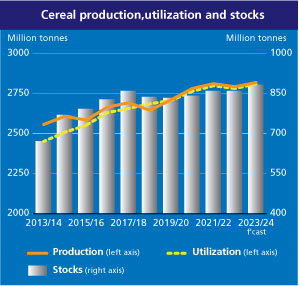

Rome: In a new ‘Cereal Supply and Demand Brief’, released here today, the Food and Agricultural Organization of the United Nations (FAO) maintained its forecast for world cereal production in 2023 at 2, 819 million tonnes, a record high.

Some adjustments were made to country-level figures, notably higher coarse grain production in China and most of West Africa and lower forecasts for the United States of America and the European Union, FAO said. Wheat output forecasts were raised for Iraq and the United States of America and revised downward for the European Union and Kazakhstan.

World rice production in 2023/24 is forecast to increase marginally year-on-year. The new revisions include an upgrade to India’s production, more than offsetting various other revisions, particularly a further downgrade of Indonesian production prospects.

World rice production in 2023/24 is forecast to increase marginally year-on-year. The new revisions include an upgrade to India’s production, more than offsetting various other revisions, particularly a further downgrade of Indonesian production prospects.

World cereal utilization in 2023/24 is forecast to reach 2 810 million tonnes, with the total utilization of both wheat and coarse grains set to surpass the 2022/23 levels while that of rice is expected to stagnate at the previous season’s level.

The world cereals stocks-to-use ratio for 2023/24 is forecast to stand at 30.7 per cent, “a comfortable supply situation from a historical perspective” and marginally above the previous year’s level of 30.5 per cent, according to FAO.

Global trade in cereals in 2023/24 is forecast at 469 million tonnes, a 1.6 per cent contraction from the preceding year.

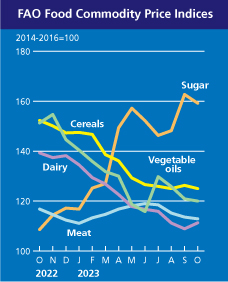

Meanwhile, the benchmark for world food commodity prices declined moderately in October, down by 0.5 per cent from September with the index for dairy products the only one to rise, FAO stated.

The ‘FAO Food Price Index’, which tracks monthly changes in the international prices of a set of globally-traded food commodities, averaged 120.6 points in October, down 10.9 per cent from its corresponding value a year earlier.

The FAO Cereal Price Index declined by 1.0 per cent from the previous month. International rice prices dropped by 2.0 per cent amid generally passive global import demand, while those of wheat dropped by 1.9 per cent, weighed on by strong supplies from the United States of America and strong competition among exporters. By contrast, quotations for coarse grains rose slightly, led by maize due to thinning supplies in Argentina.

The FAO Vegetable Oil Price Index decreased by 0.7 per cent from September, as lower world palm oil prices, due to seasonally higher outputs and subdued global import demand, more than offset higher prices for soy, sunflower and rapeseed oils. Soy oil prices rose owing to a robust demand from the biodiesel sector.

The FAO Sugar Price Index declined by 2.2 per cent but remained 46.6 per cent above its year-earlier level. The October decline was mainly driven by a strong pace of production in Brazil, although concerns over a tighter global supply outlook in the year ahead capped the drop.

The FAO Meat Price Index declined by 0.6 percent, as sluggish import demand especially from East Asia led to a fall in the international prices of pig meat, more than offsetting marginal increases in the prices of poultry, bovine and ovine meats.

In a contrasting trend, the FAO Dairy Price Index rose by 2.2 per cent in October, ending a nine-month decline. World milk powder prices rose the most on the back of surging import demand for both near and longer-term supplies as well as some uncertainty over the impact of the El Niño weather conditions on the upcoming milk production in Oceania.

– global bihari bureau