Record Tariff Wave Meets Parallel Drive to Ease Trade

Global Trade Split Between Protection And Facilitation

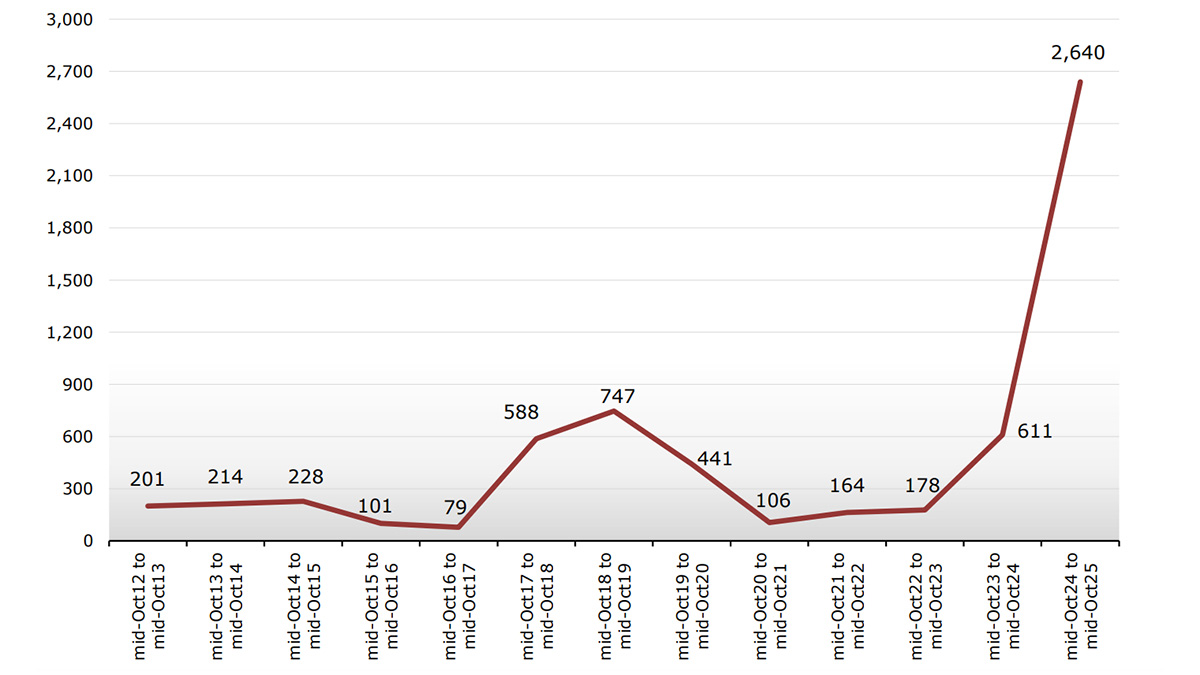

Geneva: Global trade has entered a contradictory phase in which governments are raising barriers at a record pace while simultaneously claiming commitment to cooperation and facilitation. The World Trade Organization’s latest annual overview of developments in the international trading environment shows that the value of global goods imports hit by new tariffs and other import-restricting measures surged more than fourfold between mid-October 2024 and mid-October 2025 compared with the previous year. The trade coverage affected by these measures is now the highest recorded since WTO monitoring began in 2009, exceeding even the elevated levels registered in the preceding reporting cycle. Yet the same period saw WTO members introduce a far larger set of measures intended to ease trade flows rather than obstruct them, covering around one-and-a-half times more trade than in the prior year. Officials continue to maintain that governments are still engaging more in dialogue than retaliation, even as the statistical weight of restrictions climbs.

The value of global imports affected by newly imposed tariffs and related restrictive measures is estimated at US$2.64 trillion, representing roughly 11.1 per cent of global goods imports. A year earlier, the corresponding value was near US$611 billion. When both import and export restrictions are combined, the total trade affected stands at around US $2.966 trillion, more than triple the previous monitoring period. These are not marginal adjustments; they mark sweeping state intervention in international commerce, reshaping sourcing decisions, shipping routes, and industrial supply chains in ways that businesses have little time to adapt to.

