Stock Watch: Banks Lead the Way

![]() By Amit Sinha*

By Amit Sinha*

Weekly Insights – Technical

24 April 2023 – 28 April 2023

Indian Stock Market Indices status as of day closing April 28, 2023:

Sensex: 61,112 (+463.06) +0.076%

Nifty 50: 18.065 (+149.95) +0.84%

Nifty Bank: 43,233 (+233.05) -1.24%

Indian Stock Indices bounced back and took off like a rocket from last week’s consolidation and as expected banks led the rally again as the most powerful sector. A little bounce back from the IT sector also fuelled the momentum upwards. This week was the best week for the stock market since July 2022.

Nifty and Sensex finally broke out from a narrow range to hit a multi-month high!

Nifty reclaimed 18,000 for the first time since February 16, 2023. Attributing to positive global cues with strong earnings reports in the USA offset slowdown worries, a sharp drop in oil prices mid-week and robust FII buying boosted sentiment. Midcaps (+1.3%) and Small caps (+0.9%) were equally enthusiastic. Over two stocks advanced for every loser.

India’s banking sector is on the cusp of a fintech revolution, with the potential to become the global fintech hub due to its large population and increasing digital penetration. It is projected to become the fifth-largest banking sector in the world by 2025, driven by factors such as financial awareness, rising incomes, and the government’s focus on financial inclusion. The banking sector has shown robust growth in the recent financial year, with public and private sector banks reporting impressive profits. Public sector banks have reported a surge in net profit, increasing by 64% year-on-year in April-December 2022. Private Banks have also witnessed a 33% increase in their profits in Q3. The growth in the banking sector is attributed to the decline in bad loans and healthy loan growth.

The graph of Nifty50 below depicts the movement of strength, trapping the Option writers and succumbing to Option Buyers (Bears to Bulls) on a strong directional upswing on a daily time frame from April 24 onwards till April 28, 2023.

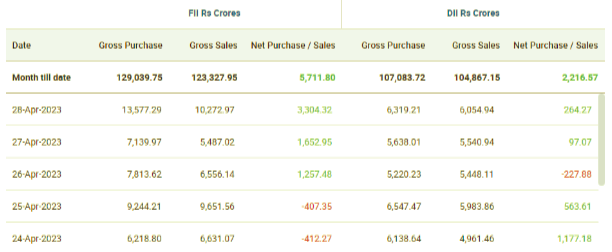

As of April 2023-MTD (Month to Date) basis, the net cash purchase of Foreign Institutional Investors (FIIs) is about 5711 crores and Domestic Institutional Investors (DIIs) is about 2216 crores.

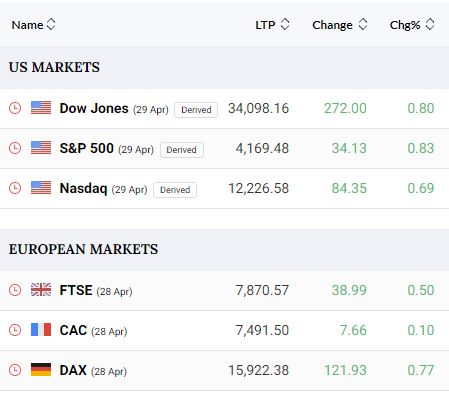

The World Market particularly the USA (Dow Jones and NASDAQ) market and European Market is showing strong resilience to inflation. In spite of US GDP data growth for the March quarter coming in well below expectations, the markets do not seem to be worried at all. Strong consumption data and perhaps more strong corporate earnings results could well be the reason for the decent and smart performance of the market. The threat of a recession has been pushed to the back burner for now. Weekly initial claims in the US about unemployment have declined. However, a very low probability of recession at present is a classic case of things happening very gradually, then suddenly.

The Fed is expected to increase interest rates by another 25 basis points next week, potentially the last hike in the U.S. central bank’s fastest monetary policy tightening cycle since the 1980s. The Fed has raised its policy rate by 475 basis points since March of last year from the near-zero level to the current 4.75%-5.00% range.

The US and European Markets’ position

Next Week Market / Trading Session Outlook

A long green candle with a small lower shadow emerged on the charts yesterday as the Nifty soared past the 18,000 mark, indicating the continuation of bullish momentum with strength. Accordingly, the index also negated last week’s bearish engulfing candle pattern on the weekly chart and now appears to be going towards the development of a new higher top. On the daily charts, the relative strength index (RSI)-14 readings reached 70 and are now in the overbought zone. Private Banks – ICICI and HDFC could lead the Index to move on the higher side. While Public Sector Undertaking banks – Canara Bank and the State Bank of India can hold the command.

Technically, Nifty continued its upward trend of higher highs and lower lows and made a bullish candle on the daily charts, while it also continued its upward trajectory of higher tops and lower bottoms for the fifth consecutive week on the weekly scale forming a bullish candlestick pattern.

Banking giants like Axis Bank and SBI showed promising potential for investors due to their high 5-year historical Earnings Per Share (EPS) growth and 1-year forward EPS growth metrics. Experts believe that these banks may offer a good entry point for investors looking to enter the banking sector.

Looking ahead, the ongoing economic crises faced by major global banks like Credit Suisse, Signature Bank, and SVB, along with government bailouts, have created an urgent need for international investors to search for safer investment opportunities in emerging markets. As a result, the Indian banking sector could see a boom in investment activity.

The market is anticipated to rise up to the next resistance of 18,200-18,300 Nifty50 levels in the coming week as the short-term upward trend of the Nifty continues intact. Volatility has fallen dramatically, giving bulls more comfort. The fear index India VIX has been at its lowest level since December 2019.

Continuing a trailing stop-loss is best suited for this market conditions for the Investors and Traders to ride the euphoric momentum in the rally.

Disclaimer: The opinions expressed within the content are solely the author’s (not a SEBI registered advisor) and do not reflect the opinions and beliefs of the website or its affiliates. You should consult a qualified broker or an independent financial advisor before making any investment.

*The writer is a long-term investor/trader. The views expressed are personal.