

In their April forecast, released only weeks after the start of the war in Ukraine, WTO economists had to rely on simulations to generate reasonable growth assumptions, in the absence of hard data about the war’s impact. As events have unfolded, the WTO’s GDP projections for 2022 turned out to be broadly correct. The estimates for 2023, however, now appear overly optimistic, as energy prices have skyrocketed, inflation has become more broad-based, and the war shows no sign of letting up.

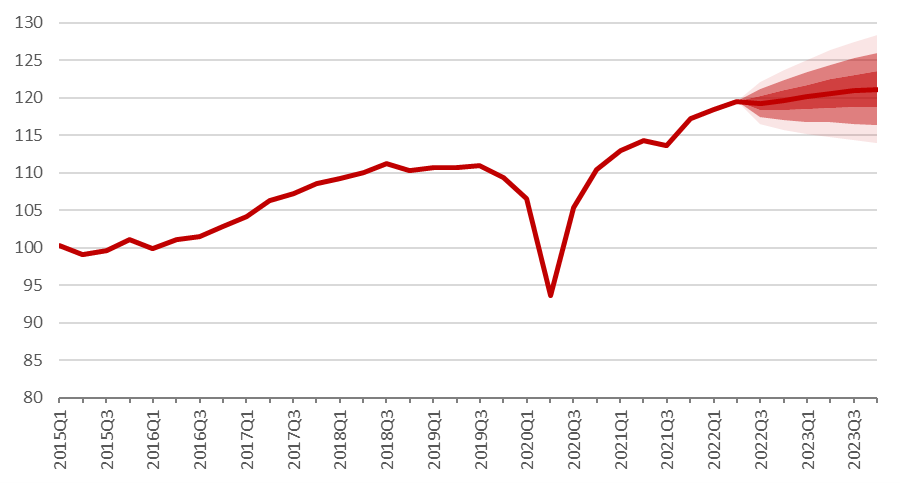

If the current forecast is realized, trade growth will slow sharply but remain positive in 2023. It should be noted that there is a high degree of uncertainty associated with the forecast due to shifting monetary policy in advanced economies and the unpredictable nature of the Russia-Ukraine war. Chart 1 shows quarterly world merchandise trade volume through 2023 with error bands around the forecast period. If current assumptions hold, trade growth in 2022 could end up between 2.0% and 4.9%. If the downside risks materialize, trade growth in 2023 could then be as low as -2.8%. If the surprises are on the upside, however, trade growth next year could be high as 4.6%. Trade could also finish outside of these bounds if any of the underlying assumptions change.

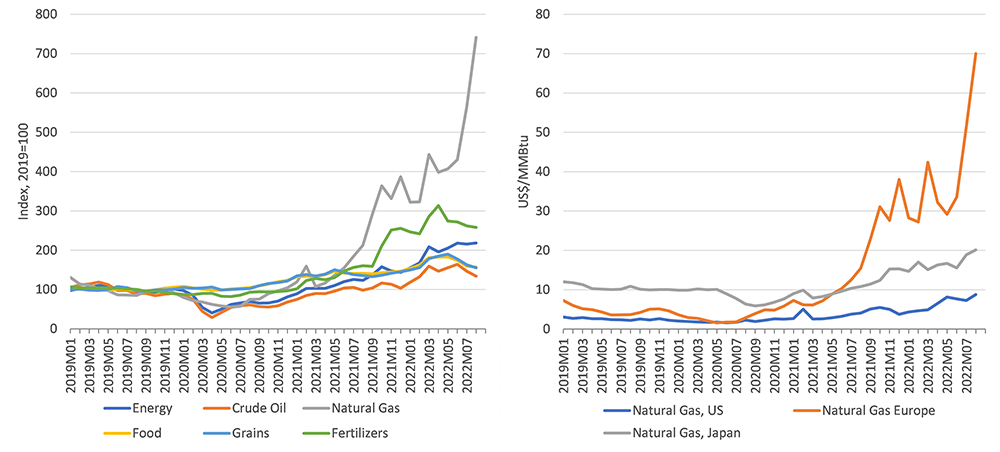

The Ukraine crisis has pushed up prices for primary commodities, particularly fuels, food, and fertilizers. These are illustrated by Chart 2, which shows global commodity price indices on the left and natural gas prices by region on the right. In August, energy prices were up 78% year-on-year, led by natural gas, which was up 250%. The 36% increase in the price of crude oil over the same period was small by comparison but still significant for consumers.

