FDI Slump Hits Global South Hardest, UNCTAD Warns

Geneva: Global foreign direct investment (FDI) cratered by 11% in 2024, marking its second consecutive year of decline and delivering a sobering wake-up call for developing countries, according to the World Investment Report 2025, released by UN Trade and Development (UNCTAD) in Geneva, Switzerland, on 19 June 2025. This deepening slowdown in productive capital flows, coupled with a sharp drop in investments vital to the Sustainable Development Goals (SDGs), threatens to stall progress across the Global South, UNCTAD warns. Released ahead of the Fourth International Conference on Financing for Development (FFD4), the report highlights the urgent need to overhaul global investment and finance systems to drive inclusive, sustainable growth as leaders prepare to confront the growing chasm between capital flows and development needs.

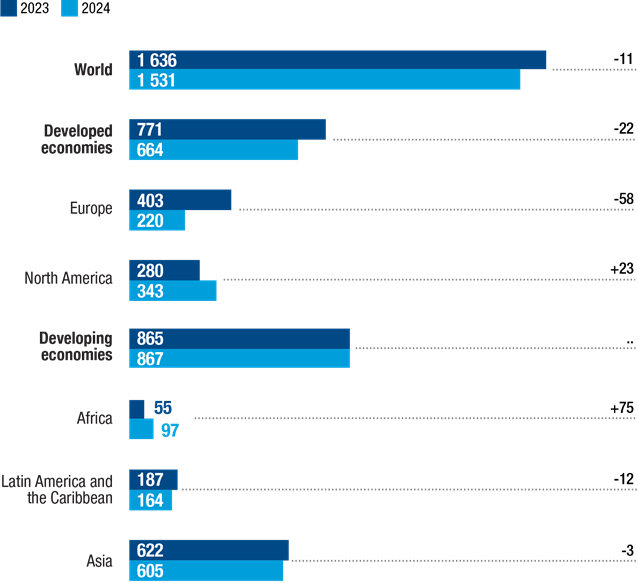

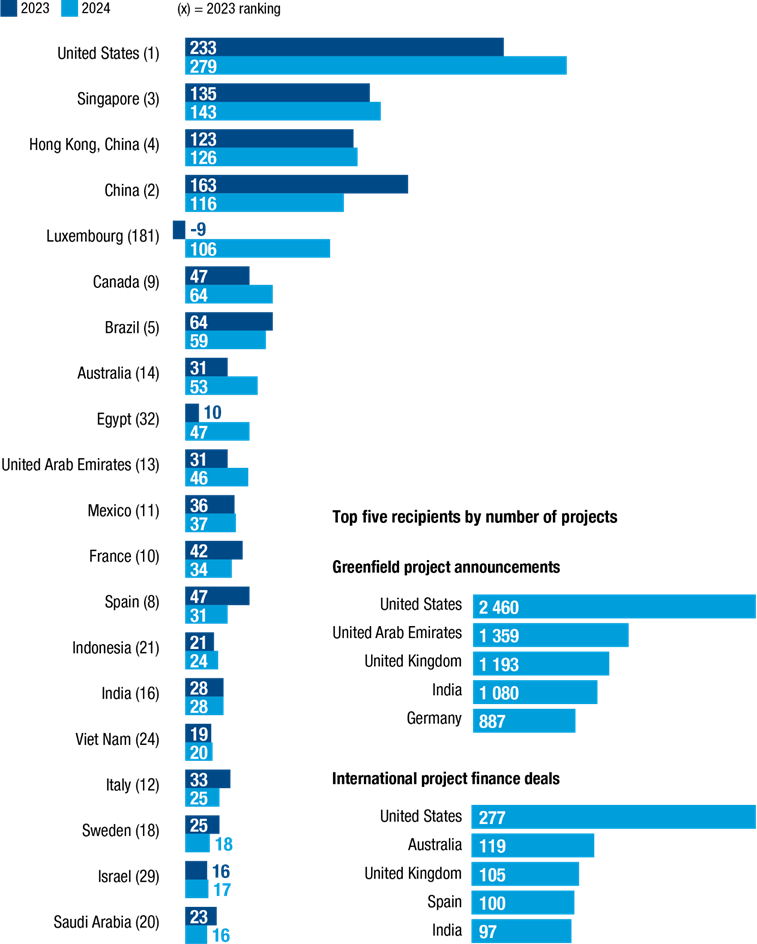

The headline figures mask a complex reality. While global FDI rose 4% in 2024 to $1.5 trillion, this uptick was fueled by volatile financial conduit flows through European economies, often acting as mere transfer hubs, obscuring a broader decline. Developed economies faced a 22% FDI drop, with Europe reeling from a 58% plunge. North America defied the trend, posting a 23% rise led by the United States. In developing countries, inflows seemed stable, but this hid a crisis: capital is either stagnating or bypassing critical sectors like infrastructure, energy, technology, and industries that spark job creation. “Too many economies are being left behind not for lack of potential, but because the system still sends capital where it’s easiest, not where it’s needed,” said UN Trade and Development Secretary-General Rebeca Grynspan, her words laced with urgency and hope. “But we can change that. If we align public and private investment with development goals and build trust into the system, domestic and international markets will bring scale, stability, and predictability, and today’s volatility can become tomorrow’s opportunity.”

