Geneva: Merchandise trade volume has been picking up in the third quarter of 2024 after demand for traded goods stalled in 2023 amid high inflation and rising interest rates, according to the latest World Trade Organization’s Goods Trade Barometer. However, it cautioned that the outlook remains uncertain due to shifting monetary policy in advanced economies, weakening export orders, rising geopolitical tensions, and ongoing regional conflicts.

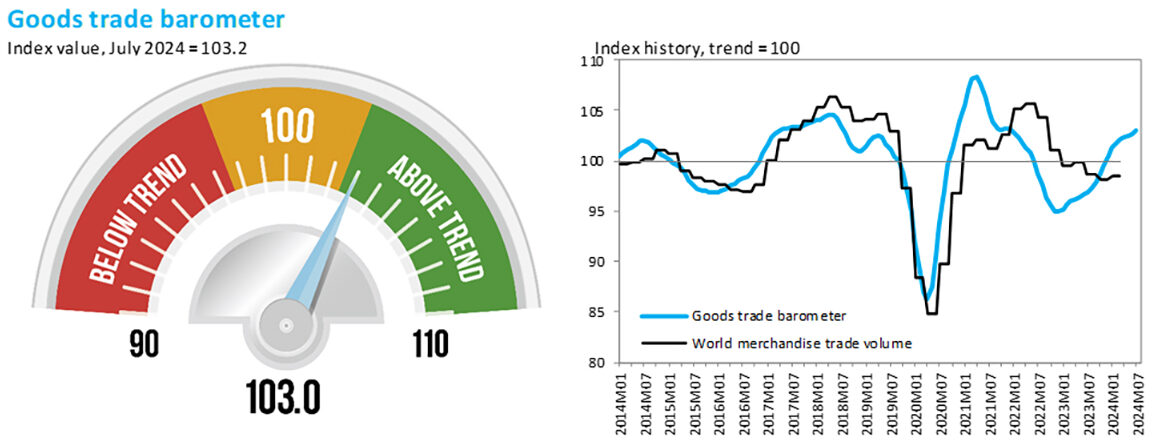

The Goods Trade Barometer is a composite leading indicator for world trade, providing real-time information on the trajectory of merchandise trade relative to recent trends. Barometer values greater than 100 are associated with above-trend trade volumes while barometer values less than 100 suggest that goods trade has either fallen below trend or will do so soon.

The latest reading of 103.0 for the barometer index (represented by the blue line above) is above both the quarterly trade volume index (represented by the black line) and the baseline value of 100 for both indices, suggesting that merchandise trade volume growth should remain positive in the second and third quarters of 2024 once official statistics for these periods become available.

After remaining flat since the final quarter of 2022, the volume of world merchandise trade started to turn up in the fourth quarter of 2023 and gained momentum in the first quarter of 2024. In 2024 Q1, the last period for which data is available, trade was up 1.0% quarter-on-quarter and 1.4% year-on-year.

Quarter-on-quarter growth in the last two quarters averaged 0.7%, which is equivalent to 2.7% on an annualized basis. This is quite close to the WTO’s most recent forecast of April 2024, which predicted a 2.6% increase in world merchandise trade volume in 2024. Recent data in value terms show weaker-than-expected trade growth in Europe and stronger-than-expected growth in other regions. As a result, the WTO’s regional projections may need to be adjusted in the next WTO trade forecast update, which will be issued in mid-October.

All of the barometer’s component indices are currently on or above trend, with the notable exception of the electronic components index (95.4), which is below trend and falling. Component indices for automotive products (103.3), container shipping (104.3) and air freight (107.1) are all firmly above trend, although the automotive products index appears to have lost momentum recently. New export orders (101.2), usually the barometer’s most predictive component, are marginally positive but have been turned down, which could be a cause for concern going forward. The index of raw materials (99.3) is nearly on trend but has declined sharply over the last three months.

– global bihari bureau

Top Image by Bellergy RC from Pixabay