Chart 1: Volume of world merchandise trade, 2015Q1-2023Q4

Seasonally-adjusted volume index, 2015=100

Natural gas prices have diverged strongly across regions, with European prices up 350% year-on-year in August. U.S. prices were up 120% in the same month but remained well below European levels (US$ 8.80 per million Btu compared to US$ 70.00 in Europe). European demand for liquified natural gas (LNG) to supplement reduced supplies from the Russian Federation has also pushed up energy costs in Asia, where the price of LNG was up 87% in August. European gas prices have moderated recently, falling 34% between 31 August and 23 September, but they remain high by historical standards. Oil prices have also receded from recent peaks, possibly indicating weaker global demand rather than an improved supply situation.

Chart 2: Primary commodity prices, January 2019 – August 2022

Index 2019=100 and US$ per million Btu

Food prices in US dollar terms have also risen sharply due to the fact that the Russian Federation and Ukraine are both major suppliers of grains and fertilizers. This raises food security concerns in many countries, particularly low-income ones that tend to spend a large fraction of household income on food. Many currencies have also fallen against the dollar in recent months, making food and fuels even more expensive in national currency terms.

Global grain prices in August were up 15% year-on-year while wheat alone was up 18%. This marks an improvement over April, when grains had increased 33% and wheat had risen 76%. Potentially more worrying for the future are fertilizer prices, which were up 60% year-on-year in August after nearly tripling since 2020. Reduced fertilizer imports and use could reduce crop yields and increase food insecurity next year.

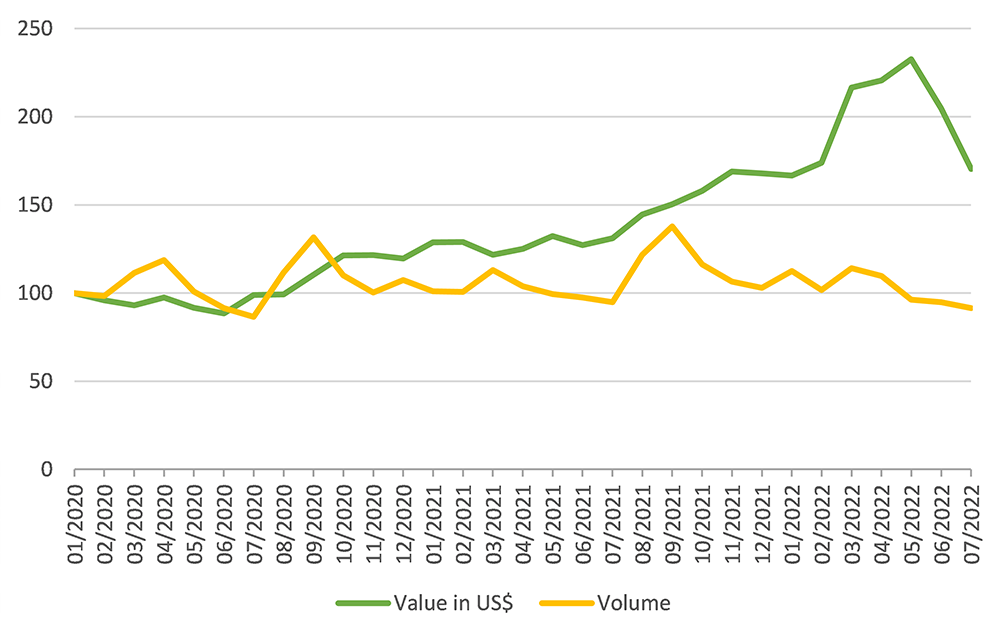

While the supply situation for grains may not be as dire as some had feared at the start of the Ukraine war, it is still a cause for concern. This is illustrated by Chart 3, which shows the estimated value and volume of world trade in wheat. In July the volume of traded wheat was down nearly 20% compared to March but only 4% year-on-year. Underlying data suggest that some countries have responded to higher prices by reducing consumption and imports. Since March, quantities of imported wheat are down year-on-year in Bolivia (-69%), Jordan (-41%), Zambia (‑38%), Nigeria (-37%), and Ecuador (‑30%), among others.

