India Unveils Comprehensive GST Reforms

GST Cuts Boost Exports, Ease Consumer Costs

New Delhi: The Government of India launched an ambitious overhaul of the Goods and Services Tax (GST) system, unveiled today, following the 56th GST Council meeting, intending to slash operational costs for businesses, sharpening export competitiveness, and easing financial burdens on consumers across a diverse array of sectors. These sweeping reforms span textiles, fisheries, dairy, healthcare, automobiles, heavy industries, and nutraceuticals, tackling tax distortions, streamlining refund mechanisms, and bolstering Micro, Small, and Medium Enterprises (MSMEs), small exporters, and rural communities. The initiative aligns with Prime Minister Narendra Modi’s vision of a “Good and Simple Tax” that empowers every economic segment, aiming to position India as a global manufacturing and export hub while enhancing domestic welfare.

At the heart of the reforms is a decision to eliminate the value threshold for GST refunds on low-value e-commerce exports, a move rooted in a Directorate General of Foreign Trade (DGFT) proposal dated May 8, 2025, and formalised through an amendment to Section 54(14) of the Central Goods and Services Tax (CGST) Act, 2017. This change allows exporters to claim tax refunds on shipments of any value, a relief for small businesses and e-commerce sellers who rely on courier or postal services to ship products like handicrafts, apparel, or spices. By removing the previous cap—often as low as Rs. 500 per consignment—this reform is projected to unlock working capital for over 1.5 lakh MSME exporters, reduce compliance paperwork by an estimated 30%, and boost India’s e-commerce exports, which grew 15% to $5 billion in 2024-25, according to DGFT data.

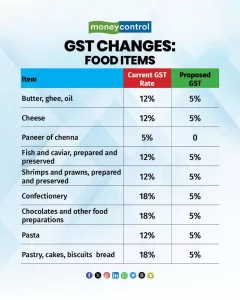

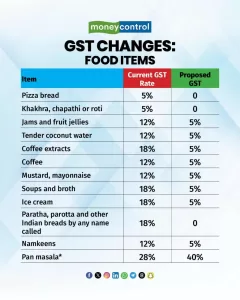

The fisheries sector reaps substantial benefits with GST rates slashed from 12–18% to 5%, effective September 22, 2025, encompassing fish oils, fish extracts, prepared or preserved fish, shrimp products, and critical aquaculture inputs like diesel engines, pumps, aerators, sprinklers, and chemicals for pond preparation and water quality management. Fishing nets, rods, tackle, landing nets, butterfly nets, and gear also drop from 12% to 5%, making equipment more accessible for the 3.5 crore people— including 2.1 crore fish farmers and aquaculturists—dependent on the sector. Job work services in seafood processing fall from 12% to 5%, while composting machines for organic manure and eco-friendly pond management are taxed at 5%, supporting sustainable practices. This sector, producing 195 lakh tonnes in 2024-25 and exporting Rs. 60,000 crore worth of seafood in 2023-24, positions India as the second-largest fish producer and a leading shrimp exporter, with the reforms expected to enhance its $8 billion export market by 10–15% annually, aligning with the Blue Economy strategy.

The dairy industry undergoes a transformative GST restructuring, effective September 22, 2025, with Ultra-High Temperature (UHT) milk and paneer (pre-packaged and labelled) now exempt (0% from 5%), and butter, ghee, dairy spreads, cheese, condensed milk, beverages containing milk, ice cream, and milk cans reduced from 12–18% to 5%. This supports over 8 crore rural farmer families, including 6 crore small and marginal milk producers, within India’s 239 million tonne milk output in 2023-24, valued at Rs. 12.21 lakh crore in a Rs. 18.98 lakh crore market. The changes aim to cut production costs by 8–10%, reduce adulteration risks, and boost exports of value-added products like ghee, which saw a 12% export rise to $300 million in 2024, while keeping essentials affordable for 300 million daily milk consumers.

