Global Auto Boom Exposes Limits of India’s Exports

India’s Automotive Sector Strong at Home, Modest Abroad

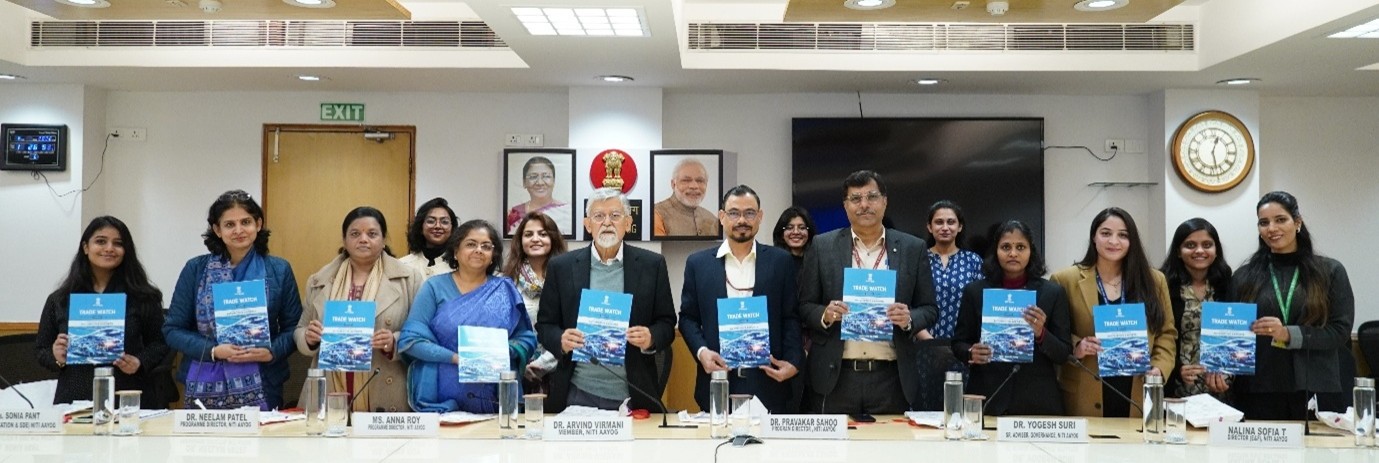

New Delhi: India’s trade performance in the April–June quarter of FY26 unfolded against a backdrop of steady global trade expansion, marked by shifting demand patterns, rising South–South trade and a gradual reconfiguration of global value chains. While overall trade remained resilient, the latest quarterly assessment by NITI Aayog highlights that India’s automotive exports continue to reflect a narrow integration into global markets, with competitiveness concentrated in select segments even as global demand for automobiles and components remains robust.

Global trade in goods and services expanded by about 2.5 per cent quarter-on-quarter during April–June 2025, led largely by developing economies and a recovery in services trade after a contraction in the preceding quarter. Technology-intensive goods, particularly electronics and products linked to artificial intelligence and digital infrastructure, remained key drivers of merchandise trade growth. India’s external sector broadly tracked these trends. Total merchandise and services trade reached about $439 billion during the quarter, registering year-on-year growth of roughly 3.5 per cent despite persistent geopolitical uncertainty and uneven recovery across regions.

This headline stability concealed pronounced divergences within India’s trade basket. Services exports continued to anchor performance, expanding by 10 per cent during the quarter and generating a surplus of nearly $48 billion. Merchandise trade was more subdued. Goods exports declined by 2.1 per cent to $112 billion, weighed down by petroleum products and select labour-intensive sectors, while imports rose modestly, driven by higher inflows of electronics, industrial machinery and specialised intermediates. The combined trade deficit of about $21 billion was substantially offset by services, reinforcing the structural role of services in cushioning merchandise volatility.

The quarter’s data also reflected a longer-term shift in India’s export composition. Over the past decade, dependence on commodity-linked exports has steadily declined, while technology-intensive manufacturing has gained ground. Electronics exports surged by 47 per cent year-on-year, lifting their share to more than 11 per cent of total exports, largely on the back of smartphone shipments and components. Machinery exports also recorded double-digit growth. In contrast, petroleum exports contracted sharply due to both price and volume effects, while gems and jewellery exports remained under pressure amid rising competition and tariff barriers in key markets. This rebalancing has improved diversification but has also exposed uneven competitiveness across manufacturing sectors that are more directly exposed to global demand conditions.

The automotive sector provides one of the clearest illustrations of these dynamics. Globally, automobiles and auto components together accounted for around $2.2 trillion of trade in 2024, making the sector one of the most important pillars of world merchandise commerce. Passenger vehicles alone account for more than 70 per cent of global automotive imports, followed by commercial vehicles and components. The sector is deeply embedded in global value chains, with production platforms, supplier relationships and market access shaped by decades of trade agreements, technological standard-setting and cross-border investment.

India’s automotive industry, by contrast, has evolved primarily around domestic demand. Since liberalisation, the sector has expanded rapidly, supported by foreign investment, phased manufacturing programmes and localisation mandates. It now supports an estimated 30 million direct and indirect jobs, consumes large volumes of domestic steel, aluminium and rubber, and anchors manufacturing clusters across Tamil Nadu, Maharashtra, Gujarat and Haryana. India has built strong capabilities in selected segments such as two-wheelers, three-wheelers, tractors and small passenger vehicles, and has emerged as a significant production base for global firms serving the domestic market.