Chart 3: Estimated value and volume of world trade in wheat, January 2020 – July 2022

(Index, January 2020=100)

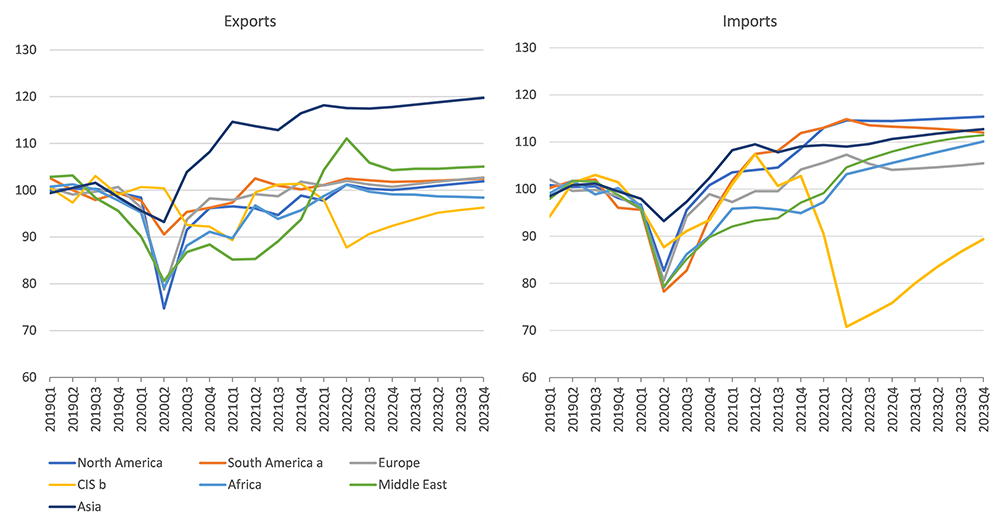

Chart 4 shows quarterly merchandise trade volume developments and projections by region from 2019 to 2023. The CIS region suffered a strong 10.4% quarter-on-quarter export decline in Q2 of 2022 as sanctions against the Russian Federation started to bite. Exports from South America, Africa and especially the Middle East beat expectations in the first half of the year, helping to make up for reduced shipments from the CIS region. Exports from North America, Europe and Asia in the first half of the year were broadly in line with expectations.

On the import side, the CIS region plunged 21.7% during the second quarter of 2022, probably as a result of the Russian Federation’s exclusion from the SWIFT payments system. Imports by other resource-rich regions (South America, Africa and the Middle East) came in stronger than expected, as higher commodity prices inflated export revenues, allowing countries in these regions to import more. North America and Europe recorded stronger than expected import growth in the first half of 2022 but Asian imports stagnated, registering a year-on-year growth of just 0.7% in the first half.

Chart 4: Merchandise exports and imports by region, 2019 Q1-2023Q4

b. Refers to the Commonwealth of Independent States, including certain associate and former member States.

