Real GVA Rises 7.6% as Economy Accelerates

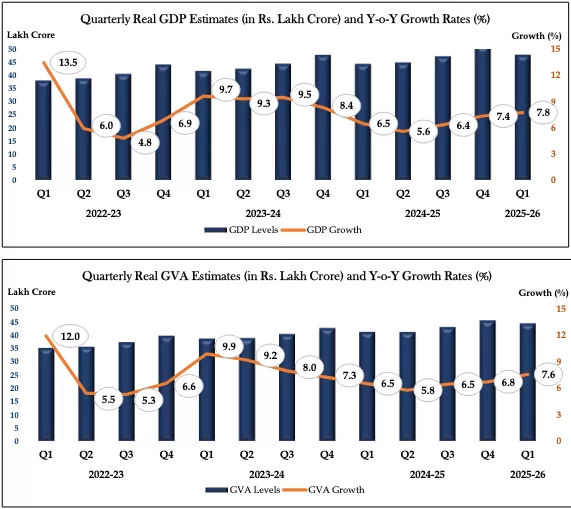

New Delhi: India’s economy registered a real growth rate of 7.8% in the first quarter of FY 2025-26, up from 6.5% in the same period of the previous year, signalling a strong start to the financial year. Nominal GDP, which captures the value of goods and services at current prices, rose by 8.8% to ₹86.05 lakh crore from ₹79.08 lakh crore in Q1 FY 2024-25. Real Gross Value Added (GVA) at basic prices increased to ₹44.64 lakh crore, marking a 7.6% rise over ₹41.47 lakh crore, while nominal GVA grew to ₹78.25 lakh crore, reflecting an 8.8% increase compared with the previous year.

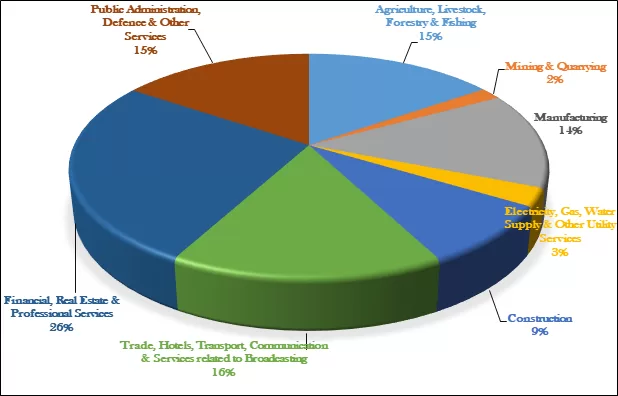

Sectoral Composition of Nominal GVA in Q1 of FY 2025-26

The services sector continued to drive growth, expanding 9.3% in real terms compared with 6.8% in the corresponding quarter last year. This expansion was supported by a wide range of activities, including trade, hotels, transport, communication, broadcasting, financial services, real estate, professional services, and public administration.

Quarterly GDP and GVA Estimates along with Y-o-Y Growth Rates from Q1 FY 2022-23 to Q1 FY 2025-26 at Constant Prices

Manufacturing and construction, the two largest components of the secondary sector, registered real GVA growth of 7.7% and 7.6%, respectively, demonstrating sustained industrial and infrastructural activity. Electricity, gas, water supply, and other utility services recorded modest growth of 0.5%, while mining and quarrying contracted by 3.1%, reflecting challenges in the extraction sector. The primary sector, including agriculture, livestock, forestry, and fishing, grew 3.7%, a marked improvement over the 1.5% expansion in Q1 FY 2024-25, supported by higher production of food grains, oilseeds, horticulture crops, and allied agricultural activities.

Expenditure components of GDP showed a positive trajectory. Government final consumption expenditure rose 9.7% in nominal terms, compared with 4% in the first quarter of FY 2024-25, reflecting increased public spending. Real private final consumption expenditure grew by 7%, slightly below the 8.3% increase a year ago, indicating continued household demand. Gross Fixed Capital Formation, a key indicator of investment activity, expanded 7.8% at constant prices, up from 6.7% in the same quarter of the previous year, highlighting ongoing investment in infrastructure and productive assets.

The National Statistics Office (NSO) compiles quarterly GDP estimates using the benchmark-indicator method, extrapolating data from the corresponding quarter of the previous financial year using sector-specific indicators. The estimates draw on multiple sources of data, including crop production targets and advance estimates for food grains, oilseeds, and horticulture; livestock and fisheries production; industrial output of coal, crude petroleum, natural gas, steel, and cement; transport and logistics indicators such as rail and air passenger traffic, port cargo handling, and commercial vehicle sales; financial sector data including bank deposits, credits, and insurance premiums; GST and tax collection data; and central and state government accounts including revenue expenditure, subsidies, and interest payments. Total tax revenue used for GDP compilation includes both GST and non-GST revenues, while product subsidies such as those for food, urea, petroleum, and nutrients are factored into current price estimates.

Officials noted that improved data coverage and revisions from source agencies may result in updates to the estimates. The next quarterly GDP release for July–September 2025 is scheduled for 28 November 2025.

Overall, the first-quarter growth underscores a broad-based expansion in the Indian economy. The services sector remained the primary engine, while manufacturing, construction, and agriculture contributed significantly to sustained momentum. Moderation in mining and utilities tempered gains, but robust consumption and investment activity helped maintain a strong growth trajectory. Analysts suggest that continued support from public expenditure, private consumption, and capital formation will be crucial in sustaining growth in the coming quarters.

– global bihari bureau