US President Donald Trump with leaders of C5 Central Asian countries in Washington D.C.

U.S. Blitz Reshapes Steppe Trade Map

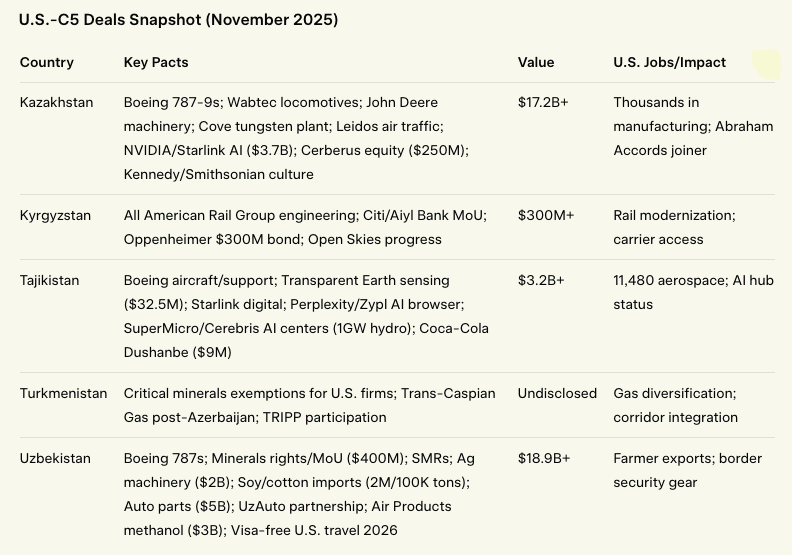

Washington: The White House transformed into a high-stakes commercial showroom as President Donald J. Trump hosted the leaders of Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan for the 10th C5+1 Summit on November 6, 2025.

The result: a cascade of binding contracts exceeding $50 billion in immediate U.S. exports, pushing total trade and investment commitments over the next decade past $100 billion, according to White House announcements and State Department fact sheets released the following day.

These pacts spanned Boeing 787 Dreamliners, Wabtec locomotives, John Deere agricultural machinery, Starlink satellite constellations, Perplexity AI government browsers, SuperMicro AI data centers powered by one gigawatt of Tajik hydropower, and a $3 billion Air Products methanol production facility in Uzbekistan. Granular wins included Uzbekistan’s $8.5 billion order for 22 Dreamliners and up to $2 billion in U.S. farm equipment; Kazakhstan’s $7 billion for eight 787-9s to bolster Air Astana, $4.2 billion in Wabtec rail gear—the largest such deal ever—and up to $5 billion from John Deere; Tajikistan’s $3.2 billion Boeing package supporting 11,480 American jobs, a $32.5 million Transparent Earth remote-sensing contract for mining and agriculture, and a $9 million Coca-Cola expansion in Dushanbe; Kyrgyzstan’s $300 million Oppenheimer-underwritten bond for state-owned Aiyl Bank alongside a Citi memorandum of understanding and All American Rail Group engineering pact; and Turkmenistan’s preferential exemptions for U.S. firms in critical minerals, tied to post-Azerbaijan Caspian seabed accords enabling the Trans-Caspian Gas Pipeline. Uzbekistan further pledged annual imports of two million tonnes of U.S. soybeans and 100,000 tonnes of cotton, a $5 billion automotive parts haul exploring UzAuto Motors privatization, mining rights-of-first-refusal, and small modular reactors from American vendors; Kazakhstan added a $1.1 billion Cove Capital tungsten plant, $200 million Leidos air traffic upgrade, $3.7 billion in NVIDIA, HP, Cisco, GDA, Joby Aero, Oracle, and Starlink AI/digital ties, and a $250 million Cerberus private equity programme; while Tajikistan’s Perplexity-Zypl AI browser and SuperMicro-Cerebris data centres aim to forge a regional AI inference hub. Softer edges included Uzbekistan’s 30-day visa-free travel for Americans starting in 2026, Kazakhstan’s Kennedy Center arts contribution and Smithsonian cultural heritage partnerships via the new Kazakhstan Cultural Heritage Fund and U.S. Ambassadors Fund, and a Commerce Department memorandum of understanding with Kazakhstan on mineral exploration to build “resilient, transparent supply chains.”

Middle Corridor Impact: The New Eurasian Lifeline

These transactions were not mere commerce but a calibrated thrust to supercharge the ‘Middle Corridor’—the Trans-Caspian International Transport Route (TITR), a 4,250+ km multimodal artery threading from China’s western provinces through Kazakhstan, across the Caspian Sea via Azerbaijan and Georgia, and onward through Turkey to Europe. Pre-2022, it handled a modest 1.5 million tonnes annually, dwarfed by the Northern Route’s billion-tonne dominance via Russia. Ukraine sanctions flipped the script: Northern volumes plunged 40-50%, while Middle Corridor freight doubled to 3.2 million tonnes in 2022, surged 89% year-over-year to 1.9 million tonnes by September 2023, hit 4.5 million in 2024 (up 62%), and is on track for 5.2 million in 2025—Azerbaijan alone processed 2.651 million tonnes in the first nine months of 2025, up 6%, with Azerbaijan Railways planning 1,000 block trains next year.