Source: WTO and UNCTAD

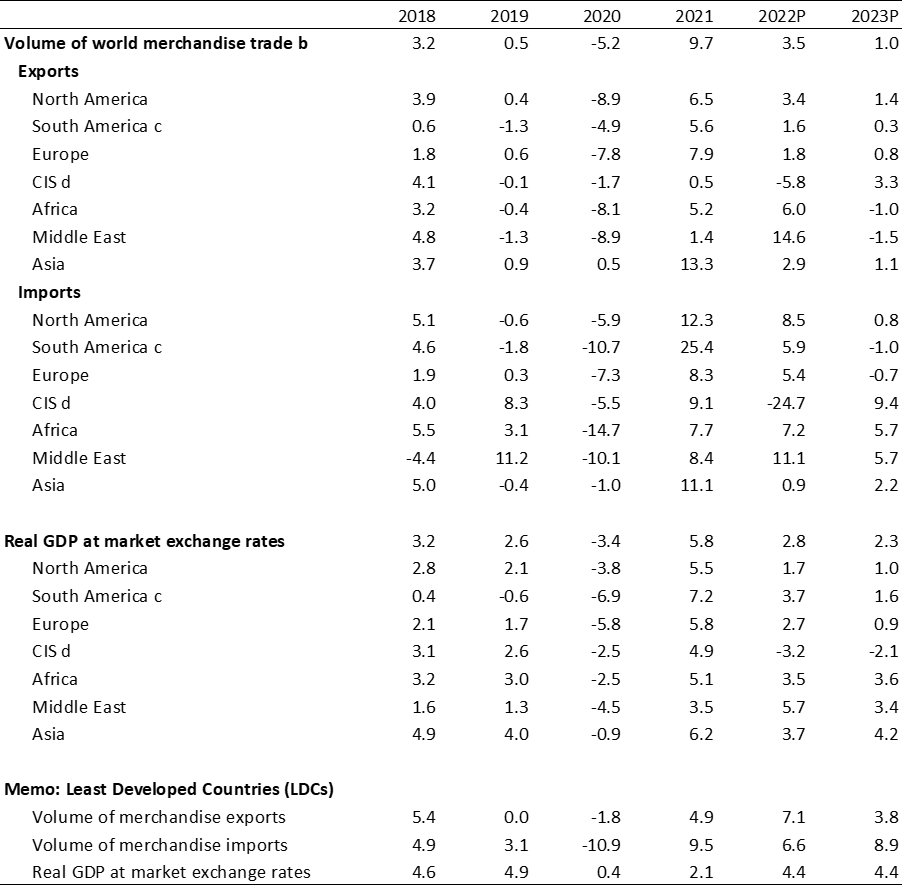

Table 1 summarizes the revised annual trade projections for 2022 and 2023. Note that annual trade volume statistics may diverge slightly from quarterly statistics due to differences in methodology, but in general they track each other quite closely.

The WTO’s current forecast of 3.5% growth in the volume of world merchandise trade in 2022 is close to but slightly stronger than the previous estimate of 3.0% from last April, but the difference is mostly explained by statistical revisions and the availability of new data. The Middle East is expected to record the strongest export growth of any WTO region this year (14.6%), followed by Africa (6.0%), North America (3.4%), Asia (2.9%), Europe (1.8%) and South America (1.6%). In contrast, CIS exports should decline by 5.8% for the year. The Middle East also had the fastest trade volume growth on the import side (11.1%), followed by North America (8.5%), Africa (7.2%), South America (5.9%), Europe (5.4%), Asia (0.9%) and CIS (-24.7%).

One notable feature of Table 1 is the resilience of trade growth in the Middle East and Africa in 2022. These regions should see small declines in exports next year, but imports will remain strong, each set to grow by 5.7%. The CIS region is expected to post a large growth rate for imports next year, over 9%, but if this happens it will be mostly due to the reduced base for 2022. Other regions can expect modest growth in both exports and imports in 2023.

Table 1: Merchandise trade volume and real GDP, 2018-2023a

Annual % change

a. Figures for 2022 and 2023 are projections.

b. Refers to average of exports and imports.

c. Refers to South and Central America and the Caribbean.

d. Refers to Commonwealth of Independent States (CIS), including certain associate and former member States.

Note: These projections incorporate mixed-data sampling (MIDAS) techniques for selected countries to take advantage of higher-frequency data such as container throughput and financial risk indices.

Sources: WTO for trade, consensus estimates for GDP.

These projections incorporate mixed-data sampling (MIDAS) techniques that use higher frequency data to improve forecasting accuracy. Specifically, monthly data on container throughput are exploited to capture the effects of port congestion and supply disruptions in the United States and China. Taking this information into account had a small positive impact on imports by North America and Asia in 2022, reflecting the clearance of backlogs at U.S. West Coast ports and increased container handling in Chinese ports following pandemic-related stoppages earlier in the year.

Risks to the forecast are numerous and interrelated. Major central banks are already raising interest rates in a bid to tame inflation but overshooting on tightening could trigger recessions in some countries, which would weigh on imports. Alternatively, central banks might not do enough to bring inflation down, possibly necessitating stronger interventions in the future. High-interest rates in advanced economies could trigger capital flight from emerging economies, unsettling global financial flows. Escalation of the Russia-Ukraine war could also undermine business and consumer confidence and destabilize the global economy. An underappreciated risk would be the decoupling of major economies from global supply chains. This would exacerbate supply shortages in the near term and reduce productivity over the longer term.

Trade developments in value terms

The WTO’s trade forecasts are issued together with quarterly and annual trade statistics in nominal U.S. dollar terms.

