Stock Watch

By Amit Sinha*

By Amit Sinha*

Week: February 3-9, 2023

Indian Stock Market Indices status as of day closing February 10, 2023

Sensex: 60,682 (-123.52)

Nifty 50: 17856 (-36.95)

Nifty Bank: 41559 (+5.10)

Last week the stock market was marred by the Adani Group‘s shares falling like a pack of cards after the American short seller Hindenburg’s report. The face-saving efforts from the Adanis and Domestic institutional investors (DIIs) appeared short-lived.

However, reeling under the news impact, the market it seems is not ready for a considerable fall, resisting the downtrend, hovering near its important resistance of 18000 which is evident on the Nifty 50 weekly graph. Refer to the graph below:

The market was trying to stabilize this week and even though Nifty underperformed, the mid-caps stocks took a step up by say 2%. The earning reports have been very patchy.

This week’s Reserve Bank of India’s repo rate hike by 25 basis points was on expected lines by the market and there was not much volatility in the market as an after-effect. However, on February 1, 2023, the market hailed the new “Amrit Kaal” budget on a positive note which obviously got derailed due to the Adani turmoil. The market plummeted instantly arousing negative sentiments. The market as of now is on pause mode looking for more cues and insights into the Adani Group’s real market valuations. Any good news trigger which could give upside momentum is missing.

Tightening Monetary Policy – The increase in the Repo rate by RBI constantly is making retail investors look to invest more in Bank Fixed Deposits (FDs) which are giving around 6-7% annualised Return On Investment (ROI) now. It means there will be a liquidity crunch in the stock market as far as retail investors are concerned. For the stock market to keep at par with the bank FDs will have to at least need to give a return of 10% ROI or more, chances of which are quite slim as per the prevailing market conditions. RBI’s policy stance on repo rate is on peaking lines of US Federal Reserve policy rates which is aiming aggressively to tame inflation and remains hawkish as interest rates could go higher on a more prolonged basis in next quarters to come, based on their recent non-farm robust unemployment data. Markets expect the US Federal Reserve to approve two more rate hikes — a quarter-point each at the March and May meetings.

Next Week Outlook: February 10-16, 2023

All the expected triggers are over, be it earnings season, US FED rate, Budget, or RBI repo rate. Keep a watch out for the Adanis which could bring momentum to the overall market sentiment.

The market is in the accumulation or consolidation stage, looking for trigger cues to make an upside or downside move. Time to be cautious and not to have a prejudiced bullish or bearish view of the market. Keep proper stop loss and target, as trend forward is for keeping a balance-neutral view and taking investments/trading decisions based on support and resistance levels of individual stocks/indices/commodities. Positioning a “chameleon” view is advisable.

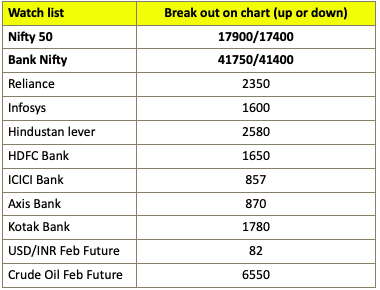

Indices/Top Stocks/Currency/Commodity – Technical Levels to watch for next week:

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

The writer is a long-term investor/trader. The views expressed are personal.