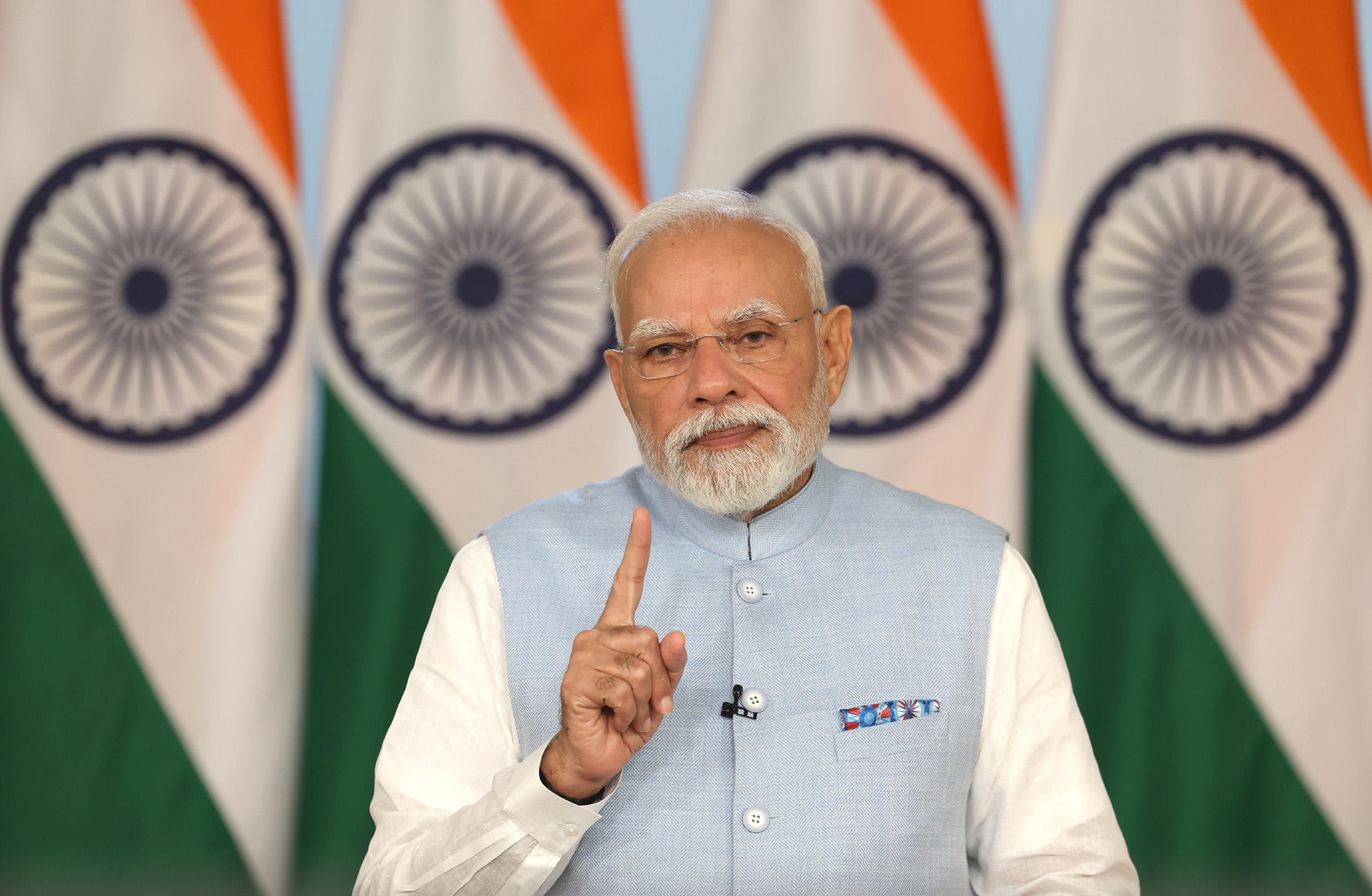

Prime Minister Narendra Modi addressing the nation on the new GST reforms via video message on September on 21, 2024.