China-Europe containers via the route ballooned 25-fold in 2024; tariffs converged to $2,500-3,250 per forty-foot equivalent unit (FEU) container, nearing Northern parity of $3,000-3,500, with transit times of 14-20 days undercutting sea routes around Africa’s Cape of Good Hope.

World Bank models forecast 11 million tonnes by 2030, triple current levels, driven by $3-4 billion in needed upgrades—836 km Dostyk-Mointy double-tracking to quintuple capacity by 2025, two Caspian ferries, single-track Baku-Tbilisi-Kars (BTK) expansion, and a proposed Trans-Caspian Development Bank pooling $18.5 billion from the European Bank for Reconstruction and Development (EBRD).

The EU’s €10-12 billion Global Gateway launched a 2025 Central Asia transit programme and Turkmen green energy ties, targeting <15-day Europe-Central Asia links via its Trans-Caspian Coordination Platform, unveiled in October 2025.

Central Asian economies stand as primary beneficiaries, their post-Soviet centrality morphing into a strategic asset. Kazakhstan, the corridor’s backbone, has rerouted 64% of westbound uranium exports and 1.4 million tonnes of 2024 crude through Baku-Tbilisi-Ceyhan pipelines, bypassing Russian conduits for $2-3 billion in annual revenues; its $17.2 billion summit haul—7% of 2024 GDP—includes Wabtec locomotives and tungsten plants directly feeding the route. Uzbekistan’s Boeing and auto deals modernise transport nodes, while Tajikistan’s AI data centres, powered by 1 GW of hydropower, position Dushanbe as a digital export hub. Kyrgyzstan’s rail pacts and Turkmenistan’s gas liberalisation unlock smaller but pivotal flows. Collectively, corridor synergies could boost regional GDP by 3.9% in 2024 and 4.8% in 2025, per World Bank estimates, with non-oil trade shares rising 60% in Armenia and Georgia by 2022.

C5+1 Summit is a multilateral format launched in 2015 to advance U.S. cooperation with the five Central Asian republics on economic, energy, and security fronts. The November 6 summit was built on the 2024 Inaugural C5+1 Critical Minerals Dialogue and Kazakhstan’s late-October $1 billion rare-earth financing programme, positioning the region—rich in tungsten, uranium, and hydrocarbons—as a counterweight to Beijing’s 80% global processing monopoly amid Trump’s Asia-Pacific mineral diplomacy with Australia, Malaysia, Thailand, and Japan. Tajikistan’s hydropower-backed AI hubs and Uzbekistan’s coal-to-chemicals acceleration integrate digital and energy grids into the corridor, while the ‘Trump Route for International Peace and Prosperity (TRIPP)’—a 99-year U.S. concession through the Armenia-Azerbaijan peace-enabled Zangezur Corridor—looms as a southern bypass for 15 million tonnes annually, evading Russian and Iranian chokepoints and leveraging Ankara’s Organisation of Turkic States (OTS), which counts four C5 nations as members (Turkmenistan observer). Kazakhstan’s Abraham Accords accession, the first in Trump’s second term, weaves Middle Eastern normalisation into Eurasian flows, opening Iowa soybeans to Uzbek markets and Gulf solar investments along the route.

Moscow’s reaction, as of November 9, 2025, remains officially muted, with no direct Kremlin statement on the summit despite its recency—Kremlin spokesman Dmitry Peskov’s November 7 briefing focused on denying rumors of Foreign Minister Sergey Lavrov’s disfavor over a separate canceled U.S.-Russia Budapest summit, insisting “there is nothing true in these reports” and affirming Lavrov’s continued role. Pro-Kremlin outlets like Pravda EN vented sharper ire, labelling Central Asian leaders’ Trump engagement “disgusting licking” and the event a U.S. stab at Russia’s “underbelly,” while Lavrov, speaking in Tashkent post-summit, decried “external interference” in the “common Eurasian home.” The Eurasian Economic Union (EAEU) funnels $45 billion in yearly trade, and the Collective Security Treaty Organization (CSTO) binds Kazakhstan, Kyrgyzstan, and Tajikistan militarily, but strains show: Kazakhstan’s sole CSTO invocation came during 2022 unrest, followed by 64% of uranium exports and 1.4 million tonnes of 2024 crude rerouted via Baku, bypassing Russian pipelines for $2-3 billion in added revenue. Remittances from 16 million Central Asian migrants in Russia—$16.1 billion to Kazakhstan in 2023—linger as leverage, alongside the 7,000-troop 201st Division in Tajikistan and a Kyrgyz airbase, yet Northern Corridor traffic has cratered 40-50% since 2022, with American locomotives now rolling on non-Russian gauge tracks. A Ukraine ceasefire might rebound those volumes, but for now, state media dismisses Boeing influxes as “temporary hype” against Central Asia’s “organic” Moscow tilt, even as independent analysts concede the shift.

