© UN Photo/Mariscal | UN Trade and Development (UNCTAD) Secretary-General Rebeca Grynspan (see on-screen and at the podium) spoke at a plenary session of the 4th International Conference on Financing for Development on 3 July in Sevilla, Spain.

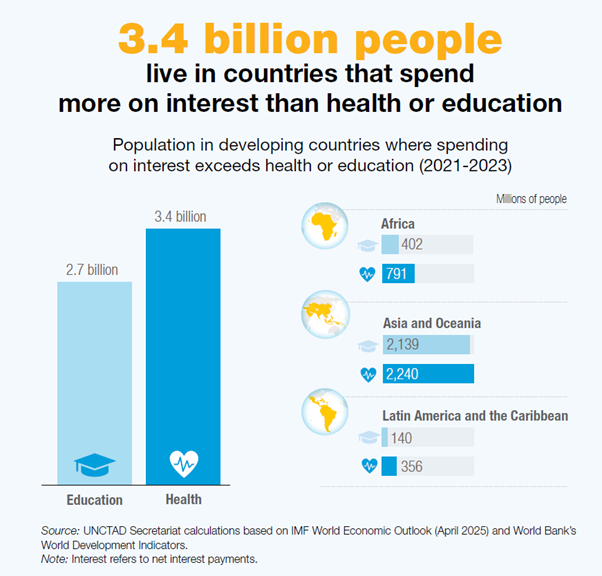

Sevilla/Geneva: A $4 trillion annual financing gap for sustainable development, coupled with rising debt, shrinking aid, and low economic growth, threatens the 2030 Sustainable Development Goals (SDGs), with 3.4 billion people living in countries prioritising debt interest payments over health or education.

The absence of the United States from the Fourth International Conference on Financing for Development (FfD4), held in Sevilla, Spain, from June 30 to July 3, 2025, raises concerns about global consensus, while the non-binding nature of the conference’s outcomes complicates implementation. Against these hurdles, FfD4’s adoption of the Sevilla Commitment and Platform for Action signals a bold effort to reform the global financial architecture for development-centric solutions.

The Sevilla Commitment, endorsed by over 190 nations, is a 38-page framework outlining strategies to bridge the financing gap through multilateral cooperation, innovative financing, and private sector engagement, targeting systemic issues like global inequality and unsustainable debt. The Seville Platform for Action complements this with over 130 initiatives focused on three priorities: a global investment push, a response to the debt crisis, and enhanced representation for developing countries in global governance. The United Nations Trade and Development (UNCTAD) reports that in 2023, 38% of developing nations allocated over 10% of revenue to interest payments, highlighting the urgency of these reforms.

A flagship outcome was the Sevilla Forum on Debt, a UN-supported platform to help debt-distressed countries coordinate management and restructuring strategies. UNCTAD’s Secretary-General Rebeca Grynspan emphasised the imbalance where developing nations negotiate alone against unified creditors. Spain, the FfD4 host, will support the UN in operationalising the forum, which promotes responsible borrowing and lending standards, likened by Spain’s Finance Minister Carlos Cuerpo to a “Sevilla moment” akin to the Paris Club’s creation.

Innovative financing was central, with an Action Plan to scale private sector investment through blended finance models, supported by the OECD, African Union Commission, and the GISD Alliance. This plan standardises approaches to address poverty, growth, and climate risks. Eight countries, including France, Spain, and Kenya, proposed taxing premium plane tickets and private jets to fund climate action, reflecting environmental priorities. UNCTAD also launched initiatives like a South-South cooperation data community, a digital infrastructure investment catalyser with the International Telecommunication Union, and a Global Alliance for Beyond GDP to measure wealth distribution, social resilience, and sustainability.

International trade was underscored as a vital link between local economies and global growth. UNCTAD advocates for predictable trade rules and transparent investment policies to build capacity and resilience in developing nations. The organisation supports tripling multilateral development bank lending from $50 billion to $150 billion and reforming the G20 Common Framework for Debt Treatment to lower borrowing costs and enable timely debt restructuring, transforming public debt into a development tool.

Gender equality and social inclusion were integral to the Sevilla Platform, with commitments to direct financing toward programs empowering women and marginalised groups, particularly in education and healthcare. Climate finance discussions emphasized scaling resources for adaptation and mitigation, proposing green bonds and redirecting fossil fuel subsidies to sustainable infrastructure. Digitalisation efforts included leveraging technology for inclusive financial systems, such as digital platforms for microfinancing to support small businesses in vulnerable economies.

Despite over 15,000 participants, including 50 world leaders and 4,000 representatives from business and civil society, the U.S.’s absence from FfD4 sparked doubts about universal buy-in. Zambia’s UN representative, Chola Milambo, hailed the conference as proof that “multilateralism can still work,” while UN Secretary-General António Guterres urged urgent action for a financial system serving people and the planet. Looking ahead to UNCTAD16 in October 2025, themed “Shaping the future: Driving economic transformation for equitable, inclusive and sustainable development,” Grynspan stressed integrating trade, finance, and technology for global solidarity.

The Sevilla Commitment’s non-binding status and historical resource shortfalls underscore the need for enforceable mechanisms. With half the SDGs at risk, FfD4’s roadmap depends on mobilising trillions annually and addressing entrenched inequalities to deliver tangible results by 2030.

– global bihari bureau