Stock Watch

![]() By Amit Sinha*

By Amit Sinha*

Weekly Analysis, Insights and Forecast – Technical

29 May 2023 – 02 June 2023

Indian Indices – Nifty 50 and Nifty Bank are heading for an “All Time High” (ATH) after they hit the peak in December 2022. This may happen on Monday, May 29, 2023, or anytime in this coming trading week.

Top reasons for markets touching ATH (ALL-TIME HIGHs)

The Nifty 50 index this week has risen 1.6% with positive global cues. The upward trajectory has breached the 18,500 mark for the first time in 2023. The investors have turned richer by ₹2.2 lakh crore amid broad-based buying.

The four main reasons behind the upswing in Indian Stock Market are as follows

1. FII boom

Foreign Institutional Investors bought shares worth ₹20,256 crore in May. This was followed in March and April wherein they had bought shares worth ₹1,997 crore and ₹5,711 crore, respectively. We see the trend of money returning to India, which was once directed to China on their so-called China growth story of China+1.

2. Indian companies are earning more

The strong earnings performance of Indian companies in the March quarter has also fuelled the growth. Leading sectors have been Banks, Automobiles, FMCG and Infrastructure in Q4FY23. We expect the next quarter to be more robust as inflation keeps in line with R.B.I’s expectations. The Reserve Bank of India had already taken a pause on raising the repo rate last month, which is the first by any country as of now. Other countries like the USA, the U.K., Germany, and Australia have kept on raising the interest rates as latest till last month, still reeling under higher inflation and not being able to contain at the stipulated levels.

3. Bouyant IT sector

The positive progress in US debt ceiling talks, with the Congress aligned with raising the debt ceiling has provided a boost to Indian IT companies as well. IT companies have been a laggard till last month as a lot of US jobs in services were halted for Indian IT companies due to banking issues in the US and inflation worries. Now we are seeing traction returning in the IT sector in India and this will lead to short covering in IT stocks.

4. Retail inflation hits a low

In India, the retail inflation rate has eased to an 18-month low of 4.7% in April. Prices of commodities like Crude oil may further decline on fear of a global recession and slow growth projection in the Chinese economy. Low prices would lead to more demand and further boost the economy.

The positive sentiments seem to be buoyant in Indian markets presently and are most likely to continue further until we witness some negative geo-political situations and any turmoil in the US economy.

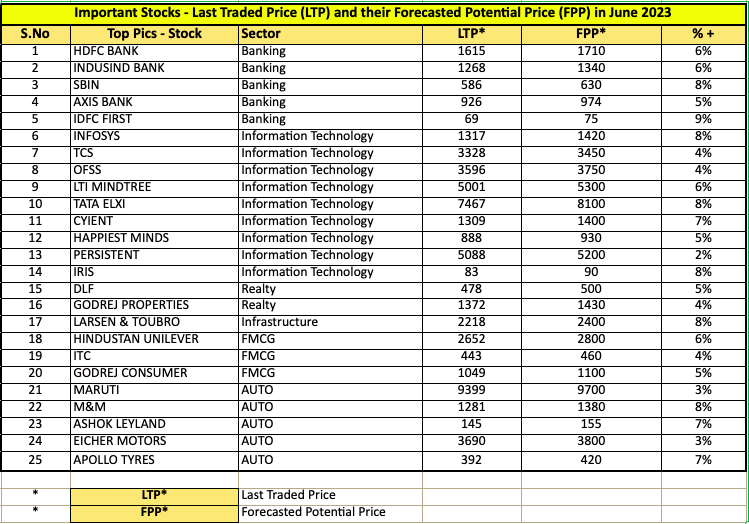

However, to drive the momentum upward and to keep the buoyancy, it’s imperative that the following top stocks in their respective sectors keep the demand high for buying. Analysts are tracking the following stocks (See the table) that they believe will determine further upwards movement. A lot will depend on their daily trade levels and closing positions.

Spotlight stocks (not a buy or sell recommendation)

As of the day trade closing last Friday May 26, 2023, the top indices status closed at:

- Nifty 50 closed at 18,499 and the ATH is 18,887.60

- Bank Nifty closed at 44,018 and the ATH is 44,151.70

Present and all-time high levels of NIFTY50 during the week

Present and all-time high levels of NIFTY Bank during the week

A lot of positive sentiments is driving the Indian stock market to scale up and maintain at higher levels and any possibility of short sellers trying to short the market is immediately being bought by FIIs and DIIs. As per data, the buying by FIIs in the month of May 2023 is: 20,256 crore.

World Economic Forum (WEF) President Borge Brende is very optimistic about India’s growth story and during his visit to India last week, he said, “Some countries overspent on stimulus, that there is no ammunition left. India was not in debt itself, of course, it came up with stimulus but Prime Minister Narendra Modi was able to hold back whereas some countries are in debt trap”.

This year, WEF is expecting India to achieve 6 per cent economic growth -purportedly the highest growth for any big economy in the world.

As per the International Market Assessment India’s 2023 Global Operations Benchmarking Survey, India is well poised to beat China as the top destination of multinational corporations.

In the United States, at Wall Street, the Dow Jones Industrial Average (.DJI) ended a five-day losing streak, while the Nasdaq Composite Index (.IXIC) and S&P 500 (.SPX) closed at their highest levels since August 2022, with the S&P 500 above 4,200 points.

Wall Street has spiked up after the cooling down of the issues of the US Debt Ceiling and the Federal Reserve’s expected interest rate hike in June 2023. These were the two main reasons for the earlier slowdown. As for US Debt Ceiling, President Joe Biden and House Speaker Kevin McCarthy reached an agreement in principle to raise the nation’s legal debt ceiling late on Saturday (May 27) as they raced to strike a deal to limit federal spending and avert a potentially disastrous U.S. default.

With regards to the Federal Reserve’s potential interest rate hike in June 2023, the investors now expect the Federal Reserve to take a breather at its June 13-14 confab after ten consecutive meetings with rate hikes. The Federal Open Market Committee (FOMC) makes the big monetary policy decisions for the Fed. In June, the committee is most likely to leave the federal funds target rate unchanged for the first time since early 2022. There is also little chance that the FOMC will change its policy of allowing assets to roll off of its $8.5 trillion balance sheet.

These developments are indeed going to influence the Indian Stock Market sentiments, and set the stage for the rise in levels all across the US as well as Indian Stock Indices in the coming near future!

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.

Very relevant and useful for common man with limited financial knowledge and more importantly limited time to read and gather such a variety of content – as Amit Sinha has been able to compress here, without the feeling of ‘overloaded with information’.

Excellent article!!