Geopolitically, the U.S. manoeuvre capitalises on converging frailties. Russia’s Ukraine fixation has pared regional forces to those Tajik and Kyrgyz holdouts, while China’s $89 billion 2023 trade and $24.3 billion Belt and Road Initiative (BRI) outlays by mid-2025—capped by Xi Jinping’s $209 million Astana Summit grant—confront debt backlash, with Tajikistan owing Beijing half its external load and Kyrgyzstan 40%. Washington’s non-coercive model—no bases sought, no reform strings beyond anti-cartel intelligence swaps—contrasts sharply, amplified by the EU’s $10.8 billion Global Gateway and Japan’s $3 billion digital infusions outpacing Russia’s $2 billion aid. Azerbaijan’s 130% Q1 2023 container leap to 8,696 and Georgia’s 71% early-2025 surge spotlight corridor pull, with TRIPP’s Zangezur promise of 99-year U.S. rights to a southern evade. Human Rights Watch warns of repression risks—Rahmon’s 30-year Tajik reign, Berdimuhamedov’s Turkmen dynasty—as investor red flags, though fact sheets spotlight prosperity over backsliding; preparatory choreography, from Deputy Secretary Christopher Landau’s Kazakhstan-Uzbekistan tour to Secretary Marco Rubio’s November 5 ministers’ dinner, underscores premeditation. Uzbekistan seeks expanded U.S. educational exchanges for its tech-savvy youth, aligning with Washington’s regional integration push.

Historical context illuminates this pivot’s roots. U.S. ties dawned with December 1991 independence recognition and $1.2 billion in 1990s Freedom Support Act aid to blunt 20-60% GDP nosedives and Tajikistan’s 1992-1997 civil war. Caspian energy beckoned U.S. firms in the 1990s, sparking Russian pipeline clashes, but Middle East distractions kept engagement marginal. Post-9/11, security bloomed: Uzbekistan’s Karshi-Khanabad (K2) base (2001-2005, axed after Andijan rights rebuke), Kyrgyzstan’s Manas Transit Centre (2001-2014), Kazakh overflights, and Tajik rail for 40,000 rotations. $79 million in Foreign Military Sales (FMS), $3-5 million yearly border financing per nation, and $16.2 million Global Peace Operations Initiative (GPOI) backed UN forays; Steppe Eagle exercises honed 300 Kazakh Iraq peacekeepers; stockpile cuts tallied $22 million since 2006; National Guard pairings endured—Arizona-Kazakhstan (1998), Montana-Kyrgyzstan (1995), Virginia-Tajikistan (2002), Nevada-Turkmenistan (1996-2011, revival floated), Mississippi-Uzbekistan (2012). Afghan drawdown by 2014 shuttered bases amid parliamentary ire, birthing C5+1’s economic pivot—$1.2 billion cumulative trade by 2020 versus China’s $40 billion—augmented by 2023 New York’s cybersecurity and migration adds, though Uzbekistan’s 2016 thaw and Kazakhstan’s post-2022 tweaks revived reciprocity.

The economic overhaul is foundational. Kazakhstan’s $17.2 billion haul—7% of 2024 GDP—modernizes via Leidos and Cerberus; Uzbekistan’s Boeing and auto/auto parts pacts refresh a 60% Soviet fleet, buoying GM’s Tashkent plant and methanol-to-olefins; Tajikistan’s aviation/AI electrifies 25% mining GDP from 1990s tech; Kyrgyzstan’s bond/rail triples throughput; Turkmenistan’s gas nods unlock flows. U.S. export heft—thousands of jobs from Wabtec, John Deere, Coca-Cola—bolsters homefront support, with first-half 2026 trade eyed at $12.4 billion, tripling 2024, and World Bank pegging 3.9% regional GDP lift in 2024, 4.8% in 2025 en route to 11 million-tonne ‘Middle Corridor’ capacity by 2030. A November 4 State-Kennedy Center conference, USAID-tied to Uzbek horticulture cuts on post-harvest losses for multimillion-dollar exports and low-emission Central Asian Regional Energy Market ties, wove cultural-economic threads. As Mirziyoyev toasted Trump, “president of the world,” and floated a permanent secretariat, the affair outgrew deals.

Risks cloud the vista. Caspian ferries (just two) and single-track BTK cap 5 million tonnes, craving $3-4 billion upgrades; Chinese debt imperils Tajik/Kyrgyz defaults; authoritarianism—Uzbek visa-free amid crackdowns—may chill capital; Congress, haunted by 2005 base ejections, craves rights benchmarks; Houthi Red Sea chaos or Hormuz/Iran pipeline sabotage could shunt sea traffic, eroding tariffs near Northern parity. Environmental NGOs probe emissions, and a Ukraine truce might flood Northern lanes anew.

For multi-vector capitals, three decades of Moscow-Beijing balance now absorbs Washington, tilting west. If $100 billion yields rails, reactors, humming hubs, it forges bonds; else, it fades like past flares. Leaders jetted home on fresh Boeings, contracts clutched, steppe stirring with diversified dawns—and a softening Soviet spectre.

– global bihari bureau