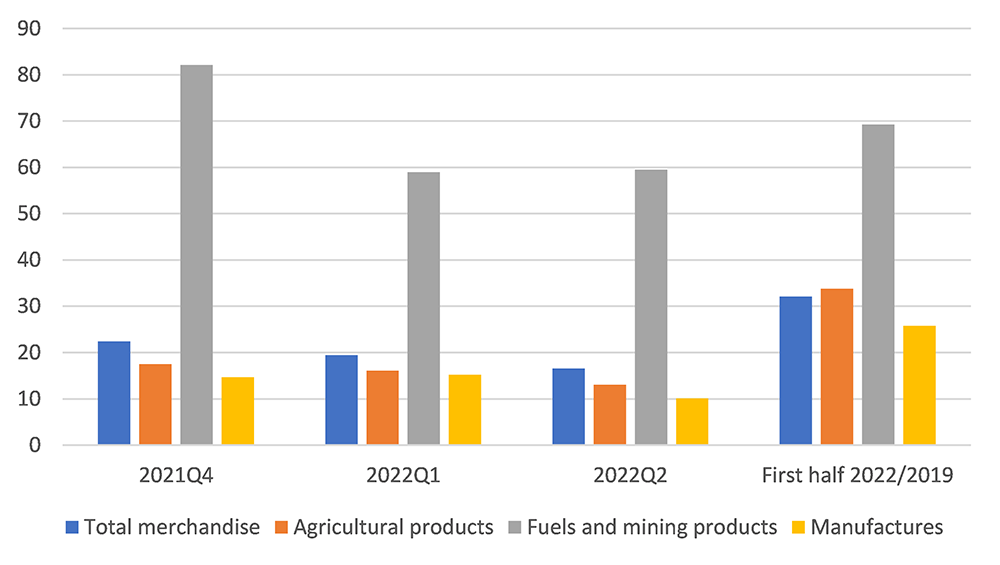

Chart 5 shows year-on-year growth in merchandise exports over the last three quarters in value terms. It also compares the value of exports in the first half of 2022 to exports in the first half of 2019, before the start of the pandemic. It shows that total merchandise trade was up 17% year-on-year in the second quarter of 2022, as compared to 22% year-on-year in the fourth quarter of 2021. Trade in the first half of 2022 was also up 32% compared to 2019. The main takeaway is that because of changes in prices, merchandise trade values are growing at double-digit rates even as trade growth in volume terms remains in the low single digits.