The value of global imports affected by newly imposed tariffs and related restrictive measures is estimated at US$2.64 trillion, representing roughly 11.1 per cent of global goods imports. A year earlier, the corresponding value was near US$611 billion. When both import and export restrictions are combined, the total trade affected stands at around US $2.966 trillion, more than triple the previous monitoring period. These are not marginal adjustments; they mark sweeping state intervention in international commerce, reshaping sourcing decisions, shipping routes, and industrial supply chains in ways that businesses have little time to adapt to.

Despite this, a sharp increase in trade-facilitating actions runs in parallel. WTO members introduced 331 new measures intended to ease trade in goods — estimated to cover roughly US $2.09 trillion in trade — about 1.5 times the volume recorded in the prior review. In services, governments registered 124 policy shifts, most described as easing regulatory requirements linked to establishment abroad and the temporary movement of professionals. The duality remains clear: governments are ring-fencing sectors deemed sensitive while creating pathways for commercial flows where these align with domestic industrial, technological and geopolitical priorities.

Trade remedies remain a heavily used lever. Anti-dumping duties, countervailing measures and safeguards accounted for a large share of the interventions tracked. Members launched an average of 32.3 new investigations per month, while terminations of such measures stayed near their lowest point since 2012, about 11.4 per month. Companies have learned that once a protectionist measure is imposed, it is unlikely to be reversed quickly; it becomes part of the policy landscape rather than a temporary shock absorber.

The Secretariat’s forecast for global merchandise trade growth retains a cautious optimism — 2.4 per cent growth projected for 2025, slowing to about 0.5 per cent in 2026. Stronger-than-expected figures from the first half of 2025 are partly attributed to “front-loading” by importers anticipating future barriers and partly to surging demand for goods tied to artificial intelligence. Such demand may sustain high-tech segments of world trade but does not fully offset the broader friction created by proliferating interventions, particularly in sectors where governments treat supply chains as national assets rather than commercial networks.

Another structural shift running through the report concerns the rising use of general economic support measures, particularly those delivered through regulatory rather than fiscal channels. Governments are widening the use of domestic-content rules, procurement conditions and sector-specific standards as tools of industrial strategy, especially in energy, agriculture and environment-linked technologies. These non-financial instruments are more opaque than subsidies, more resistant to monitoring, and more likely to embed advantages for domestic producers in long-term regulatory architecture. The multilateral system, designed for tariff transparency and negotiated disciplines, has limited recourse against such measures beyond prolonged committee challenges and persistent diplomatic pressure.

Committees remained busy. Members filed concerns, challenged one another’s measures and demanded clarifications. The Secretariat’s monitoring document — compiled under the Trade Policy Review Mechanism — serves less as a verdict and more as an evidence ledger of where states are clashing over trade. The forum rarely forces rapid correction; instead, it creates a record that trading partners return to repeatedly as long as the disputes endure.

The Director-General’s remarks accompanying the report acknowledged the heightened surge in protectionism but placed it in an aspirational frame: governments should seize the present disruption to address grievances linked to unilateral trade policies and to “fast-forward” long-discussed reforms of the trading system so that members can capture emerging growth opportunities rather than remain trapped in retaliatory cycles. Whether major economies are prepared to shift from documenting disagreements to resolving them is a question Geneva cannot answer on its own.

The cumulative lesson from the latest monitoring cycle is that the multilateral trading system is being pulled in opposing directions. Barriers and facilitators are rising together, but not in the same sectors, not affecting the same countries, and not serving the same priorities. For exporters and supply chains, that means the global trading environment has become more unpredictable and more politically conditioned. For the WTO, it means that documenting the tension is easier than defusing it — and that the direction of global trade policy will be determined not by the existence of multilateral rules but by whether governments decide to stop treating exceptions as the rule.

– global bihari bureau