The 2024 investment landscape was roiled by geopolitical tensions, trade fragmentation, and fierce industrial policy competition, amplifying financial risks and eroding long-term investor confidence. Multinational companies leaned into short-term risk management, particularly in sectors tied to national security, supply chain shifts, and evolving trade policies.

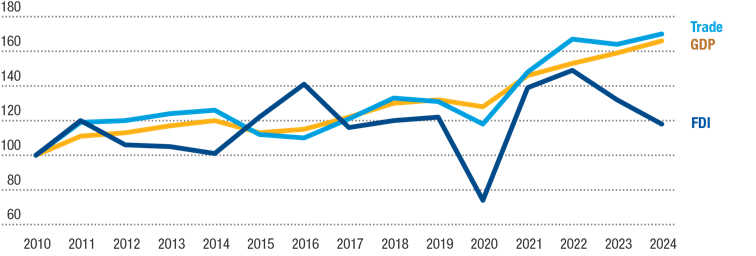

FDI is losing pace with GDP and trade

The above graph plots FDI, GDP, and trade indexed (2010 = 100) in blue lines against a black background, underscoring the divergence.

Figure 2

Figure 3

Figures 2 and 3 further reveal the uneven decline, detailing FDI inflows by economic grouping, region, and the top 20 host economies in billions of dollars and percentage change (Source: UNCTAD, World Investment Report 2025).

Regional trends painted a patchwork picture. Africa’s FDI skyrocketed 75%, driven by a single mega-project in Egypt; excluding this, inflows still climbed 12%, buoyed by investment facilitation and regulatory reforms. Developing Asia, the world’s top FDI magnet, pulled in $605 billion—40% of global FDI and 70% of developing economy inflows—but saw a 3% dip. In East Asia, China, the largest developing economy recipient, endured a 29% drop. The Association of Southeast Asian Nations (ASEAN) sparkled, with a 10% rise to $225 billion, fueled by growth in Indonesia, Malaysia, Singapore, Thailand, and Viet Nam. South Asia held steady, with gains in Pakistan and Sri Lanka, though India saw a slight dip. Central Asia slumped, driven by Kazakhstan, while the United Arab Emirates rebounded in the Gulf Cooperation Council, unlike Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia. Asia hosted nearly a third of global greenfield projects by number and over a quarter by value, but their value fell 23% to $363 billion. India shone with a 28% surge in capital expenditures for announced projects to $110 billion, joined by Azerbaijan, Bahrain, Qatar, and Türkiye. International project finance (IPF) in Asia plummeted 43%, with deals down 27%, reflecting high capital costs and risk perceptions. Cross-border mergers and acquisitions sales tanked 57% to $25 billion, driven by a 49% decline in China and divestments in India (notably Disney’s partial exit) and the United Arab Emirates.