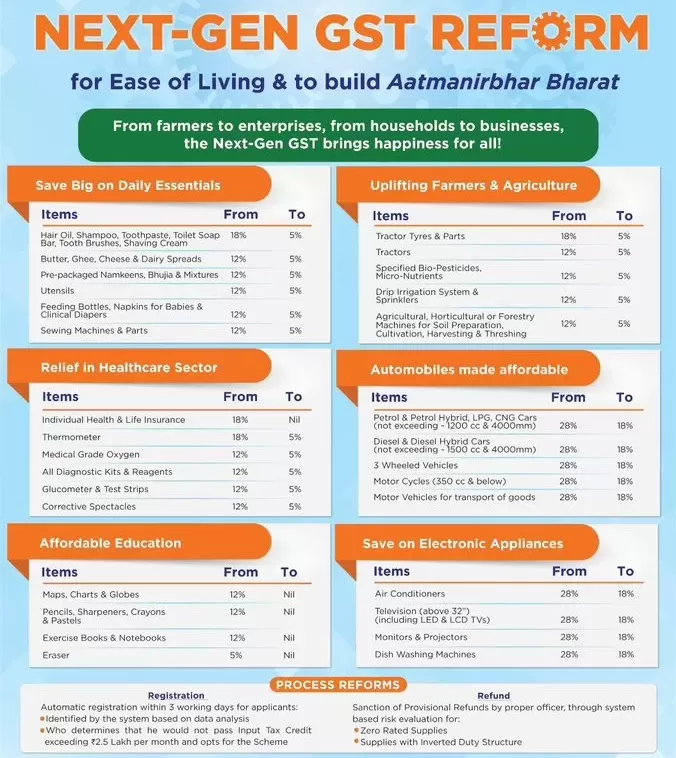

Healthcare reforms bring relief with GST on essential medicines dropping to 5% or 0% from 12%, benefiting 50 million patients with chronic conditions like diabetes, hypertension, and cancer by lowering annual treatment costs by an estimated Rs. 2,000–3,000 per patient. Medical devices such as anaesthetics, medical-grade oxygen, gauze, bandages, diagnostic kits, surgical gloves, glucometers, and thermometers fell from 12% to 5%, reducing healthcare delivery costs for 15,000 hospitals and 50,000 clinics, particularly in Tier-2 and Tier-3 cities. Spectacles, spectacle lenses, and contact lenses drop to 5% from 12%, aiding 100 million people needing vision correction, with an expected 20% uptake increase. Health and life insurance premiums, including family floaters and senior citizen plans, are now exempt, potentially covering 50 million more households under Ayushman Bharat, saving Rs. 5,000–7,000 annually per policy. Gym and fitness centre services drop from 18% to 5%, supporting the Fit India Movement for 20 million fitness enthusiasts, while no cuts apply to tobacco, pan masala, or sugary drinks, aligning with Poshan Abhiyaan to combat non-communicable diseases affecting 100 million Indians.

The automobile sector sees broad GST reductions effective September 22, 2025, with two-wheelers (up to 350cc) dropping from 28% to 18%, boosting sales for 15 million rural and semi-urban riders, including farmers and gig workers, by reducing bike prices by Rs. 10,000–15,000. Small cars (petrol <1200cc, diesel <1500cc, <4m length) fall from 28% to 18%, making 500,000 units more affordable for first-time buyers in smaller cities, while large cars are set at a flat 40% with no cess, enhancing Input Tax Credit and cutting costs by Rs. 1–1.5 lakh per vehicle for 200,000 aspirational buyers. Buses (10+ seats) and commercial goods vehicles (trucks, delivery vans) drop from 28% to 18%, lowering fleet costs for 50,000 operators and reducing freight rates by 5–7%, benefiting 65–70% of India’s goods traffic. Tractors (<1800cc) and parts fall from 12% to 5%, while road tractors (>1800cc) drop from 28% to 18%, supporting 1.2 million farmers with mechanisation, and auto components are reduced to 18%, sustaining 3.5 crore jobs across the supply chain, including tyres, batteries, and steel.

Commerce Secretary Sunil Barthwal hailed the reforms as a “game-changer for small exporters and MSMEs, unlocking working capital and simplifying refunds,” noting a potential 20% export growth for e-commerce. Union Minister Piyush Goyal, at the Bharat Nutraverse Expo 2025 on September 4, 2025, called it a “tremendous boost” for consumption, urging businesses to pass all savings to consumers and promote Indian products, aligning with Viksit Bharat 2047. He cited India’s 7.8% GDP growth in Q1 2025-26 despite global turmoil, targeting a $30 trillion economy by 2047, and highlighted nutraceuticals like turmeric and probiotics supporting 5 million farmers and MSMEs. Prime Minister Narendra Modi tweeted, “The Union Government had prepared a detailed proposal for broad-based GST rate rationalisation… aimed at ease of living for the common man and strengthening the economy,” while Health Minister Jagat Prakash Nadda added, “Reduced tax rates… will enhance ease of living, help families manage costs,” and Finance Minister Nirmala Sitharaman emphasized a “multi-sectoral and multi-thematic focus” for citizens and businesses. The reforms correct inverted duty structures in textiles, food processing, and pharmaceuticals, reducing GST on inputs like packaging (12–18% to 5%) and logistics (trucks from 28% to 18%), freeing up Rs. 50,000 crore in working capital annually, though challenges include ensuring savings reach consumers and managing a potential Rs. 45,000 crore revenue loss (SBI Research estimate). Effective implementation will be crucial to realising benefits for India’s global hub ambitions in textiles, fisheries, and beyond, with unverified details like exact revenue impacts and export growth projections requiring close monitoring.

– global bihari bureau