Stock Watch: Friday’s leapfrog!

By Amit Sinha*

By Amit Sinha*

Weekly Insights – Technical

24 February – 03 March

Indian Stock Market Indices status as of day closing 3 March 2023:

Sensex: 59,808 (+ 899.62)

Nifty 50: 17,594 (+272.45)

Nifty Bank: 41,251 (+861.55)

The stock market’s benchmark indices snapped its losing streak from an over-sold territory and re-bounced sharply on Friday, March 3, 2023, to register the single day’s biggest gain in the last four months. The Sensex climbed almost 900 points and the Nifty 50 index re-claimed its 200 DMA (Daily Moving Average) closing around the 17,600 level, bringing some respite to the tired and exhausted traders and Investors.

The reasons for the positive sentiments is like a technical “morning star” seen in the market, mainly attributed to the factors:-

- Adani Group: GQG Partners, a US-based FII ( Foreign Institutional Investor), has executed a multi-crore buy deal; Rs.15,446 crores in Adani Group by buying stakes in Adani Enterprises, Adani Ports, Adani Transmission and Adani Green. This acquisition has sent a positive sentiment in the stock market which soared Adani shares in the last 3 trading sessions. The flagship company Adani Enterprises rose to 60% from its recent downfall and out of 10 Adani group stocks, 7 stocks hit the U.C. (upper circuit). The money raised by Adani is, as per them to be used for paying debts to the banks, which helped the leading banks’ shares like SBI and others to rebound on this positive note. As per estimated data, Rs. 81,200 crores is the exposure by Indian Banks collectively to the Adani Group which has been the key concern in the stock market.

- Supreme Court: The Supreme Court has crafted and constituted an action-oriented technical-legal committee of eminent personalities who will probe into the Adani-Hindenburg Row. The deadline for the comprehensive report sought is within 2 months from now which makes the Adani group not on a sticky wicket for this period till the report is submitted. The allegation against the Adani Group made by Hindenburg in its report will be under national and international purview. The SEBI has also been asked by the SC to continue its ongoing investigation with regard to any regulatory failure and cooperate with the panel for the relevant cause and factors. With all these developments both Macro and Micro details will be taken care of for truth and for the world at large. Let’s see if this is a time–bomb ticking or a welcome respite.

- Economic Data: The February 2023 Services India manufacturing Purchasing Managers’ Index (PMI) figure came at a high of 59.4 which beats the market forecast of 56.2, showing a 12-year high with demand resilience and competitive pricing. The input cost inflation eased and output cost inflation also reduced positively.

- Revival of China’s economy: The China re-opening theme is great news for commodities –Iron Ore, Steel/Metal, Real Estate, and Oil companies. China is the leading consumer of these commodities in the world. There will be a certain boost for Indian Steel companies as exports to China will rise imminently.

Nifty50 chart on Daily Time frame as on March 4, 2023 (closing)

Next Week Trading Session Outlook:

The upcoming session looks like a short covering is expected further till we have some breaking news from US Fed which has indicated that there could be a 0.5 basis points increase in interest rates instead of the 0.25 basis which the market had already factored in. However, the market on Friday, March 3, 2023, appreciated a dovish commentary by one of the FED members on the rate-setting panel. We are not out of the woods yet, as far as the inflation vis-à-vis rates hike is concerned.

As stock market euphoria has shifted to China due to its re-opening, once it normalises, we should see India outperforming in the world market on bolstered sentiment.

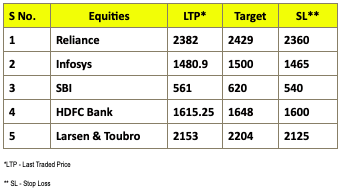

Top Stocks – Technical Levels to watch for next week (not a buy/sell recommendation)

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.