GST Revamp: Modi’s Navratri Boost for India

New Delhi: On the eve of Navratri, Prime Minister Narendra Modi addressed the nation, announcing the rollout of next-generation Goods and Services Tax (GST) reforms, effective from September 22, 2025. Describing the initiative as a “savings festival,” Modi outlined how the simplified tax structure would reduce costs for citizens, streamline business operations, and support India’s goal of becoming self-reliant. The announcement, delivered ahead of the festive season, aims to benefit diverse sections of society, including farmers, youth, women, shopkeepers, entrepreneurs, and the neo-middle class.

The timing of the address holds added resonance, coinciding with the effective date of a major US policy shift on H-1B visas, which comes into force on September 21, following President Donald Trump’s executive order signed on September 19. The order imposes a one-time $100,000 fee on new H-1B visa applications for skilled foreign workers, primarily impacting Indian professionals who account for over 70% of approvals in recent years. While clarifications from the White House indicate the fee applies only to new petitions and not renewals or existing holders, the move has triggered widespread anxiety in India’s IT sector, with companies like Microsoft and Amazon issuing urgent advisories for employees to return to the US before the deadline. Trade bodies such as Nasscom have voiced concerns over the short notice, warning of disruptions to families and businesses, even as the Indian government studies the full implications. This development, set against Modi’s domestic push for self-reliance, underscores broader tensions in global talent mobility, potentially accelerating a return of skilled workers to India’s manufacturing and tech hubs.

Also read: H-1B Visa Overhaul: What Indian Professionals Must Know

The Prime Minister extended Navratri greetings, linking the festival’s cultural significance to the economic reforms. The new GST framework reduces tax slabs to 5% and 18%, with most daily essentials—food, medicines, soap, toothpaste, and health and life insurance—either exempt from tax or placed in the 5% bracket. Nearly 99% of items previously taxed at 12% will now fall under the 5% slab, a move intended to make everyday goods more affordable. Modi emphasized that these changes would enhance purchasing power, particularly for the poor, middle class, and neo-middle class, while boosting economic growth and attracting investment.

Recalling the pre-GST era, Modi described the challenges of a fragmented tax system, with octroi, entry tax, sales tax, excise, VAT, and service tax creating a complex web for businesses and consumers. He cited a 2014 foreign media report about a company finding it easier to ship goods from Bengaluru to Europe and back to Hyderabad than directly within India, due to multiple checkpoints and paperwork. The 2017 GST reform, he said, unified the nation under “One Nation, One Tax,” and the new reforms build on this by addressing current economic needs and simplifying compliance further.

Modi highlighted India’s socio-economic progress, noting that 25 crore people have moved out of poverty over the past 11 years, forming a neo-middle class with growing aspirations. He connected the GST reforms to recent income tax exemptions up to ₹12 lakh, stating that the combined relief would save citizens over ₹2.5 lakh crore annually. Reduced GST rates, he added, would lower the cost of consumer goods like TVs, refrigerators, scooters, and cars, as well as hotel stays, making travel more affordable. These measures, he argued, would empower citizens to fulfil their dreams.

The Prime Minister also addressed Micro, Small, and Medium Enterprises (MSMEs), emphasizing their role in India’s self-reliance. Lower tax rates and simplified procedures would reduce their burden and boost sales, he said, urging MSMEs to produce world-class goods to enhance India’s global reputation. He called for a renewed focus on *swadeshi* (indigenous) products, encouraging citizens to buy “Made in India” goods and make every home and shop a symbol of self-reliance. Modi urged state governments to promote manufacturing and create investor-friendly environments to support this vision.

The announcement has generated cautious optimism, with shopkeepers reportedly displaying “before and after” price boards to highlight savings for consumers. However, the success of these reforms hinges on effective implementation and clear communication, given past challenges with GST rollouts, particularly for small businesses. While the simplified tax slabs and focus on affordability are welcome, their impact on household budgets and economic growth will only become clear with time. As India enters the festive season, the nation awaits the tangible outcomes of this ambitious economic reset, even as external pressures like the H-1B changes test the resilience of its global workforce ambitions.

– global bihari bureau