Chart 5: Year-on-year growth in world merchandise exports through 2022Q2

% change in US$ values

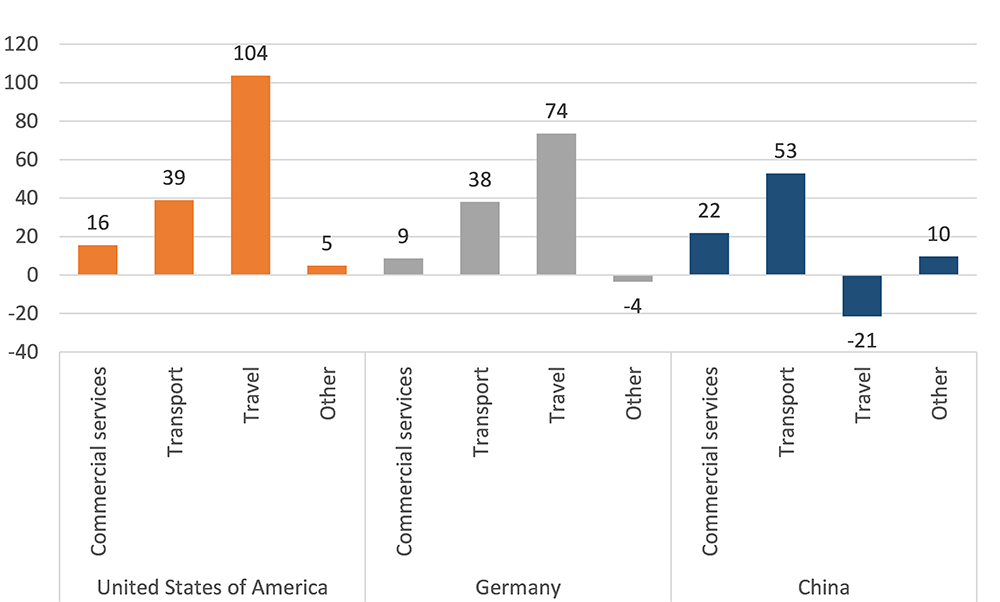

WTO quarterly statistics on commercial services trade for the second quarter have not been released yet, but monthly data through July provide an indication of trends for major economies (Chart 6). Exports of travel and transport services rebounded strongly in many countries as pandemic-related restrictions have eased. China is an exception, with travel spending held back by the country’s zero-COVID policy. Exports of other commercial services (a category that includes financial and business services) grew at a modest pace, partly due to the fact that they did not decline much during the pandemic.

Chart 6: Year-on-year growth in commercial services exports by category, January-July 2022

% change in US$ terms

Supplemental indicators

The WTO tracks a number of indicators to identify current trends in merchandise and commercial services trade. Some of these are presented below to provide additional context to the forecast.

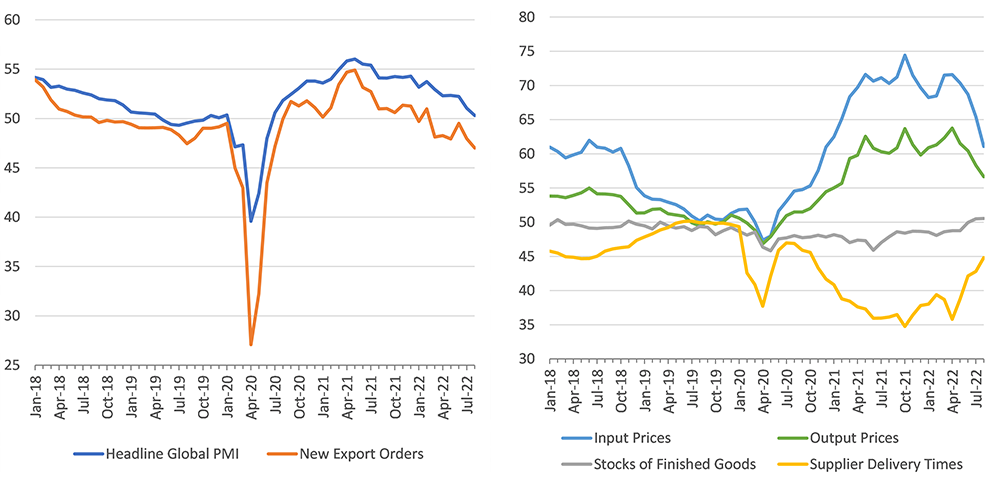

Purchasing managers’ indices (PMIs) are monthly economic indicators based on business surveys. J.P. Morgan aggregates PMIs from over 40 countries into a global manufacturing PMI, with values greater than 50 indicating expansion and values less than 50 denoting contraction (Chart 7). The headline PMI index fell to a 26-month low of 50.3 in August, just above the threshold value of 50 separating expansion from contraction. Meanwhile, the sub-index representing new export orders fell to 47.0, signalling contraction. This suggests that global manufacturing activity has stalled and that goods trade will continue to slow in the coming months.

Other sub-indices of the PMI cast light on the state of global supply chains. An index representing input prices fell from 71.6 in April to 61.1 in August. Another index of final goods prices dropped from 63.8 to 56.7 over the same period. Together, these suggest that inflationary pressures, while still high, may have peaked. Delivery times also shortened in August and stocks of finished goods rose. A few months ago, these would have been seen as positive indications that supply chain pressures were easing, but today they could signal that global demand is weakening.

Chart 7: Global Purchasing Managers Indices, January 2018 – August 2022

(Diffusion index, base = 50)

