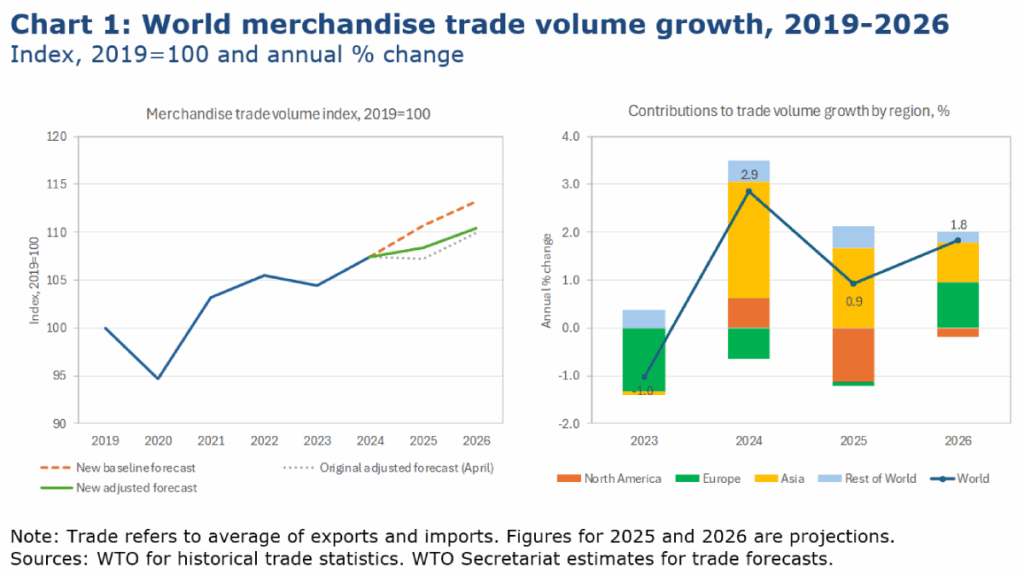

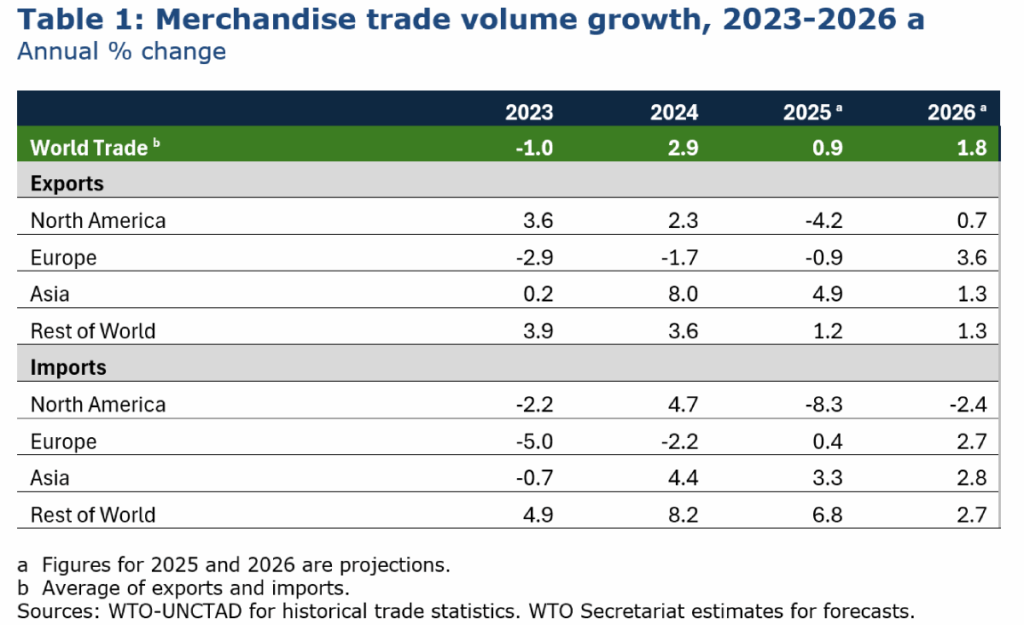

Geneva: Frontloading and measured responses are cushioning the impact of new US tariffs on global trade in 2025, but risks loom large for 2026, the World Trade Organization (WTO) announced in its updated Global Trade Outlook and Statistics released on August 8. World merchandise trade, encompassing goods such as electronics, steel, and textiles, is now projected to grow 0.9% in 2025, up from the -0.2% contraction forecasted in April but down from the 2.7% estimate pre-dating the tariff increases. The upgrade is mostly due to frontloading of imports in the United States, WTO economists said. However, higher tariffs over time will weigh on trade, bringing next year’s expected trade volume growth down to 1.8% from 2.5%. A surge of imports in the United States in the first quarter, ahead of widely anticipated tariff hikes, contributed to the upward revision to the 2025 forecast issued in the April Global Trade Outlook and Statistics report. Increased tariffs—including those that took effect this week—will dampen trade in the second half of 2025 and in 2026.

The US triggered this shift by imposing higher tariffs, prompting businesses to frontload imports—accelerating purchases to avoid future cost increases. US imports surged 11% year-on-year in volume terms in the first half of 2025, with a sharp 14% quarter-on-quarter increase in Q1, followed by a 16% drop in Q2 on a seasonally adjusted basis. This frontloading, coupled with inventory accumulation, temporarily boosts the 2025 trade outlook but is expected to result in lower import demand in the second half of 2025, with some correction occurring only in 2026 and beyond. The WTO notes that a similar, though less extreme, pattern is observed in imports of other countries, possibly driven by fears of retaliation.

“Global trade has shown resilience in the face of persistent shocks, including recent tariff hikes,” said WTO Director-General Ngozi Okonjo-Iweala. “Frontloaded imports and improved macroeconomic conditions have provided a modest lift to the 2025 outlook. However, the full impact of recent tariff measures is still unfolding. The shadow of tariff uncertainty continues to weigh heavily on business confidence, investment and supply chains. Uncertainty remains one of the most disruptive forces in the global trading environment.” She emphasised, “Nevertheless, it is important that a broader cycle of tit-for-tat retaliation that could be very damaging to global trade has so far been avoided. The WTO Secretariat will continue to monitor developments closely, including further work on the impact of the latest tariff measures on the share of global trade conducted under Most Favoured Nation (MFN) principles. Work will also continue with members to safeguard the stability and predictability so essential to the world’s trading system.”

