New Rules: Directors’ KYC Filing Required Every Three Years

MCA Simplifies KYC Compliance for Directors under the Companies Act

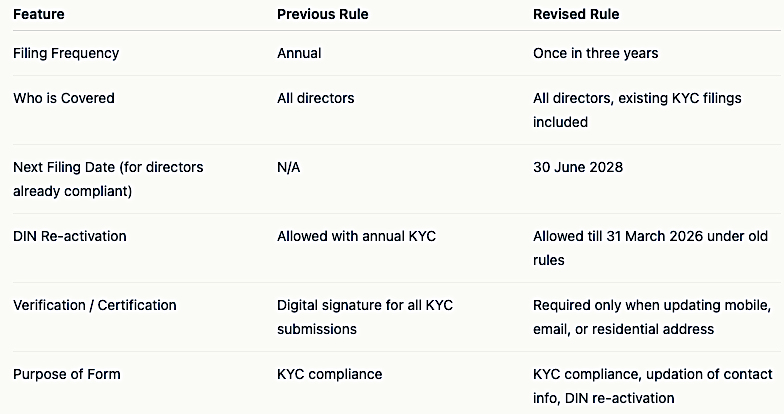

New Delhi: The Ministry of Corporate Affairs (MCA) has revised the Know Your Director (KYC) compliance requirements under the Companies Act, 2013, replacing the annual filing mandate with a simplified KYC process once every three years. The amendment, notified on 31st December 2025 and effective from 31st March 2026, follows recommendations from the High Level Committee on Non-Financial Regulatory Reforms (HLC-NFRR) and inputs received from stakeholders.

The amendment affects Rule 12A of the Companies (Appointment and Qualification of Directors) Rules, 2014, which previously required all directors to file their KYC information annually. Under the revised framework, directors holding a Director Identification Number (DIN) as on 31st March of a financial year are required to file KYC intimation in Form No. DIR-3 KYC Web to the Central Government on or before 30th June of the immediately following every third consecutive financial year. The rules also require directors to submit Form No. DIR-3 KYC Web within 30 days in the event of a change in their personal mobile number, email address, or residential address, along with the prescribed fee under the Companies (Registration Offices and Fees) Rules, 2014.

The amendment also includes updates to the administrative references in Rule 11 of the Companies (Appointment and Qualification of Directors) Rules, 2014. The term “Regional Director (Northern Region), Noida” has been replaced with “Regional Director, Northern Region Directorate I” wherever it occurs. References to the previous DIR-3 KYC e-form or web service have been substituted with Form No. DIR-3 KYC Web to standardise the KYC filing process.

Under the revised framework, all existing KYC-compliant directors are included in the new three-year cycle. Directors who have already completed their KYC filings will have their next submission due by 30th June 2028. Directors who have not yet submitted their KYC Form can continue to re-activate their DINs as per existing provisions until 31st March 2026.

The simplified KYC Form is designed for multiple purposes, including KYC compliance, updation of mobile number, email address, residential address, and reactivation of DINs. Verification through a digital signature by the director and certification by a professional will be required only when the Form is submitted to update mobile numbers, email addresses, or residential addresses.

The MCA has stated that the amendment is aimed at providing ease of compliance for directors across all companies, reducing administrative burden while maintaining regulatory oversight. The official Gazette Notification, G.S.R 943 (E) dated 31st December 2025, has been placed on the Ministry’s website for reference.

Quick Reference: Director KYC Compliance – Old versus New

The amendment standardises KYC filing procedures across all companies and provides clarity on administrative references, while maintaining the requirement for digital verification where personal details are updated. The change is expected to ease compliance for directors, reduce administrative requirements, and streamline KYC management across companies while keeping the verification process intact, where critical updates are made.

– global bihari bureau