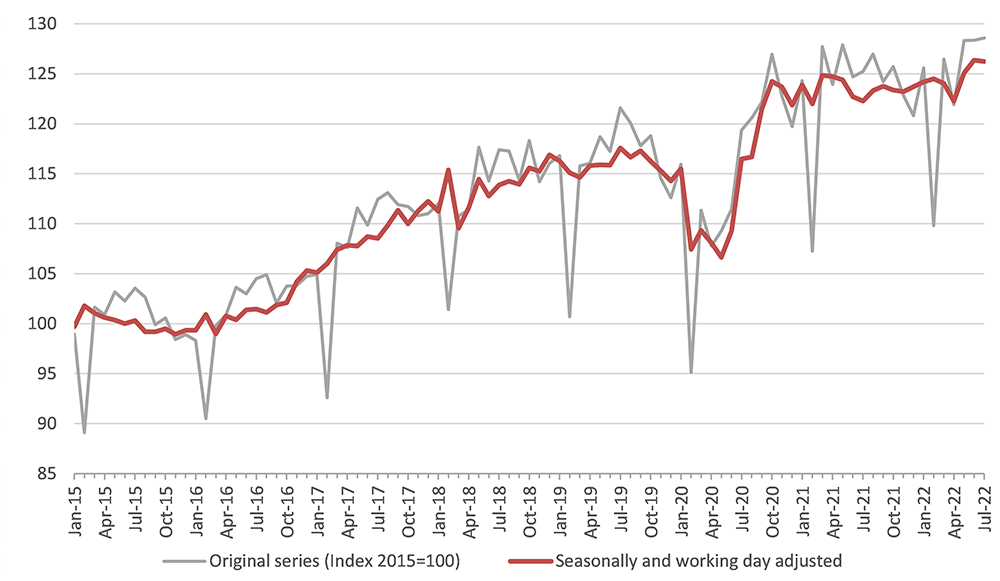

The RWI/ISL container throughput index tracks global goods trade quite closely. Although the index remained near its all-time high in July, it has been mostly flat since October 2020. Throughput of Chinese ports dipped in the spring due to pandemic-related lockdowns, but traffic rebounded again after these measures were relaxed. The decline in China was partly compensated by increased container handling at U.S. ports, which had previously experienced severe congestion. Overall, the index suggests continued stagnation in merchandise trade.

Chart 8: RWI/ISL global container throughput index, January 2015-July 2022

Index 2015=100

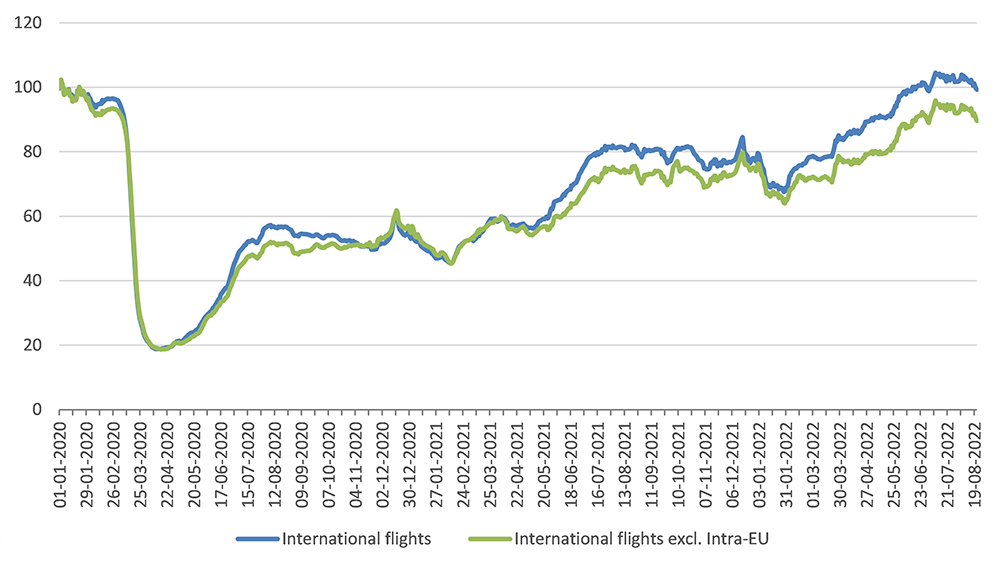

The WTO does not forecast services trade, but Chart 6 shows that travel and transport are its most dynamic components. This is backed up by data on international flights from the OpenSky network (Chart 9). Daily commercial flights (including those within the European Union) finally exceeded pre-pandemic levels this summer but in late August they turned down slightly. Whether this pause is temporary or long-lasting remains to be seen.

Chart 9: International commercial flights, 1 January 2020 — 22 August 2022

Index, week of 1 January = 100, 7-day moving average

– global bihari bureau