This domestic scale, however, has translated only partially into global trade presence. In 2024, India’s automotive exports were valued at about $30 billion, accounting for roughly 1.4 per cent of global demand, a share that has remained broadly unchanged over the past decade. The gap between production capacity and export penetration becomes more pronounced when viewed against the structure of global demand. In passenger vehicles, which dominate global trade, India’s export share remains below 1 per cent. Revealed Comparative Advantage indicators underscore this imbalance, showing persistent competitiveness in motorcycles, tractors and selected components, but weak or declining comparative advantage in passenger vehicles and higher-end automotive systems.

India’s export success is thus concentrated in segments with relatively low weight in global trade. Motorcycles, which account for less than 3 per cent of global automotive demand, represent nearly 9 per cent of India’s export share, supported by cost competitiveness and demand from price-sensitive markets. Tractors form another niche where India has established a comparative advantage, accounting for over 1.5 per cent of global demand. However, these segments do not offer the scale needed to significantly lift India’s overall share in global automotive trade.

Destination-wise, India’s automotive exports are also highly concentrated. Two-wheelers, tractors and components are primarily shipped to a limited set of markets in Africa, Latin America and West Asia. Penetration in the European Union, the United States and East Asia remains modest, reflecting both competitive disadvantages and limited preferential market access. This geographic concentration exposes exports to demand volatility in a narrow group of markets and constrains the ability to scale exports rapidly.

Auto components present a more dynamic picture, but with similar structural constraints. Global demand for auto components reached about $856 billion in 2024, growing at an average annual rate of 3 per cent since 2015. India’s component exports nearly doubled over the same period, rising from $8.2 billion to $16.9 billion and growing at about 7 per cent annually. Strong growth was recorded in vehicle parts, tyres, diesel engines and motorcycle components, where India has demonstrated a sustained revealed comparative advantage. Yet even here, India’s share of global demand stands at around 2 per cent.

“Though India has done well in specific segments of the automotive export market, there are significant opportunities to increase market share in the $2.2 trillion global automotive export market, which is growing. The analysis, based on mapping of global automotive exports, India’s exports, and stakeholder consultations, suggests specific policy steps to enhance competitiveness, global positioning, two-way trade, and to reorient production toward high-demand segments. Further, suggestions include strengthening quality standards, certification systems, technology adoption and market diversification alongside fostering forward linkages in global automotive supply chains,” the NITI Aayog stated.

This performance reflects deeper, though still partial, integration into global value chains. Backward integration has strengthened markedly, with the share of imported intermediates in exports rising from about 32 per cent in 2015 to 46 per cent in 2024. This has been driven by increased imports of electronics, power electronics, semiconductors and EV-related subsystems. While this integration supports competitiveness in components, it also highlights persistent dependence on imported high-value inputs, limiting domestic value addition and exposing exporters to supply-chain disruptions.

Forward integration remains limited. Indian firms participate less in high-value activities such as advanced engineering, system integration and platform-level design, which are dominated by established suppliers in East Asia, Europe and North America. Firm-level fragmentation compounds this challenge. India’s auto-component export base is dominated by small and mid-sized suppliers with limited scale, constrained access to global marketing networks and restricted capacity to meet diverse regulatory and certification requirements across markets.

Non-tariff factors further shape export outcomes. The report highlights high logistics costs, limited testing and homologation infrastructure and compliance with divergent technical and safety standards as significant barriers, particularly for finished vehicles. Competing exporters such as Mexico, Thailand and Vietnam benefit from deep free trade agreements with major automotive markets, giving them preferential access and tighter integration into global production platforms. India’s relatively limited FTA coverage places its exporters at a disadvantage, especially in passenger vehicles, where margins are thin, and scale is critical.

Policy sequencing has also mattered. Many global automotive value chains were established before India emerged as a major manufacturing base, and platform decisions and supplier relationships are often locked in for extended periods. While recent initiatives such as production-linked incentives and efforts to rationalise standards aim to address these gaps, the legacy of late entry continues to shape export outcomes.

The global transition to electric mobility sharpens these challenges. Worldwide, electric vehicle imports expanded nearly thirty-fold between 2020 and 2024, driven by rapid technological change and policy mandates in advanced economies. India’s participation in this trade remains marginal, accounting for around 0.1 per cent of global EV exports and imports. The gap reflects both the nascent state of domestic EV supply chains and continued dependence on imported batteries, electronics and power systems.

Taken together, the April–June trade assessment presents a picture of an automotive sector that is strong domestically, selectively competitive internationally and increasingly integrated into global supply chains, but still misaligned with the structure, geography and technological direction of global demand. The contrast between the rapid growth of auto-component exports and the stagnation of finished vehicle exports captures both the progress achieved and the constraints that persist. In a global market shaped by scale, technology, preferential access and deep value-chain integration, India’s automotive trade performance reflects a sector in transition, shaped by long-standing policy choices and the evolving contours of global commerce.

– global bihari bureau