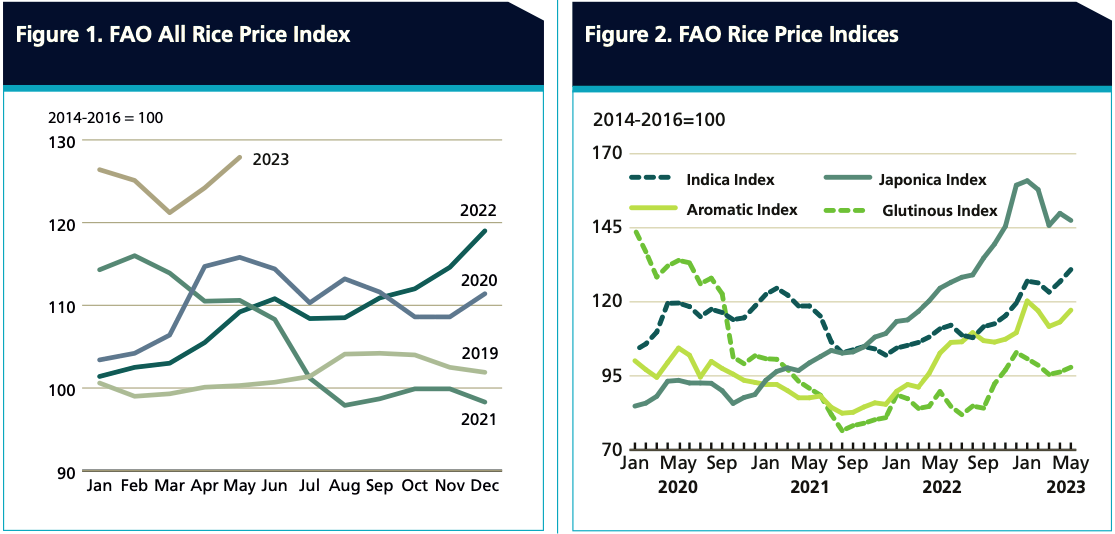

Rome: Against the backdrop of production disruptions in 2022-23 and strong Asian demand, international rice prices have reached their highest level since October 2011. However, barring major setbacks, global production could recover in 2023-24, which, coupled with an anticipated stabilization in use, could boost world rice stocks.

At the same time, global wheat production, stocks and trade are all forecast to fall in 2023-24 from their 2022-23 record-high levels. Nevertheless, with significant carryover stocks from last season and nearly stagnant total utilization, world wheat supplies are set to remain ample, according to a report released today by the Food and Agriculture Organization of the United Nations (FAO).

The report, Food Outlook, forecasts the world food import bill to reach a new record this year, though it is predicted to grow at a much slower pace compared to last year, as rising world prices, driven by higher quotations for fruits, vegetables, sugar and dairy products, dampen demand, especially in the most economically vulnerable countries,

It estimates that the global food bill will rise to $1.98 trillion in 2023, up 1.5 per cent from 2022. It rose by 11 per cent in 2022 and 18 per cent in 2021.

While food imports by advanced economies continue to expand, the import bill for the group of Least Developed Countries (LDCs) is predicted to decline by 1.5 per cent this year and that for net food-importing developing countries (NFIDCs) to decline by 4.9 per cent, according to FAO.

“The decline in food import volumes is a concerning development in both groups, suggesting a decline in purchasing capacity,” the biannual report from FAO’s Markets and Trade Division warns. “These concerns are amplified by the fact that lower international prices for a number of primary food items have not, or at least not fully, translated into lower prices at the domestic retail level, suggesting that cost-of-living pressures could persist in 2023.”

The new edition of Food Outlook has a particular chapter examining recent changes in the food component of the consumer price index for NFIDCs, and how currency movements, especially in relation to the US dollar in which most agrifood trade is invoiced, impact food price inflation in these countries.

While the US dollar’s depreciation during the 2007-08 global food crisis helped food importers offset the increase in food prices, the reverse effect has been marked in recent years. For example, world maize prices declined by 10.2 per cent between April 2022 and September 2022, but by only 4.8 per cent on average when calculated in real local currencies of NFIDCs.

That underscores the importance of well-tailored interventions to combat inflation, said FAO Senior Economist El Mamoun Amrouk, author of the chapter. Otherwise, he warned, “rising food prices can lead to social unrest and increased financial challenges, undermining efforts to fight poverty and food insecurity and wiping out any progress achieved so far.”

Commodity trends

FAO’s latest release of the Food Outlook, containing forecasts of the production, trade, utilization and stock levels across the world’s major basic foodstuffs, point to likely increases in production across most categories, including rice, coarse grains, oil crops, milk, sugar, meat and fish and fishery products. However, global wheat output could fall from last season’s all-time high.

Notwithstanding this generally positive outlook, the global agrifood production systems remain vulnerable to shocks, stemming from extreme weather events, geopolitical tensions, policy changes and developments in other commodity markets, with the potential to tip the delicate demand-supply balances and impact prices and world food security.

Global production of coarse grains is forecast to rise by 3.0 per cent to 1 513 million tonnes, a new record, buoyed by an expected significant increase in maize output in the United States of America and a record harvest in Brazil, leading to higher overall supplies and lower prices.

World rice production is forecast to rise by 1.3 per cent in 2023/24 to 523.5 million tonnes, while international trade is expected to drop by 4.3 per cent in volume terms to 53.6 million tonnes. The anticipated output increase mostly reflects positive incentives provided by generally higher producer prices, easing fertilizer costs and continuing government assistance measures. By contrast, world wheat production in 2023 is expected to decline by 3.0 per cent from its all-time high of 777 million tonnes in 2022, due mainly to expected decreases in the Russian Federation and Australia, both of which registered record outputs last year. The declines mostly reflect the likely impacts of extreme weather events, seen leading to lower planted areas.

Global outputs of oil crops, milk and sugar are all expected to expand, as is that for meat, although pig and bovine meat volumes could drop slightly in 2023.

Global production of aquatic animals is also expected to grow in 2023, although that is due to an anticipated increase in aquaculture production as capture fisheries are seen contracting.

– global bihari bureau