Latin America and the Caribbean saw FDI slide 12% to $164 billion, with South America hit hardest—Argentina, Chile, Colombia, and Brazil faced reduced inflows. Brazil, despite an 8% drop, remained the region’s top draw, bolstered by renewable energy. Guyana and Peru gained from mining and offshore oil, while Central America saw modest growth, led by Mexico’s manufacturing and logistics. The Caribbean bucked the trend, rising 21% to $3.9 billion, driven by stable Dominican Republic inflows. Greenfield investments grew in number and value, spurred by refined petroleum, digital economy, and renewables, with Argentina and Brazil leading. Cross-border mergers and acquisitions slumped, hit by asset sales and Brazil’s market slowdown. IPF declined across most of the region, except in the Caribbean, with Brazil, Chile, Jamaica, Peru, and Uruguay drawing renewable energy and infrastructure projects via the build-own-operate model led by major firms, focusing on green fuels, hydrogen, solar energy, and lithium mining.

Among structurally vulnerable economies, FDI was uneven: least developed countries rose 9%, small island developing States gained 14%, but landlocked developing countries fell 10%. Investment remained concentrated in a few countries across these groups. The Middle East, classified as Western Asia under the UN’s M49 standard and included in Developing Asia, maintained strong inflows, bolstered by economic diversification in the Gulf region. Globally, greenfield investment values held steady, but IPF—crucial for infrastructure—dropped 26%, with steep declines in renewable energy (-31%), transport (-32%), and water and sanitation (-30%). The digital economy grew 14%, driven by information and communication technology (ICT) manufacturing, digital services, and semiconductors, but 80% of new digital projects were concentrated in ten countries, sidelining many developing economies due to infrastructure, regulatory, and skills gaps. UNCTAD warns that current investment levels fall far short of the $4 trillion annually needed to close the SDG financing gap in developing countries—a target growing more distant.

In Developing Asia, the report notes that the region’s mixed performance mirrors global challenges: declining infrastructure investment, rising digital flows, and growing policy uncertainty. South-East Asia stood out, with significant FDI growth, while Central Asia lagged. The region’s greenfield projects rose 5% in number but saw sharp declines in electricity, gas supply, and petroleum processing, losing over $70 billion in combined value. IPF’s 43% value drop outpaced the 27% decline in deal volume, suggesting emerging markets face disproportionate impacts from global IPF downturns due to macroeconomic, fiscal, or political risks. In Latin America and the Caribbean, policymakers leaned into investment promotion, introducing novel FDI attraction strategies for priority sectors like green hydrogen, signalling resilience despite the downturn. The Caribbean’s IPF uptick, particularly in renewables, offered a bright spot amid regional declines.

UNCTAD’s call to action is clear: the world needs “smarter capital”—long-term, inclusive, and SDG-aligned—especially in the digital economy, where gaps in infrastructure, skills, and policy risk deepening divides. Its multi-stakeholder agenda targets seven priorities: improving data and AI governance, crafting digital investment policy toolkits, advancing global digital trade rules, strengthening infrastructure via partnerships and blended finance, fostering innovation ecosystems with university-industry collaboration, enhancing digital skills through education and entrepreneurship, and promoting responsible digital investment by managing risks and advancing sustainability standards. Globally, redirecting capital demands reforms to financial frameworks, greater blended finance, and investment rules ensuring all economies benefit from digital and clean transitions. As Grynspan’s vision resonates, the stakes are high: reshape the rules, align incentives, and transform today’s volatility into tomorrow’s leapfrog opportunities for development.

– global bihari bureau