Geneva: Merchandise trade volume is likely to gradually revert towards its medium-term trend in the second half of 2023, although uncertainty remains high due to mixed economic data and rising geopolitical tensions, according to the World Trade Organization. It said today that trade statistics for the third quarter should come in slightly stronger thanks to faster GDP growth in the United States and China, even as the European Union economy continued to stagnate.

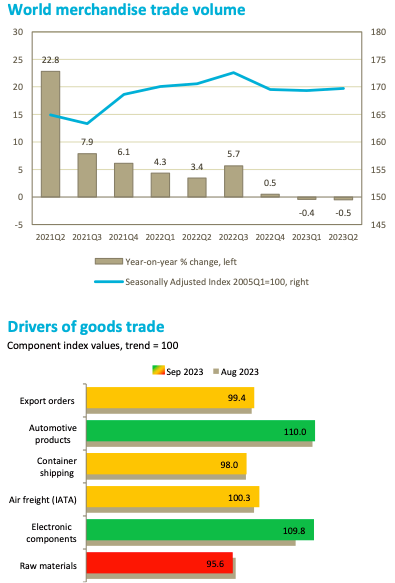

World merchandise trade volume was flat in the second quarter of 2023, up 0.2% compared to the previous quarter but still down 0.5% year-on-year. However, year-on-year trade growth is likely to be strong in Q4 in any case due to the slump that began in the same period last year.

World merchandise trade volume was flat in the second quarter of 2023, up 0.2% compared to the previous quarter but still down 0.5% year-on-year. However, year-on-year trade growth is likely to be strong in Q4 in any case due to the slump that began in the same period last year.

The WTO said these developments are consistent with the WTO’s forecast of October 5, 2023, which foresaw an 0.8% increase in global trade volume in 2023. While the forecast remains unchanged, risks to the trade outlook have shifted towards the downside in light of recent developments in the Middle East.

The latest quarterly WTO Goods Trade Barometer issued today indicates that the volume of global merchandise trade is recovering after its recent slump, with automobile sales and production and electronic components trade driving the recovery. However, mixed economic results coupled with increasing geopolitical tensions make the near-term outlook highly uncertain.

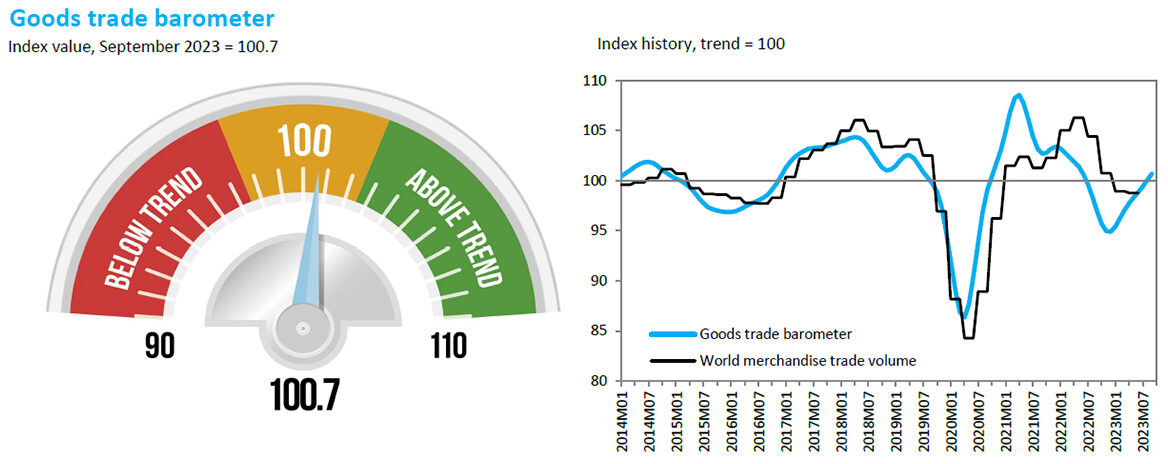

The Goods Trade Barometer is a composite leading indicator for world trade, providing an early indication of the trajectory of merchandise trade relative to recent trends. The current value of 100.7 for the barometer index (represented by the blue line above) is above the latest reading for quarterly trade volume (represented by the black line) and close to the baseline value of 100. This suggests that merchandise trade volume will gradually revert towards its medium-term trend in the second half of 2023.

The barometer’s component indices are mixed, with some rising firmly above trend and others remaining on or below trend. The biggest gains were seen in the indices for automobile sales and production (110.0) and electronic components trade (109.8). The indices for air freight (100.3), export orders (99.4) and container shipping (98.0) finished on or slightly below trend, while the raw materials index (95.6) sank below trend. The strength of the automotive products and electronic components indices may be explained by surging global demand for electric vehicles, while the weak result for raw materials may be partly due to weakening property markets as interest rates remain elevated.

– global bihari bureau