By Dr Samar Verma*

By Dr Samar Verma*

From US Shock to UK Win: Reviving Indian Apparel

If you work in India’s textile and apparel hubs, August 27 wasn’t just another date on the calendar. That’s when the United States raised duties on most Indian imports to as much as 50%, explicitly targeting sectors like garments, gems and jewellery, and seafood. Multiple reports confirm the move, and the government has since opened talks to de-escalate—while also shoring up exporters’ credit and nudging diversification.

Crisis, though, is also a forcing function. In the same quarter, India signed a UK–India Free Trade Agreement (FTA) that, once in force, eliminates UK tariffs on the vast majority of Indian goods—including textiles. The United Kingdom Parliament’s library notes that the treaty is signed but not yet in force, pending statutory scrutiny; New Delhi has already approved it. Businesses on both sides are preparing for rollout.

And at home, the GST Council’s “Goods and Services Tax (GST) 2.0” reset—effective 22 September 2025—fixes the long-criticised inverted duty structure in man-made fibres (MMF) by cutting GST on MMF fibre from 18% to 5% and on MMF yarn from 12% to 5%, alongside a broader two-rate simplification (5% and 18%). The Finance Ministry/CBIC have issued the notifications and begun price-pass-through monitoring.

Put plainly: a U.S. shock has collided with two big tailwinds—a UK market-access win and a domestic tax fix. Whether this becomes a setback or a springboard for the Indian textile industry depends on three levers we can control: price, time, and standards.

Price: The MMF tax wedge is finally being removed

Global fashion is overwhelmingly synthetic. India’s problem for years was policy-priced MMF: higher GST upstream and input-stage Quality Control Orders (QCOs) pushed domestic polyester/viscose costs above rivals, dulling any external tariff advantage. GST 2.0 changes that arithmetic: cutting fibre and yarn rates to 5% should unlock input-tax credits and lower ex-factory quotes in MMF-rich categories (athleisure, outerwear, uniforms). The reform is on the books and in effect.

Two caveats keep this realistic. First, QCOs on inputs still need right-sizing: industry has asked New Delhi to rationalise or defer specific orders (e.g., viscose fibre), while the government has deferred the new QCO on textile machinery to 2026—a useful precedent for sequencing. The policy direction is constructive, but exporters will judge by delivered input prices and variety.

Second, we should track prices, not just rates. The Finance Ministry has instructed CGST formations to monitor MRP pass-through after the rate cuts; similar watchdogging for export offer prices would ensure the GST relief lands in FOB, not just margins.

Bottom line: with MMF inversion corrected and the UK set to zero tariffs on our garments at entry-into-force, India’s delivered price should improve—provided QCO frictions are managed and credit flows.

Time: shave the weeks buyers can’t afford

Even before the U.S. tariffs, India’s apparel cycle time (order placement → delivery) lagged Bangladesh by roughly two weeks. That is what costs replenishment orders. The practical fixes remain the same: replace pre-shipment inspections (PSI) with risk-based self-declarations, align DGFT–Customs data, and run 24×7 clearances at ports/ICDs. The good news is that PM MITRA parks are moving from announcements to ground—for example, Dhar (Madhya Pradesh) has launched parallel development of common infrastructure (CETP, steam, housing) and unit construction, with dozens of investors queued up. Integrated parks make “distance ≠ delay”.

What to watch: an operational performance that compresses cycle time toward ≤50 days in major clusters during FY26. This is achievable with the regulatory clean-up and integrated parks now underway. (States pushing faster commissioning—Madhya Pradesh, Telangana—will set the tempo.)

Standards: the EU’s rules won’t wait for us

The EU’s Ecodesign for Sustainable Products Regulation (ESPR) has now published its 2025–2030 working plan with textiles among the first priority product groups. This feeds directly into the Digital Product Passport (DPP)—a product-level data requirement—and into textile EPR rules Parliament adopted this month to curb waste. In practice, brands selling into the EU from 2027 will need machine-readable product data on origin, composition, and environmental performance. This is no longer speculative; it’s timetabled.

For India, two moves are low-cost, high-impact. First, set up a Textiles Data Stack / Digital Exporter Dossier so MSMEs enter once, reuse everywhere (customs, buyers, audits). Second, hard-wire mutual recognition/data-equivalence annexes into FTAs (the UK deal is signed; an EU pact would compound the benefit) so the same digital dossier clears multiple gates.

Having written that, diversifying smartly while defending the U.S. should be an important pillar of our strategy. The U.S. will remain a critical market; some Indian categories will stay competitive even at elevated tariffs. But exporters also need optionality. The UK FTA—signed on 24 July 2025 and awaiting UK parliamentary procedures—offers duty-free entry for most Indian goods, including textiles, and the government is already holding outreach sessions to brief firms. Export finance is gearing up too: EXIM Bank has expanded credit lines and risk limits to help pivot to Africa and other growth markets while U.S. tariffs bite.

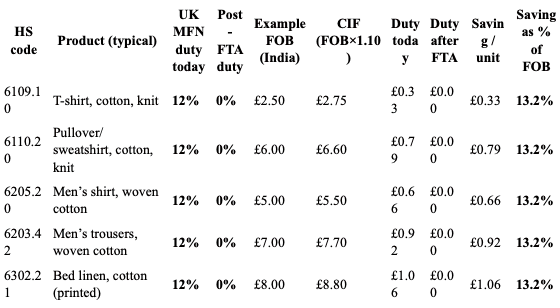

[Illustrative duty savings for a UK buyer importing from India; assumes freight + insurance = 10% of FOB; VAT ignored because UK VAT-registered importers reclaim input VAT- Actual may vary]

BRICS, pragmatically used, is about plumbing—payments interoperability (UAE as a hub), cotton security (Brazil), and logistics adjacency (Egypt/Ethiopia). It will not conjure preferences, but it reduces frictions and financing costs while we monetise the UK deal and pursue EU access. (And yes, all of this must respect sanctions rules.)

What then should be our policy priorities?

Land the price pass-through: with GST 2.0 in force, publish MMF price dashboards (PSF/VSF vs global benchmarks) so buyers see the wedge closing. Use auto-ITC refunds and export-order prioritisation for fibre/yarn to keep cash moving.

Finish the border clean-up: formalise risk-based PSIC alternatives and 24×7 clearance for top gateways. This is the cheapest way to win back replenishment programs in FY26.

Operationalise the UK deal: issue sectoral “route-to-zero” notes for apparel (HS chapters, rules of origin, cumulation, DPP readiness) so MSMEs can quote lower landed prices on day one of entry-into-force.

De-risk QCOs: keep safety-critical orders, but downstream enforcement where quality truly matters; use time-bound exemptions for export production if upstream friction resurfaces. Recent textile-machinery QCO deferral to 2026 shows pragmatic sequencing is possible.

Make PM MITRA deliver speed, not just land: prioritise CETP/steam, common labs, and worker housing; measure success by cycle-time reduction and buyer retention.

The larger truth is now more evident than ever. Tariffs are politics by other means. Our reply must be the economics of better plumbing. In the next year, GST 2.0 + UK FTA + border reform + integrated parks can convert a U.S. shock into a competitiveness upgrade. Do that, and the three variables that actually win purchase orders—delivered price, speed, and standards compliance—will mark a decisive step to Atmanirbhar Bharat.

*Samar Verma is an economist and public policy professional. He has worked in a leading textile company in Ahmedabad and published research papers on WTO & Textiles for think tanks and international agencies. This article is an early version of the talk the author is invited to deliver at the International Textile Conference (Intexcon2025) in Ahmedabad in October 2025.