The 0.9% growth forecast for 2025 is driven by two positive factors and one negative. First, the US import surge and inventory accumulation are the primary contributors, providing the most significant lift to the outlook. Second, a more favourable global macroeconomic climate supports trade growth, with the depreciation of the US dollar against other currencies easing financial conditions for developing economies and falling oil prices supporting growth in manufacturing economies, while simultaneously reducing import demand in oil-producing regions. Third, recent tariff changes have a net negative impact compared to the April forecast. On the one hand, the US-China truce and exemptions for motor vehicles contribute positively; on the other hand, higher “reciprocal” tariff rates introduced on August 7 are expected to weigh increasingly on imports in the United States and depress exports of its trading partners in the second half of 2025 and in 2026.

Regional trade contributions vary significantly. Asian economies are projected to remain the largest positive driver of world merchandise trade volume growth in 2025, with exports rising 4.9%, up from 1.6% in the April forecast, though their contribution in 2026 will be smaller than predicted in April. North America will weigh negatively on global trade growth in both 2025 and 2026, but its negative impact in 2025 will be smaller than previously estimated, with imports declining 8.3%, less than the 9.6% drop foreseen in April, and exports falling 4.2%. Europe’s contribution to trade in 2025 has shifted from moderately positive to slightly negative, with exports contracting by 0.9% and imports growing by 0.4%, slightly weaker than predicted in April (1.0% exports, 1.9% imports). Other regions, including economies whose exports are largely energy products, will see their positive contribution to trade growth shrink between 2025 and 2026 as lower oil prices reduce export revenues and dampen import demand.

The -0.2% projected trade contraction for 2025 in the April forecast was based on measures in place at that time (14 April), including the suspension of “reciprocal” tariffs by the United States. Subsequent US agreements with China and the United Kingdom raised the forecast for the year to 0.3%, but higher tariffs on steel and aluminium later brought it back down to 0.1%. The current 0.9% growth forecast reflects the positive tailwinds from frontloading, inventory accumulation, and an improved macroeconomic climate, balanced against the negative impact of tariffs. The WTO remains committed to monitoring these developments and working with members to mitigate risks, as tariffs pose increasing challenges for global trade stability in 2026.

– global bihari bureau